contract Final Evaluation and Closeout

(CT:COR-56; 10-26-2020)

(Office of Origin: A/OPE)

14 FAH-2 H-571 General

(CT:COR-25; 09-29-2014)

a. A contract is complete when all services have been rendered, all articles, material, reports have been delivered and accepted; administrative actions accomplished; and final payment has been made to the contractor.

b. Contract closeout actions are primarily the responsibility of the contracting officer. The contracting officer’s representative's (COR) assistance is necessary to certify that all services have been rendered satisfactorily and that all deliverables are acceptable.

14 FAH-2 H-572 Final Evaluation

(CT:COR-56; 10-26-2020)

a. The Department of State uses the Contractor Performance Assessment Reporting System (CPARS) to capture contractor performance reports. Reference the CPARS website. The CPARS applications are designed for UNCLASSIFIED use only. Classified information is not entered.

b. Refer to 48 CFR 42.1502 which requires completion of past performance evaluations for all contracts and orders that are terminated for default.

c. Evaluation is due within 120 days of contract completion.

d. For contracts of over 1 year in duration, annual reports are due within 60 days of anniversary of the contract award date.

e. The contracting officer is responsible for ensuring that the evaluation takes place, but the COR may be tasked with evaluating contractor performance.

f. The contracting officer shall prepare evaluations of contractor performance for each contract and order (as defined in FAR part 2) that exceeds the simplified acquisition threshold. Agencies are required to prepare an evaluation if a modification to the contract causes the dollar amount to exceed the simplified acquisition threshold.

g. The CPARS Users’ Manual for the Department of State is available from the A/OPE/PD intranet site.

14 FAH-2 H-573 Contract Closeout

(CT:COR-25; 09-29-2014)

The following sections cover several areas of contract closeout which may vary based on the complexity of the contract.

14 FAH-2 H-573.1 Purpose

(CT:COR-25; 09-29-2014)

The purpose of this contract closeout guide is to provide guidance for issues which may be relevant when closing out contracts across the Department of State. This guide does not supersede the Federal Acquisition Regulation (FAR); Department of State Acquisition Regulation; Department of State Procurement Information Bulletins (PIB); or any other statutory regulation. It is the responsibility of the acquisition professional to use this contract closeout guide together with the appropriate regulations and procedures.

14 FAH-2 H-573.2 Regulatory Timeframe for Contract Closeout

(CT:COR-25; 09-29-2014)

a. The time period for closing a contract is based upon both the type of contract and date of physical completion.

b. The standard timeframes for closing out contracts are stated in 48 CFR 4.804-1 “Closeout by the office administering the contract.” The table below illustrates the contract type and timeframes required to properly closeout the contract:

|

STANDARD CONTRACT CLOSEOUT REQUIREMENTS |

|

|

Timeframes |

Contract Type/Procedures |

|

Immediately after the contracting officer (CO) receives evidence of receipt of property and final payment |

When using Simplified Acquisition Procedures (SAP) |

|

Six months after the date on which the CO receives evidence of physical completion |

Firm-Fixed Price (FFP) (not using SAP) |

|

20 months after the date on which the CO receives evidence of physical completion |

All other contracts |

|

36 months after the date on which the CO receives evidence of physical completion |

Contracts requiring settlement of Indirect Cost Rates |

c. A contract file must not be closed if:

(1) The contract is in litigation or under appeal; or

(2) In the case of a termination, all termination actions have not been completed.

d. Time standards are based upon the time required for closing the majority of contract files. It recognizes that delays beyond the standards may occur (such as termination and bankruptcies).

14 FAH-2 H-573.3 Government Contract Files

(CT:COR-56; 10-26-2020)

a. Documentation in the contract files must be sufficient to constitute a complete history for the purpose of:

(1) Providing a complete background as a basis for informed decisions at each step in the acquisition process;

(2) Supporting actions taken;

(3) Providing information for reviews and investigations; and

(4) Furnishing essential facts in the event of litigation or congressional inquiries.

b. Refer to 48 CFR 4.803 that details the documentation that must be included in official contract files. Also, refer to 48 CFR 4.802(f) that authorizes the contracting office to maintain files in any medium (paper, electronic, microfilm) or any combination of media if the requirements are met. It is recommended that a second, electronic copy of the contract and COR files be kept on a shared drive for administrative ease. This is particularly important on programs where contract administration personnel rotate frequently such as in overseas contingency environments.

|

GENERAL CONTRACT FILE RETENTION PERIOD |

|

|

Document / File |

Retention Period |

|

Contract Disputes Act actions |

One year after final payment |

|

Contracts equal or lower than the SAT other than construction |

Three years after final payment |

|

Contracts greater than the SAT other than construction |

Six years and three months after final payment |

|

Contracts equal or lower than (≤) $2,000 for construction |

Three years after final payment |

|

Contracts greater than (>) $2,000 for construction |

Six years and three months after final payment |

|

Cancelled solicitations |

5 years after cancellation |

14 FAH-2 H-573.4 Completion of a Contract

(CT:COR-25; 09-29-2014)

14 FAH-2 H-573.4-1 Physical Completion of a Contract

(CT:COR-25; 09-29-2014)

a. A contract is considered physically complete when the contractor completes the required deliveries or performs the required services and the Government inspects and accepts the supplies or services, and all option provisions, if any, expire. A contract is considered physically complete if the Government has given the contractor notice of complete contract termination.

b. Facilities contracts and rental, use, and storage agreements are considered physically complete when the Government has given the contractor a notice of complete contract termination or the contract period has expired.

c. Please note that under cost-type or Time and Material/Labor Hour (T&M/LH) contracts, the contractor does not have to deliver the required supplies because the terms of the Limitation of Cost/Limitation of Funds and Payments under the T&M and LH Contracts clauses specify that the contractor does not have to continue performance once costs equal the established cost ceiling of the contract. Thus, under these types of contracts, if the government does not provide additional money to the contract, that contract should be considered physically complete once the cost ceiling is reached.

14 FAH-2 H-573.4-2 Administrative Completion of Contract

(CT:COR-25; 09-29-2014)

Although a contract may be physically complete, other factors may delay the actual closeout. For example, if the final amount due the contractor has not been determined or if there is an outstanding claim by or against the contractor, the contract may not be closed even if it is physically complete. Based on these considerations, a contract may not be closed until it is physically complete, the amount owed the contractor has been finally determined, and all claims regarding the contract have been resolved. Essentially, contracts are administratively complete when all administrative activities have been accomplished, releases executed, and final payment made.

14 FAH-2 H-573.5 Contract Closure Procedures

(CT:COR-25; 09-29-2014)

The contracting officer (CO) is responsible for initiating administrative closeout of the contract after receiving evidence of its physical completion. Ordering contracts such as indefinite delivery/indefinite quantity (IDIQ) contracts can be closed at the individual order level to make final contract closure easier. The closeout procedures must ensure that the following actions, as applicable, occur.

14 FAH-2 H-573.5-1 Disposition of Classified Material is Completed

(CT:COR-25; 09-29-2014)

Review the contract for a Form DD-254 Contract Security Classification Specification or other terms and conditions indicating the generation or receipt of classified material. Coordinate with Diplomatic Security to ensure appropriate disposition of classified material. The contractor should verify destruction or return as appropriate.

14 FAH-2 H-573.5-2 Final Patent Report is Cleared

(CT:COR-25; 09-29-2014)

Review the contract for any patent clauses. Patent clauses are included in research and development contracts where inventions may be made and patents filed. A patent report at contract completion summarizes any patents submitted during contract performance. This clause is not common in Department of State contracts.

14 FAH-2 H-573.5-3 Final Royalty Report is Cleared

(CT:COR-25; 09-29-2014)

Contracts for research and development or manufacture of high technology equipment may require the use of other contractor’s technology through the payment of patent royalties. Since the government has royalty-free licenses to use patents developed at government expense there may be no charge for the use of this technology. Review the contract to determine if a royalty clause is included requiring a final report. Verify that the contractor did not pay royalties that were not required. This clause is not common in Department of State contracts.

14 FAH-2 H-573.5-4 No Outstanding Value Engineering Change Proposal

(CT:COR-25; 09-29-2014)

Value engineering rewards a contractor for reducing the cost of an item by developing changes that do not affect form, fit or function. The contractor submits value engineering change proposals pursuant to a value engineering clause in the contract and shares in future cost savings. Review the file to determine if the value engineering clause is included and if so, whether any value engineering change proposals were submitted and are still pending. This clause is not common in Department of State contracts.

14 FAH-2 H-573.5-5 Plant Clearance Report is Received

(CT:COR-25; 09-29-2014)

a. The plant clearance report summarizes residual property in the event of a termination and at contract completion when a cost reimbursement contract is used. It discusses the types of residual property and property condition and suggests disposition. This applies to all cost reimbursement contracts to include service contracts without a physical “plant” or factory.

b. The plant clearance officer handles disposition of property while the property administrator handles property issues while in use plus loss of U.S. Government personal property, which includes damaged property issues. Both are CORs and may be separate individuals or same individual for contracts with little U.S. Government-owned property.

c. Reference 48 CFR 45.6 for use of Form SF-1428, Inventory Disposal Schedule submitted by the contractor to the plant clearance officer who then completes the Form SF-1424, Inventory Disposal Report, following disposition of the property. The plant clearance officer must ensure the completed report (Form SF-1424) is provided to the administrative or termination contracting officer, with a copy to the property administrator.

14 FAH-2 H-573.5-6 Property Clearance Completed

(CT:COR-25; 09-29-2014)

a. Property clearance is disposition instructions from the plant clearance officer to the contractor for U.S. Government-owned personal property. When U.S. Government property has been provided or title to contractor acquired property passes to the U.S Government, ensure that disposition guidance (i.e. reuse by owning agency, reuse by U.S. Federal agencies or U.S. State Agencies for Surplus Property, competitive public sale, abandonment or destruction, demilitarization, proper handling of hazardous property or hazardous waste, etc.) has been provided to the contractor within the 120 calendar days timeframe and that the contractor has complied. (Reference 48 CFR 45.6)

b. Government property provided to the contractor during contract performance and not consumed must be returned to the government or (if applicable) disposed of upon written notification by the contracting officer at the end of the contract. Any property acquired or manufactured by the contractor, but excess to the contract at completion, may also become government property under certain conditions, such as a cost reimbursement contract. Reference 48 CFR 52.245-1(f)(1)(iv) "Physical inventory" and (j), "Contractor inventory disposal" require that this property be inventoried by the contractor, returned to the government if needed, or disposed appropriately before the contract can be closed out. Reference 48 CFR 45.000 and DOSAR 48 CFR 645 provide procedures for the proper disposition of government property, which include contractor reporting of all government property.

c. The transfer of accountability for government property from one Department of State contract to another, including follow on contracts, must be approved by the contracting officer (see 48 CFR 45.102) and must be documented by modifications to both gaining and losing contracts (see 48 CFR 45.106).

d. Contact A/LM/PMP via email to LogisticsPolicyQuery@state.gov to resolve questions of policy or procedures concerning the roles and responsibilities of the plant clearance officer or property administrator for contractor-held U.S. Government personal property issues and the appropriate disposition methods. Additionally, distance learning training course "PA478 - Fundamentals of Contractor Held Property" is available for Department of State employees via the Foreign Service Institute.

14 FAH-2 H-573.5-7 All Interim or Disallowed Costs are Settled

(CT:COR-56; 10-26-2020)

a. On cost reimbursement contracts, contractor direct and indirect (overhead) costs are subject to review and audit. Invoiced costs for reimbursable contract line items are also reviewed and may be disallowed such as unapproved travel and overtime or unapproved purchases.

b. The Department has an agreement with the Defense Contract Audit Agency (DCAA) to perform cost audits on reimbursable contracts. DCAA audits are requested through A/OPE/AQM/QA Contract Audit Group (CAG).

c. Costs may be billed on an interim basis pending final reconciliation. Costs that are not supported or are not allowable are determined to be disallowed costs by the contracting officer. Review any contract cost disallowances and verify that the contractor has adjusted final billings to account for disallowances.

14 FAH-2 H-573.5-8 Price Revision is Completed

(CT:COR-25; 09-29-2014)

Flexibly priced contracts containing incentive provisions or economic price adjustments allow contractors to adjust the price based on actual performance. Review the contract to determine if it contains any price revision clauses and complete and document the revisions.

14 FAH-2 H-573.5-9 Prime Contractor Settled Subcontracts

(CT:COR-25; 09-29-2014)

Prime contractors on cost reimbursement contracts are required to settle the cost of any cost reimbursable subcontracts before submitting a final invoice. Determine if the prime contract is cost reimbursable and whether any cost reimbursement subcontracts still require settlement. Require the prime contractor to document the settlements.

14 FAH-2 H-573.5-10 Prior Year Indirect Cost Rates are Settled

(CT:COR-56; 10-26-2020)

a. Contractors on cost reimbursement contracts are required to submit indirect cost rate proposals to the cognizant contracting officer within 180 days after the end of their fiscal year. These rates are audited, negotiated and the results documented. These negotiated rates are then used for final price determination and final invoicing.

b. The cognizant agency negotiates the rates. Cognizant agency status is determined by the agency with the largest dollar amount of negotiated contracts, including options. Once a Federal agency assumes cognizance for a contractor, it should remain cognizant for at least five years to ensure continuity and ease of administration. (Reference 48 CFR 42.003.) Contractors must know their cognizant agency. When the Department is not the cognizant agency, contracting officers should request a determination of final rates from that cognizant agency. When no other cognizant agency can be identified, the Department of State will be the cognizant agency. When the Department of State is the cognizant agency for determining indirect rates, contracting officers will request rate audits through the A/OPE/AQM/QA Contract Audit Group (CAG). Contracting officers should determine the cognizant agency for rate determination at the time of contract award to ensure timely audit support.

c. Reference 48 CFR 42.708 "Quick-Closeout Procedure" that requires the contracting officer to negotiate the settlement of direct and indirect costs for a specific contract, task order or delivery order to be closed in advance of the determination of final direct costs and indirect rates if:

(1) The contract, task order, or delivery order is physically complete;

(2) The amount of unsettled direct costs and indirect costs to be allocated is relatively insignificant, which is defined as the lessor of $1,000,000 or 10% of the total value;

(3) The contracting officer performs a risk assessment of not obtaining a final rate audit and negotiating final individual rates based on considering the adequacy of the contractor’s accounting, estimating and purchasing business systems, other pertinent information, and any concerns of the auditors. See 48 CFR 42.708(a)(3) for further details; and

(4) Agreement can be reached on reasonable estimate of allocable dollars.

d. The contracting officer’s determination of final indirect costs is final for the contract or order it covers and is documented in the contract file.

14 FAH-2 H-573.5-11 Termination Docket is Completed Subcontracts

(CT:COR-25; 09-29-2014)

Contract terminations result in the creation of a termination docket to settle the costs of the termination and any adjustments to the price of continuing work. Review the contract file to determine if a termination took place and whether the contractor’s termination costs have been settled. Settlements are documented with a contract modification.

14 FAH-2 H-573.5-12 Contract Audit is Completed

(CT:COR-56; 10-26-2020)

a. The contracting officer should coordinate contract audit requirements at the beginning of contract performance. Audit support may be needed to audit invoices for costs incurred. This may eliminate the need for a final incurred cost audit if the contractor is not claiming any additional costs beyond those previously audited and paid. The CO should consult the A/OPE/AQM/QA Contract Audit Group (CAG) at contract award to identify audit support requirements:

(1) Cost reimbursement contracts usually require a contract audit of costs incurred to determine if costs were allowable, allocable and reasonable;

(2) Some fixed priced contracts may contain cost reimbursable line items such as for material or travel that need an audit if the contractor cannot adequately document costs invoiced; and

(3) Labor hour and time and material contracts may require audit to validate hours incurred and material provided if the contractor does not provide adequate information with their invoices to the COR to justify invoice payment.

b. CORs should work with their contracting officer to determine the need for contract audits supporting contract closure. The CO will request audit support through the A/OPE/AQM/QA Contract Audit Group (CAG). The results of the contract audit are used by the contracting officer to determine the final price of the cost reimbursement contract. Audit results are shared with the contractor and a final price is negotiated and documented. The contractor may then bill any remaining amount.

14 FAH-2 H-573.5-13 Contractor's Closing Statement (Release and Assignment) is Completed

(CT:COR-25; 09-29-2014)

a. The Contractor’s closing statement is submitted by the contractor on contracts over the Simplified Acquisition Threshold. It verifies that the contractor agrees that all work is completed and no additional payments are due. The closing statement may be provided in an email response.

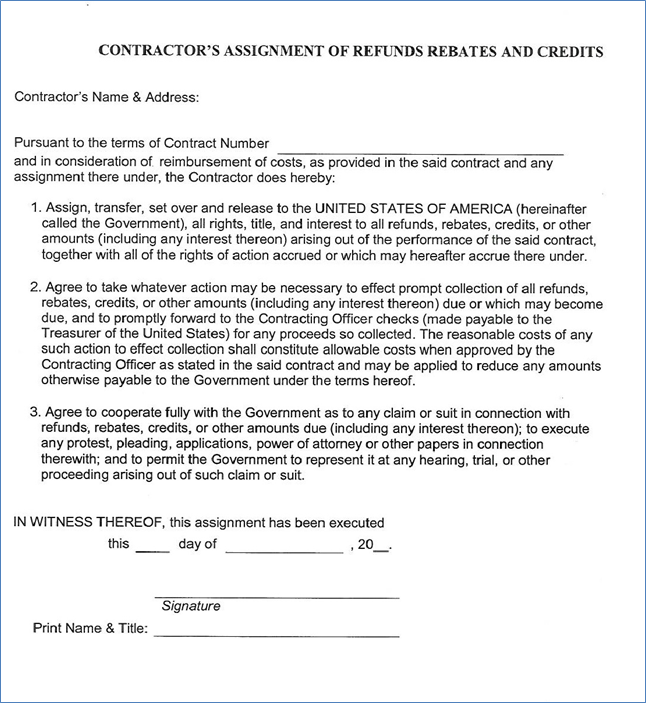

b. On cost reimbursement, labor hour (LH) and time and materials (T&M) contracts, the contractor also executes an Assignment and Release of Claims. This verifies that the contractor has no further claims against the government. See 14 FAH-2 Exhibit H-573.5-13 for a sample Assignment and Release of Claims.

14 FAH-2 H-573.5-14 Contractor's Final Invoice has Been Submitted

(CT:COR-56; 10-26-2020)

a. On cost reimbursement contracts, the contractor must submit a final invoice to bill for any remaining costs resulting from the settlement of the final price. On fixed price contracts the final invoice might not be labeled as a final invoice, so the contracting officer must verify contract quantities against accepted, invoiced and paid amounts.

b. As a contract funds review is completed and excess funds de-obligated:

(1) The contracting officer performs an initial contract funds status review at physical completion and a final contract funds status review after the completion of any required audits. The review consists of a comparison of the funded contract value with the amount the contractor has invoiced and been paid. Discrepancies may occur because of:

(a) Unplanned discounts;

(b) Billing errors;

(c) Contractor failure to deliver required quantities;

(d) Lower prices than stated in the contract because the contractor substituted other conforming products;

(e) Lower costs for travel, repairs or other reimbursable line items;

(f) Lower negotiated or interim rates than planned;

(g) Payment withholds due to defective work or pursuant to a contract clause; or

(h) Other reasons.

(2) The contracting officer is responsible for initiating a funds status review and identification of excess funds. Contracting officers may delegate this responsibility to the assigned COR. The reviewer obtains payment records from the payment office or the financial management systems (RFMS, GFMS) and compares the payment amounts to the invoices paid. If there are excess funds remaining on the contract, it is the responsibility of the contracting officer to investigate and resolve this issue. This may require coordination with the contractor, the payment office and the COR. If necessary, the contracting officer must negotiate a modification to the contract de-obligating the excess funding or advise the contractor to bill for the excess funding, if appropriate;

(3) Examples of situations creating excess funds needing de-obligation may include:

|

Issue |

Result |

|

Contract required 10 widgets. |

Eight widgets have been delivered and two widgets will not be delivered. Because the contract required 10 widgets and the contractor is not going to deliver (perform as required by contract), the funds associated with the 2 widgets are excess funds. |

|

Contract called for five trips. |

Three trips were accomplished and two were not. Because two trips were not performed as required by the contract, the monies associated with these two trips are considered excess funds. |

|

Contract required 10 widgets. |

10 widgets were delivered. However, the contractor billed less than the price contained in the contract and does not plan to bill at the contract price. The monies leftover are excess funds. |

|

Contract is for Travel. |

The number of trips is not specified and performance is complete and accepted. The monies leftover are excess funds. |

|

A maintenance or repair contract requires less labor and fewer parts than originally anticipated. |

The monies leftover are excess funds. |

|

A contract line item funded the purchase of supplies that were not needed. |

The monies leftover are excess funds. |

|

A contract line item provided for payment of overtime which was not required. |

The monies leftover are excess funds. |

|

The payment clause of the time and materials contract authorized withholding of payment. |

The COR identified the need for correction of the deficiencies and requested that the contracting officer withhold $50,000. After correction of the deficiencies, the contractor may bill for the amount withheld. These monies are not excess funds. |

(4) Such reviews are particularly important with cost reimbursement contracts. Settlement of indirect cost rates with contractors can be a lengthy process. The CO must review contracts to identify and remove funds in excess of those that will likely be needed for final payment within 30 days after a contract’s physical completion:

|

Example: The CO should compare expenditures on physically completed contracts by using payment logs, payment listings from the finance office, or other means against their face value to determine whether de-obligating excess funds is feasible. |

(5) In the event that the Payment Office/Disbursing Office has disbursed more than the contract total, the Disbursing Office must be informed and it becomes its responsibility to resolve any over payment;

(6) Funds de-obligated within the original period of obligational availability are once again available for new obligations. Reference Comptroller General decisions B-214551, March 25, 1985, 64 Comp. Gen. 410 and B-114874, October 5, 1972, 52 Comp. Gen. 179. In other words, funds obligated in one fiscal year (unless it is no year money) may not be retained if they are de-obligated in another fiscal year. This money is transferred back to the U.S. Treasury unless the funding office has special authority to retain the funds; and

(7) De-obligating funds requires a modification by a contracting officer. See 14 FAH-2 Exhibit H-573.5-14, Form SF-30, Prompt-Amendment of Solicitation/Modification of Contract: A Sample Modification to De-obligate Excess Funds. The contracting officer must ensure that all liquidations have been liquidated prior to de-obligating funds, otherwise the CO risks violating the Anti-Deficiency Act, 31 U.S.C. 1341, limitations on expending and obligating amounts.

14 FAH-2 H-573.5-15 Contract Completion Statement for the Contract File

(CT:COR-56; 10-26-2020)

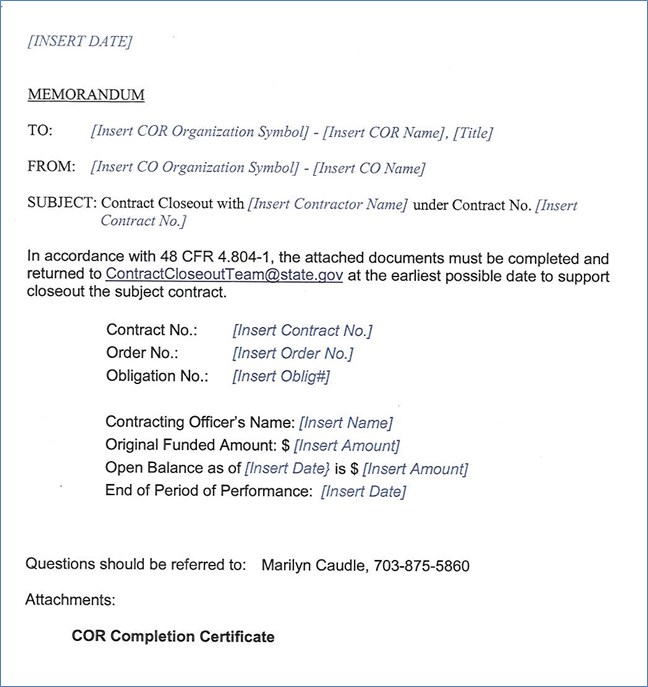

a. The contracting officer requests completion information from the COR (if assigned) or determines the state of completion. See 14 FAH-2 Exhibit H-573.5-15(a1) for a sample memo from the contracting officer to the COR requesting COR completion of closeout verification. Also see, 14 FAH-2 Exhibit H-573.5-15(a2) for a sample of a COR completion certificate.

b. The CO prepares a Contract Completion Checklist, as shown at 14 FAH-2 Exhibit H-573.5-15 (b), for all contracts over the SAT contract completion statement and places the signed original in the file. The checklist serves as the required 48 CFR 4.804-2 completion statement.

14 FAH-2 H-573.5-16 Contractor Past Performance Reporting

(CT:COR-49; 05-10-2018)

a. Past performance evaluations must be prepared when the work under the contract or order is completed. In addition, interim evaluations must be prepared to provide current information for source selection purposes, for contracts or orders with a period of performance, including options, exceeding one year.

b. All "Terminations for Default" or "Terminations for Cause" must be entered into CPARS regardless of contract purpose or dollar value. Agencies must promptly report other contractor information in the Federal Awardee Performance and Integrity Information System (FAPIIS) module of the Past Performance Information Retrieval System (PPIRS) within 3 calendar days after a contracting officer:

(1) Issues a final determination that a contractor has submitted defective cost or pricing data;

(2) Makes a subsequent change to the final determination concerning defective cost or pricing data;

(3) Issues a final termination for cause or default notice; or

(4) Makes a subsequent withdrawal or a conversion of a termination for default to a termination for convenience.

14 FAH-2 H-573.5-17 File Disposition

(CT:COR-25; 09-29-2014)

Files are maintained and retained for the required length of time and are retired in accordance with Department records archiving procedures. Reference 48 CFR 4.8,"Government Contract Files" for examples of the various documents normally contained, if applicable, in contract files and retention periods. Also 48 CFR 4.7, Contractor Records Retention" provides policies and procedures for retention of records by the contractors to meet the records review requirements of the Government.

14 FAH-2 H-574 Solutions for Problem contract Closeures

(CT:COR-25; 09-29-2014)

Problem contract closures may exist in any contracting office and may result from performance at difficult overseas locations. A problem closure is considered a contract that has unusual circumstances barring the use of traditional closeout methods. Contracting officers are encouraged to use sound business judgment for their individual situation or situations. The Department of State uses the Contractor Performance Assessment Reporting System (CPARS) website to capture contractor performance reports.

14 FAH-2 H-574.1 Common Contract Difficulties and Possible Solutions

(CT:COR-25; 09-29-2014)

a. Some common difficulties for contract closeout include the following:

(1) Contractor is no longer in business;

(2) Contractor is bankrupt;

(3) Contractor has failed to submit indirect cost data;

(4) Contractor is unable to submit supporting indirect cost data;

(5) Contractor has failed to submit final invoice;

(6) Negotiated settlement;

(7) Contracting officer's representative has departed the position; or

(8) Foreign vendor unable or unwilling to comply with requirements.

b. Traditional closeout procedures are, for the most part, dictated by the payment clauses contained in affected contracts. When the circumstances mentioned above exist, it is sometimes impossible to close contracts using traditional methods. In these instances, the contracting officer must perform a cost risk analysis and exercise business judgment in accordance with 48 CFR 1.602-2 to ensure that the U.S. Government’s interests are protected and administrative actions are reasonable. With the goal of minimizing loss to the U.S. Government, exercising and implementing efficient business practices and processes, the following guidelines are offered as a solution to these problem closures.

14 FAH-2 H-574.2 Contractor No Longer in Business

(CT:COR-25; 09-29-2014)

a. Unfortunately, it is not uncommon to have open contracts for companies that are no longer conducting business. Foreign contractors may be created and disbanded. In these instances, the U.S. Government must take every reasonable measure to locate the company and/or its principals consistent with the contract value. It is suggested that the contracting officer:

(1) Attempt to contact company officials by telephone or email;

(2) Attempt to locate company in writing, via certified mail, return receipt requested;

(3) Contact/inquire about company’s status from other U.S. Government officials;

(4) Contact the bankruptcy court of the state or country in which the company is located to determine if company has filed for bankruptcy;

(5) Use internet search engines to determine what happened to the company and its principals; and

(6) Contact the post management officer for assistance with local government officials.

b. The contract file should be documented with every attempt made to locate the company and its officials.

c. If all of the above attempts prove unsuccessful, it is recommended that the contracting officer begin the Administrative Unilateral Closeout process:

(1) Administrative Unilateral Closeout begins with a thorough review of the official contract file. The following should be ascertained during that review:

· Is the contract physically complete and has Government acceptance of goods/services been received?

· Was the contractor previously paid any funds?

· What is the status of indirect cost rate settlement (if contract is other than firm fixed price)?

· Have all reasonable measures been taken to locate the company and documented in the contract file?

· Has the contract been terminated for convenience or default?

(2) Any other pertinent information relative to the contractor or performance of the contract (e.g., unsettled subcontract cost, un-liquidated progress payments, litigation, etc.) should be considered. It is recommended that the contracting officer check with Office of the Legal Adviser, Office of Buildings and Acquisitions (L/BA) to ascertain if any actions are pending; and

(3) Recommended actions for Administrative Unilateral Closeout and, if required, determination of final contract price can be found at 14 FAH-2 H-574.6, "Contractor Failed to Submit Final Invoice."

14 FAH-2 H-574.3 Contractor is Bankrupt

(CT:COR-25; 09-29-2014)

a. The CO should coordinate promptly with L/BA on any closeout action involving bankruptcy to protect the interests of the U.S. Government. The final contract price should be established at the amount previously paid to the contractor and any excess funds de-obligated.

b. In accordance with 48 CFR 42.9,"Bankruptcy" when notified of bankruptcy proceedings, the Department must, as a minimum:

(1) Furnish the notice of bankruptcy to L/BA and other appropriate agency offices (e.g., contracting, financial, property) and affected buying activities;

(2) Determine the amount of the Government's potential claim against the contractor (in assessing this impact, identify and review any contracts that have not been closed out, including those physically completed or terminated);

(3) Take actions necessary to protect the Government's financial interests and safeguard Government property; and

(4) Furnish pertinent contract information to L/BA.

c. If you discover that the contractor is bankrupt, contact L/BA prior to taking any action in furtherance of contract closeout. A thorough review of the contract and the status of bankruptcy are required.

d. Once a bankruptcy petition is filed, an automatic stay goes into effect. This stay generally precludes any action to collect from the debtor or that would interfere with the debtor’s property interests. Contracts can be considered property of the bankrupt estate. Contract closeout actions could interfere with this property interest and violate the stay. Consequently, contract closeout actions should generally not be initiated without relief from the stay. Violation of the stay can subject responsible parties to contempt citations.

e. Another reason for immediate coordination with the legal office is that any claim against the contractor must be filed with the court in the form of a Proof of Claim. With the filing of a bankruptcy petition, the court usually will set a date by which the Proof of Claim must be filed (the Bar Date). Potential claims against the contractor must be compiled and analyzed to determine whether a Proof of Claim is in the best interests of the U.S. Government. L/BA has the responsibility for preparing the Proof of Claim and providing it to the cognizant U.S. Attorney for filing with the bankruptcy court. If the Government does not file a timely proof of claim, the Department will not be able to recover any funds.

f. If the contracting officer would like to close out contracts after stay issued, contact trustee through counsel for relief from stay.

g. If contracts have been fully performed and paid, inform trustee that the Department intends to close contracts.

h. Two types of U.S. bankruptcy the contracting officer might encounter are:

(1) Chapter 7 – liquidation – non-exempt items sold by trustee; proceeds distributed to creditors; or

(2) Chapter 11 – corporate debt reorganization in which the reorganization plan must be approved by a majority of creditors.

i. Foreign bankruptcy rules may be complex. Seek L/BA advice. Local in-country legal counsel may need to be engaged as approved by L/BA. Recommended actions for Administrative Unilateral Closeout and, if required, determination of final contract price can be found at 14 FAH-2 H-574.6, "Contractor Failed to Submit Final Invoice".

14 FAH-2 H-574.4 Contractor Failed to Submit Indirect Cost Data

(CT:COR-56; 10-26-2020)

a. In accordance with 48 CFR 52.216-7(d), the contractor on a cost reimbursement contract is required to submit a final indirect cost proposal to the contracting officer (or cognizant Federal agency official) and auditor within the 6-month period following the expiration of each of its fiscal years. Regardless of whether the rates are determined by an audit, it is the contracting officer’s responsibility to secure certified final rate claims pursuant to 48 CFR 42.705. The contracting officer should work through A/OPE/AQM/QA Contract Audit Group (CAG) with DCAA to obtain overdue proposals. Other recommended actions for the contracting officer:

(1) Determine the government contracting agency at contract inception and coordinate audit requirements;

(2) Become proactive as early as practicable and supplement/complement DCAA’s efforts;

(3) Apprise contractors of obligations, repetitively at strategic junctures throughout the lifetime of a contract, starting early in the cycle;

(4) Offer technical guidance to ensure an adequate submission; and

(5) Remember to stay on top of the situation and document all discussions and meetings, including telephone conversations to support any resulting unilateral decision.

b. The contracting officer should issue a letter to the contractor ninety days before the end of a contractor's fiscal year, requesting submission of the indirect cost proposal. If the contractor does not submit their proposal in a timely manner, measures must be taken to protect the Government's financial interest. The contracting officer should issue a letter expressing concern over non-receipt of the proposal. The letter should include a reminder that failure to submit a proposal is considered an internal control deficiency and request a response within 30 days.

c. Based on these factors, the contracting officer should proceed with unilateral determination of indirect cost rates in accordance with 48 CFR 42.703-2(c) and/or unilateral determination of final contract price. Rates established unilaterally should be:

(1) Based on audited historical data or other available data as long as unallowable costs are excluded; and

(2) Set low enough to ensure that unallowable costs will not be reimbursed.

14 FAH-2 H-574.5 Contractor Unable to Submit Supporting Indirect Cost Data

(CT:COR-56; 10-26-2020)

a. On rare occasions, contractors are unable to provide final vouchers because they have not retained their financial records for a fiscal year. When this happens, the contractor does not have the ability to support an audit or the incurred cost previously billed on contracts.

b. In these instances, Administrative Unilateral Closeout is recommended. As with all Administrative Unilateral Closeout efforts, a thorough review of the contract file is essential. You may want to do a risk assessment to ensure the financial security of the contractor. Upon completion of your review, you should have an understanding as to why the contractor is unable to provide the final voucher.

c. If Administrative Unilateral Closeout is still deemed suitable under the circumstances, it is recommended that the contracting officer proceed with the closeout as follows:

(1) Contact the appropriate DCAA office through A/OPE/AQM/QA Contract Audit Group (CAG) and obtain an opinion as to the Administrative Unilateral Closeout of the contract;

(2) Calculate the final price based on previous amounts paid to date; and

(3) Issue a modification establishing the final price at the amount previously paid to date and de-obligate any excess funds.

d. The steps outlined above are a summary of the Administrative Unilateral Closeout process and a more detailed list of recommended actions for Administrative Unilateral Closeout. If required, the determination of the final contract price can be found in 14 FAH-2 H-574.6, Contractor Failed to Submit Final Invoice.

14 FAH-2 H-574.6 Contractor Failed to Submit Final Invoice

(CT:COR-25; 09-29-2014)

14 FAH-2 H-574.6-1 Firm Fixed Price Contractor Fails To Submit Invoice

(CT:COR-25; 09-29-2014)

a. On occasion, contractors complete performance but fail to submit a final invoice on firm-fixed price contracts.

b. After making a reasonable number of requests to the contractor, the following actions should be taken:

(1) Verify that the government has accepted all shipments/performance;

(2) Send the contractor a letter asking if paid complete or when they will submit final invoice;

(3) If contractor fails to respond by suspense date in first letter, send a certified letter, return receipt requested, to the contractor advising them of the intent to administratively close the contract; and

(4) If the contractor responds that an amount is owed, but they will not submit a final invoice, the contract should be closed with remaining funds noted in the contract file. If the contractor fails to respond by the suspense date in the certified letter, the contract should be closed.

14 FAH-2 H-574.6-2 Cost Reimbursable Contractor Fails to Submit Invoice

(CT:COR-25; 09-29-2014)

a. The contracting officer has the responsibility of obtaining final vouchers and closing documents in accordance with FAR regulations. The contractor is contractually required to submit final vouchers within 120 days after settlement of final indirect cost rates. As soon as rates are settled and the contractor has signed an indirect cost rate agreement, the contracting officer should request that final vouchers be submitted in accordance with 48 CFR 52.216-7(d)(5).

b. In situations where indirect cost rates have been settled and the contractor has failed to adhere to 48 CFR 52.216-7(d) (5), it is recommended that the contracting officer research and determine the reason for non-submission. Many times the contractor may not be able to submit final vouchers because:

(1) They are awaiting final subcontractor costs;

(2) There is a lack of accounting staff to prepare final invoice;

(3) There is a lack of sufficient financial records needed to prepare cumulative cost sheets and ultimately the final vouchers;

(4) The final invoice would result in a credit balance due to the Government; and

(5) The final invoice would equal $0.00.

c. When the contractor fails to submit a final voucher within 120 days after settlement of final indirect cost rates, and has not provided a reasonable explanation along with an acceptable plan to become current in the submission of final vouchers and has not received an extension from the contracting officer, the contracting officer should take action. Remedies available to the contracting officer include:

(1) Refer the matter to higher authority;

(2) Suspend interim financing payments;

(3) Disallow or recoup previously paid costs;

(4) Decrement bidding/billing rates, or

(5) Maintain fee withholds.

d. After the contracting officer determines the reason for non-submission of final vouchers, several alternate methods exist that will enable the contracts to be closed. They include:

(1) Unilateral determination; and

(2) Accelerated final voucher preparation and review process.

14 FAH-2 H-574.7 Administrative Unilateral Closeout

(CT:COR-56; 10-26-2020)

a. The contracting officer should pursue a unilateral determination of final contract price when the contractor is non-responsive or has not provided a reasonable explanation for not submitting a final voucher. After issuance of the initial request for submission of final vouchers and the expiration of the 120-day suspense, the contracting officer should:

(1) Verify that all shipments/performance have been accepted by the government;

(2) Issue Initial Letter of Request for Final Invoice;

(3) Coordinate with the Defense Contract Audit Agency (DCAA) through the A/OPE/AQM/QA Contract Audit Group (CAG) to determine allowable cost and/or obtain the applicable incurred cost audits;

(4) Determine the total previous payments made to the contractor;

(5) Coordinate with L/BA, and/or other advisors as appropriate;

(6) Issue a letter to the contractor, which will serve as a notice of intent to unilaterally determine the final contract price if the final vouchers are not received within 30 days from date of the notice;

(7) If no final invoices are submitted, calculate the final price based on previous amounts paid to date; and

(8) If overpayment has occurred, request a refund from the contractor. If the contractor refuses to provide the refund within 30 days from the date of the request, forward the debt to the Office of Reports and Reconciliation (CGFS/F/RR).

b. If it is determined that excess funds remain on the contract, accomplish de-obligation within the unilateral determination modification.

c. Issue a modification establishing the final price at the amount previously paid to date and de-obligate any excess funds.

d. The contracting officer should:

(1) Verify that the un-liquidated balance equals $0.00;

(2) Verify that the contractor was paid in full;

(3) Verify any refund checks received have been posted and excess funds de-obligated; and

(4) Forward any delinquent refund request to CGFS/F/RR.

e. Document all contacts, telephone conversations and meetings, as evidence of government initiated attempts to engage the contractor in remedying issue.

14 FAH-2 H-574.8 Contracting Officer's Representative (COR) has Departed the Position

(CT:COR-25; 09-29-2014)

a. CORs, particularly in overseas environments, may rotate to new assignments before a contract is completed. This makes the maintenance of an adequate COR contract file, and the retention of that file on a shared computer drive, an essential best practice. This file will provide necessary information on inspection and acceptance and contractor invoicing. See 14 FAH-2 H-517 for the types of documents that must be maintained in the COR working file and 48 CFR 4.8, "Government Contract Files" plus 48 CFR 4.7, "Contractor Records Retention".

b. Outgoing and incoming CORs should ensure a transition meeting to transfer responsibilities. In those situations where no COR is available to complete the required actions such as where the contract is complete, the COR has left the Department and no follow-on COR has been appointed, the contracting officer must document with a memo in the contract file summarizing why closure can take place (i.e. evidence of completion, status of payment review, knowledge of any outstanding issues).

14 FAH-2 H-574.9 Foreign Vendor Unable or Unwilling to Comply With Requirements

(CT:COR-56; 10-26-2020)

a. Some foreign vendors may lack the knowledge and expertise in U.S. Government contracting to complete required actions or may be unwilling to perform contract closure tasks. Contracting officers should assess contractor’s ability to perform when making initial contract awards. Vendors should be given written notification of required actions. When compliance cannot be obtained, the contracting officer should document the file and proceed to closure.

b. Deliberate evasion of requirements and failure to reimburse the government for any monies due should be noted in past performance evaluations. Egregious violations should be referred to the Department’s Suspension and Debarment Official (A/OPE) for possible sanctions.

c. Other penalties for false, fictitious, or fraudulent claims presented to any person in the U.S. Government could result in fines or imprisoned for not more than five years. See 41 U.S.C. 4308, 18 U.S.C. 287, and 31 U.S.C. 3729.

14 FAH-2 H-575 THROUGH H-579 UNASSIGNED

14 FAH-2 Exhibit H-573.5-13

Sample Assignment and Release of Claims (Cost Reimbursement and Time and

Materials for Contracts Over the SAT)

(CT:COR-56; 10-26-2020)

14 FAH-2 Exhibit H-573.5-14

Form SF-30, Prompt-Amendment of Solicitation/Modification of Contract: A

Sample Modification to De-obligate Excess Funds

(CT:COR-56; 10-26-2020)

|

AMENDMENT OF SOLICITATION/MODIFICATION OF CONTRACT

|

1. CONTRACT ID CODE

|

PAGE 1 OF 1 PAGES |

||||||||||

|

2. AMENDMENT/MODIFICATION NO. 0001 |

3. EFFECTIVE DATE 02/16/XY |

4. REQUISITION/PURCHASE REQ. NO.

|

5. PROJECT NO. (If applicable)

|

|||||||||

|

6. ISSUED BY CODE

|

|

7. ADMINISTERED BY (If other than Item 6) CODE |

|

|||||||||

|

American Embassy Rosslyn 123 Main Street Rosslyn, Republic of Zee |

|

|||||||||||

|

8. NAME AND ADDRESS OF CONTRACTOR (NO., street,city,county,State,and ZIP Code)

|

x |

9a. AMENDMENT OF SOLICITATION NO. 19ZE2018R0001 |

||||||||||

|

|

|

9b. DATED (SEE ITEM 11) 01/05/XY |

||||||||||

|

|

|

10a. MODIFICATION OF CONTRACT/ORDER NO.

|

||||||||||

|

|

|

10b. DATED (SEE ITEM 13)

|

||||||||||

|

11. THIS ITEM ONLY APPLIES TO AMENDMENTS OF SOLICITATIONS |

||||||||||||

|

[x ] The above numbered solicitation is amended as set forth in Item 14. The hour and date specified for receipt of Offers [x ] is extended, [ ] is not extended Offers must acknowledge receipt of this amendment prior to the hour and date specified in the solicitation or as amended, by one of the following methods: (a) By completing Items 8 and 15, and returning ___3___ copies of the amendment;(b) By acknowledging receipt of this amendment on each copy of the offer submitted; or© By separate letter or telegram which includes a reference to the solicitation and amendment numbers. FAILURE OF YOUR ACKNOWLEDGMENT TO BE RECEIVED AT THE PLACE DESIGNATED FOR THE RECEIPT OF OFFERS PRIOR TO THE HOUR AND DATE SPECIFIED MAY RESULT IN REJECTION OF YOUR OFFER. If by virtue of this amendment you desire to change an offer already submitted, such change may be made by telegram or letter, provided each telegram or letter makes reference to the solicitation and this amendment, and is received prior to the opening hour and date specified. |

||||||||||||

|

12. ACCOUNTING AND APPROPRIATION DATA (If required) |

||||||||||||

|

13. THIS ITEM APPLIES ONLY TO MODIFICATIONS OF CONTRACTS/ORDERS, IT MODIFIES THE CONTRACT/ORDER NO. AS DESCRIBED IN ITEM 14. |

||||||||||||

|

|

A. THIS CHANGE ORDER IS ISSUED PURSUANT TO: (Specify authority) THE CHANGES SET FORTH IN ITEM 14 ARE MADE IN THE CONTRACT ORDER NO. IN ITEM 10A. |

|||||||||||

|

|

B. THE ABOVE NUMBERED CONTRACT/ORDER IS MODIFIED TO REFLECT THE ADMINISTRATIVE CHANGES (such as changes in paying office, appropriation date, etc.) SET FORTH IN ITEM 14, PURSUANT TO THE AUTHORITY OF FAR 43.103(b) |

|||||||||||

|

|

C. THIS SUPPLEMENTAL AGREEMENT IS ENTERED INTO PURSUANT TO AUTHORITY OF: |

|||||||||||

|

|

D. OTHER (Specify type of modification and authority) |

|||||||||||

|

E. IMPORTANT: Contractor [ ] is not, [ ] is required to sign this document and return ____ copies to the issuing office. |

||||||||||||

|

14. DESCRIPTION OF AMENDMENT/MODIFICATION (Organized by UCF section headings, including solicitation/contract subject matter where feasible.) A. Section C, paragraph C.2.1 is revised to read as follows: “The contractor shall provide on-site maintenance services 24 hours per day, 7 days per week.” B. The closing date is extended until March 12, XY at 4:00 pm local time.

Except as provided herein, all terms and conditions of the document referenced in Item 9A or 10A, as heretofore changed, remains unchanged and in full force and effect. |

||||||||||||

|

15A. NAME AND TITLE OF SIGNER (Type or print)

|

16A. NAME OF CONTRACTING OFFICER Harriet Warrant

|

|||||||||||

|

15B. NAME OF CONTRACTOR/OFFEROR

BY (Signature of person authorized to sign) |

15C.DATE SIGNED |

16B. UNITED STATES OF AMERICA

BY (Signature of Contracting Officer) |

16C.DATE SIGNED |

|||||||||

14 FAH-2 Exhibit H-573.5-15(a1)

Sample CO Memorandum to COR Requesting Completion of Closeout Verification

(CT:COR-25; 09-29-2014)

14 FAH-2 Exhibit H-573.5-15(a2)

Sample COR Completion Certificate

(CT:COR-25; 09-29-2014)

14 FAH-2 Exhibit H-573.5-15(b)

Contract Closeout Checklist

(Contracts Over the SAT)

(CT:COR-56; 10-26-2020)