SOLICITATION AND/OR ACCEPTANCE OF GIFTS BY THE DEPARTMENT OF STATE

(CT:GEN-621; 06-26-2025)

(Office of Origin: L/M)

2 FAM 961 SCOPE AND APPLICABILITY

2 FAM 961.1 Policy

(CT:GEN-452; 04-28-2016)

a. The Department of State has the authority to accept gifts made for the benefit of the Department of State or for carrying out its functions.

b. There are two types of gifts: in-kind, such as goods or services; and cash donations. For the purpose of Federal income, estate, and gift taxes, any gift, devise, or bequest accepted by the Department is deemed to be a gift, devise, or bequest to and for the use of the United States. In some circumstances, donations may be treated for Federal tax purposes as unreimbursed business expenses (see 2 FAM 962.6-1, paragraph b).

c. To ensure that the acceptance and use of these gifts further the Department’s interests to preserve the integrity of government, and to avoid actual impropriety or the appearance of impropriety, Department officials may solicit, accept, and use gifts on behalf of the Department only in accordance with the provisions in this subchapter. Department officials must also follow the provisions governing solicitation in this subchapter when soliciting gifts on behalf of outside organizations. To this end, Department officials should ensure that all employees involved in soliciting, accepting, or using gifts become thoroughly familiar with the contents of these provisions.

2 FAM 961.2 Scope

(CT:GEN-431; 11-07-2014)

The provisions in this subchapter govern the acceptance and use of gifts to the Department of State from nonfederal sources and the solicitation of gifts for the Department, when such solicitation assists the Department in carrying out its official functions in the United States and abroad. In general, a gift is offered for the “carrying out (of) official functions” if the gift, once accepted, would be used to supplement or take the place of funds appropriated to the Department or otherwise further authorized Department activities.

2 FAM 961.3 Authorities

(CT:GEN-431; 11-07-2014)

The authorities for the activities in this subchapter include:

(1) Foreign Service Buildings Act of 1926, Sec. 9, as amended (22 U.S.C. 300);

(2) State Department Basic Authorities Act of 1956, Sec. 25, as amended (22 U.S.C. 2697);

(3) Foreign Assistance Act of 1961, Sec. 695(d), as amended (22 U.S.C. 2395(d));

(4) Migration and Refugee Assistance Act of 1962, Sec. 3(a)(2), as amended (22 U.S.C. 2602);

(5) Foreign Gifts and Decorations Act, as amended (5 U.S.C. 7342 and 22 CFR 3);

(6) Acceptance of travel and related expense from nonfederal Sources (31 U.S.C. 1353);

(7) Mutual Educational and Cultural Exchange Act of 1961 (Fulbright-Hays), Sec. 105(f) and Sec. 108A, as amended (22 U.S.C. 2455(f) and 22 U.S.C. 2458(a)), and

(8) 41 CFR 301 and 41 CFR 304.

2 FAM 961.4 Definitions

(CT:GEN-431; 11-07-2014)

For the purposes of these sections, the following definitions shall apply:

(1) “Gift” means anything with an ascertainable market value for which the recipient does not pay market value, including donations of cash, or donations of loans of goods, services, and real property;

(2) “Gifts of travel” means payment by a nonfederal source or a foreign government of travel expenses for official travel; Reference 2 FAM 962.12 for guidance;

(3) “Nonfederal source” includes any individual, private, or commercial entity other than the U.S. Government, including but not limited to corporations, nonprofit organizations or associations, international or multinational organizations, and foreign, state, or local governments;

(4) “Public diplomacy purposes abroad” means programs or initiatives which advance the Department’s mission by engaging with foreign publics through informational, educational and/or cultural programs and similar outreach efforts in order to strengthen understanding of the United States, including its society, culture, politics and values; build public support for U.S. policies; and further mutual understanding. Public diplomacy purposes abroad are distinguishable from representational use. Reference 2 FAM 962.9 for guidance; and

(5) “Representational use” means use for the establishment and maintenance of relationships beneficial to the United States; Reference 2 FAM 962.7 for guidance.

2 FAM 961.5 Abbreviations

(CT:GEN-569; 03-25-2021)

The following abbreviations apply:

(1) Office of the Legal Adviser: L;

(2) Office of the Legal Adviser – Ethics and Financial Disclosure: L/EFD;

(3) Office of the Legal Adviser – Management: L/M;

(4) Office of the Legal Adviser – Public Diplomacy: L/PD;

(5) Office of Emergencies in the Diplomatic and Consular Service: CGFS/EDCS;

(6) Bureau of Overseas Buildings Operations: OBO;

(7) Bureau of Overseas Buildings Operations – Planning and Real Estate: OBO/PRE;

(8) Bureau of Overseas Buildings Operations – Resource Management – Office of Financial Management: OBO/RM/FM;

(9) The Secretary’s Office of Global Partnerships: S/GP;

(10) Bureau of Administration – Directorate of Operations – Office of Real Property Management: A/OPR/RPM;

(11) Chief of mission: COM; and

(12) Deputy chief of mission: DCM.

2 FAM 962 SOLICITATION AND ACCEPTANCE OF GIFTS

(CT:GEN-431; 11-07-2014)

a. The Under Secretary for Management (Under Secretary) is the delegated Department official responsible for the general direction and overall supervision of the Department’s gift acceptance program. He or she is responsible for the acceptance of all gifts to the Department of State for official purposes, unless a specific delegation to another official has been made in these provisions or subsequently, in writing, from the Under Secretary or from a person delegated authority to accept gifts under these provisions. Any person who has been delegated authority to accept gifts under these provisions will consider the same criteria that the Under Secretary considers consistent with 2 FAM 962.1, and will perform basic vetting to ensure no major conflicts exist with the donor, and that acceptance of the gift from the donor will not cause embarrassment to the Department.

b. No Department employee may engage in solicitation or other fundraising activities for U.S. Government use, or for the use of an outside organization without prior authorization, in writing, from the Under Secretary for Management, except as specifically authorized in 2 FAM 962.3 through 2 FAM 962.17, or 3 FAM 4123.4.

2 FAM 962.1 Authority to Solicit and Accept Gift Funds

2 FAM 962.1-1 Due Diligence: Process for Vetting and Approving Donors

(CT:GEN-569; 03-25-2021)

a. To aid in evaluating any requests for authority to solicit and accept gift funds, the requesting office must obtain from the Secretary’s Office of Global Partnerships (S/GP) a due-diligence informational memorandum for all U.S.-based, nonfederal entities to be solicited:

(1) The office should then review the due diligence memorandum carefully and make a determined judgment that soliciting and accepting gifts from each entity would not cause embarrassment or harm to the Department or its reputation; and

(2) The office should also make a reasoned judgment that soliciting the entity or entities would not give the appearance of a conflict of interest that would cause a reasonable person to believe that any Department official involved lost objectivity in the performance of his or her official duties.

b. Regarding vetting of foreign entities and individuals for the due diligence informational memorandum referenced in paragraph a of this section, if the foreign individual or entity has a significant U.S. presence, S/GP will perform the full vet, relying upon appropriate resources from post. Likewise, if the proposed gift is based in the United States, S/GP will perform the full vet relying on appropriate resources from post. If, however, the foreign individual or entity does not have a significant U.S. presence and the gift is based overseas, S/GP will rely on post for a significant portion of the vetting process. S/GP will review the result of post’s searches for consistency and will determine if additional searches are necessary.

c. For solicitations or donations from nongovernmental organizations and for-profit entities valued at $5000 or less or from individuals valued at $3000 or less, a condensed vet will be completed by S/GP including, at a minimum, a search of Lexis/Nexis to include criminal filings, Google, A/QM, and Lobbyist Database checks. If the condensed vet reveals any red flags, a standard full vet will be performed.

d. The requesting official must prepare an action memorandum to the Under Secretary, and obtain clearances from L/M, L/EFD, and the legal office with principal responsibility for advising on the requesting office's programs, CGFS/EDCS, as well as other relevant offices. This memorandum must include the following:

(1) A detailed description of the proposed gift solicitation and its goals;

(2) A copy of the vetting report performed by S/GP;

(3) A list of the potential entities to be approached and any relevant information from the due diligence information memorandum, including any potential conflicts or information that could cause harm or embarrassment to the Department;

(4) An explanation of any funding to be used, including appropriated funds or alternative sources of funding and an explanation of funding or personnel to be provided by the nonfederal entity;

(5) Whether the money is being raised for unusual or exceptional expenses (such as capital improvements), or ordinary operating expenses of the Department;

(6) The proposed project’s importance to the U.S. Government, including whether the donor’s gift enables the Department to further achieve diplomatic goals and objectives;

(7) Background concerning how the entity or entities was/were chosen;

(8) The amount of money to be raised, the method of raising gifts, including the proposed text(s) for any communications to be used in the solicitation, and how the solicitations will be managed;

(9) The degree to which the Department will be directly involved in the fundraising;

(10) Confirmation that employees involved in the solicitation do not have an outside personal or financial interest in the potential donor;

(11) A description of any business the entity has with the Department, including value;

(12) A list and description, provided by the donor, of the donor’s subsidiaries, business affiliations and the business affiliations of the donor’s immediate family members. Corporate donors should provide a list and description of their subsidiaries. All donors should provide a description of nonroutine matters affecting the donor, the donor’s immediate family members, or the donor’s business affiliates (or subsidiaries of corporate donors) that have required, or are expected to require, the Department’s or post’s attention; and

(13) Any information necessary to allow the Under Secretary to determine whether any of the considerations set forth in 2 FAM 962.1, paragraphs e through h, exist.

e. The Under Secretary will generally not approve a request to solicit an entity that:

(1) Seeks to obtain any business, benefit or assistance from the soliciting official or other officials in the same organizational unit;

(2) Conducts operations or activities that are regulated by the requesting entity;

(3) Has interests that may be substantially affected by the performance or nonperformance of the requesting official’s duties;

(4) Appears to be entering into the gift with the expectation of obtaining advantage or preference in dealing with the requesting official, office or the Department; or

(5) Has major nonroutine business with the requesting bureau or post.

f. The Under Secretary will also not approve a request for authority to solicit that would cause a reasonable person to question the impartiality of any Department official.

g. In addition, the Under Secretary will generally not approve solicitation or fundraising proposals that involve a significant use of appropriated funds in order to conduct the solicitation.

h. Approval of solicitation or other fundraising proposals requires balancing the U.S. Governmental policy interests in favor of fundraising against the potential risks of Department involvement in raising money from the private sector. This process inherently requires making judgment calls about issues, such as the importance of the project and the risks that the Department will be subjected to criticism for its activities.

2 FAM 962.2 Gift Solicitation and/or Acceptance Procedure Other Than Funds

(CT:GEN-431; 11-07-2014)

Sections 2 FAM 962.3 through 962.17 detail the acceptance and/or solicitation procedures for various types of gifts to the Department.

2 FAM 962.3 Gifts from Foreign Governments and International Organizations

(CT:GEN-452; 04-28-2016)

a. As a general matter, the Department's acceptance of official gifts from foreign governments or international organizations must be reported to the Office of the Chief of Protocol Gift Unit via the Chief of Protocol's gift registration form.

b. An employee offered a personal gift that he or she cannot accept under the Foreign Gifts and Decorations Act (5 U.S.C. 7342, as amended) because the gift exceeds the minimal value (see 11 FAM 600), may accept the gift on behalf of the Department when it appears that refusing the gift would likely cause offense or embarrassment or otherwise adversely affect the foreign relations of the United States. The management officer at post, in consultation with the Office of the Chief of Protocol, determines whether returning an overvalued gift would likely cause embarrassment or offense, or would adversely affect the foreign relations of the United States.

c. The process for handling such a gift is as follows:

(1) Within 60 days after accepting a tangible gift of more than minimal value, an employee must:

(a) Deposit the gift for disposal or official use with post or the regional bureau, if the gift was accepted in the United States;

(b) Subject to the approval of Protocol, post will either dispose of the gift by forwarding to the Office of the Chief of Protocol who will transfer the item to GSA in accordance with applicable property disposal regulations or, in consultation with the Office of the Chief of Protocol, deposit the gift with the relevant property manager for official use;

(c) Within 30 days after terminating the official use of a gift accepted under 2 FAM 962.3(b), the management officer is to forward the gift to the Office of the Chief of Protocol who will transfer the item to GSA in accordance with applicable property disposal regulations; and

(d) No gift or decoration that has been deposited for disposal may be sold without the approval of the Secretary of State, upon a determination that the sale will not adversely affect the foreign relations of the United States; and

(2) Under certain circumstances, personal gifts of travel may be governed by Section 108A of the Fulbright-Hays Act, as amended (22 U.S.C. 2458a).

2 FAM 962.4 Gifts of Real Property

2 FAM 962.4-1 Acceptance: Gifts of Real Property

(CT:GEN-569; 03-25-2021)

Acceptance of gifts of real property must be approved on a case-by-case basis by the Under Secretary for Management, following clearance from the Bureau of Overseas Buildings Operations (OBO), CGFS/EDCS, L/M, L/EFD, and the appropriate regional bureau(s).

2 FAM 962.4-2 Approval Process

(CT:GEN-431; 11-07-2014)

a. The chief of mission (COM) or other Department official must forward all offers of gifts involving real property at an overseas post to OBO, along with the post's recommendation regarding acceptance. The donor(s) must submit a letter fully describing the gift and all associated structures/land and appurtenances, and further specifying that the gift is made pursuant to the provisions of 22 U.S.C. 300 and 22 U.S.C. 2697.

b. The Director of OBO seeks approval by Action Memorandum to the Under Secretary for Management to accept or decline the gift. OBO recommends whether to accept or decline all real property gifts. These recommendations will take into account any appearance of a conflict of interest, the desirability of the gift in terms of appropriateness, need, usefulness to the U.S. Government, and associated life-cycle maintenance costs.

c. OBO notifies the post or relevant Department official of the Under Secretary's decision. Upon approval, the COM assigned to the post or the relevant Department official issues a formal letter of acceptance on behalf of the U.S. Government. OBO will supply a draft text.

2 FAM 962.4-3 Gift Acceptance Processing

(CT:GEN-553; 09-26-2019)

a. After an offer of gift of real property has been approved, OBO’s Directorate of Planning and Real Estate (OBO/PRE) makes recommendations to the Director of OBO regarding disposition of the gift (use, sale, rental, renovation, etc.).

b. OBO/PRE notifies the Office of Financial Management in the Directorate of Resource Management (OBO/RM/FM) of all accepted real property gifts. OBO/RM/FM, in turn, ensures all pertinent data concerning gifts involving real property are reflected in the OBO annual budget estimates that will be reported to Congress, along with the budget estimates of the Department of State.

c. OBO/PRE prepares and coordinates all necessary correspondence between the Department and donors. This includes, but is not limited to:

(1) Sending letters to all donors who have formally offered real property gifts; acknowledging receipt of their offers; and providing further instructions pertaining to the acceptance of their offers; and

(2) Preparing the draft of a final letter of gift acceptance for signature by the COM.

d. OBO/PRE will advise and assist the post in the:

(1) Assignment of a building inventory number;

(2) Entry into Real Property Application (RPA) of the ownership data;

(3) Registration via a local attorney of the title in the name of the U.S. Government; and

(4) Transfer to OBO/PRE/OSP/KM of the final title documents for record keeping.

2 FAM 962.5 Acceptance: Gifts of Artwork

(CT:GEN-569; 03-25-2021)

a. Both the Under Secretary for Management and the Director of OBO have been delegated authority by the Secretary, Department of State Delegation of Authority No. 114 (Jan. 18, 1967), to accept gifts of property as authorized by Section 9 of the Foreign Service Buildings Act, 22 U.S.C. 300. This includes artworks and transportation of gifts. The Under Secretary is only involved in the acceptance of major gifts exceeding $250,000. The Director of OBO will submit the recommendation of these gifts to the Under Secretary for final Department of State approval.

b. The Director of OBO and the Director of its Art in Embassies staff (AIE) are authorized to accept or reject on behalf of the Department proposed donations of artwork valued at $250,000 or less per item for display in U.S. embassies, consulates, and chief-of-mission (COM) residences and financial donations to cover the cost of shipping, installation, and maintenance of artwork.

c. The Director of AIE and the AIE Curatorial Committee determine which gifts are to be recommended for acceptance by the Director of OBO. The Office of Art in Embassies shall prepare and manage the drafting and routing of all relevant recommendation, approval, and notification documents, which formally records acceptance or rejection.

d. In deciding whether to accept any particular gift, the OBO Director and Director of AIE will carefully follow the guidelines for acceptance of gifts set forth in 2 FAM 962.1 and 2 FAM 962.4.

e. The OBO Art Committee (OAC) chair will obtain a vetting report from S/GP for each donor or conduct the vetting of each donor pursuant to S/GP guidance.

f. When OBO Director approval is required, the OAC chair will send an action memo for approval/disapproval to the OBO Director outlining the findings of the vetting report and any relevant considerations under the guidelines set forth in 2 FAM 962.1 and 2 FAM 962.4. Several gifts may be included in the same memo, if needed.

g. The OAC chair will obtain clearance from CGFS/EDCS. L/M and L/EFD are available for consultation as needed.

h. The Office of Art in Embassies may use this authority to accept works of art for its permanent inventory for use to lend to posts, embassies, consulates and COM residences.

i. If other authority to accept a gift of artwork exists, for instance, if a piece of artwork is accepted on behalf of the Department, under 3 FAM 4122 or under the Foreign Gifts and Decorations Act, separate approval from the OBO Director is not required. However, approval from the OAC is required if the artwork is going to be displayed in a public area.

2 FAM 962.6 Embassy Refurbishment Projects

2 FAM 962.6-1 Gifts for Embassy Refurbishment

(CT:GEN-569; 03-25-2021

a. The Under Secretary for Management may accept gifts for embassy refurbishment, in consultation with CGFS/EDCS, and OBO. The Department Gift Funds Coordinator in CGFS/EDCS keeps all official records and maintains an automated database relating to such projects. Donations for such projects should be made directly to the Department. Foundations should generally not serve as an intermediary for gifts.

b. Ambassadors and other principal officers should be aware that, in cases involving personal donations to the Department for the purpose of activities at post, including embassy refurbishment in their host countries, whether cash or in-kind, the Department is generally unable to provide a statement to the donor confirming that it has provided no goods or services in consideration for the contribution. As a result, the Internal Revenue Service (IRS) may treat such donations as unreimbursed business expenses rather than charitable gifts for tax purposes. For questions regarding the tax treatment of donations for such purposes, employees should directly contact the IRS, Office of the Assistant Chief Counsel for Income Tax and Accounting, 1111 Constitution Avenue, NW, Washington, DC 20224.

2 FAM 962.6-2 Project Approval and Gift Solicitation/Acceptance Process

(CT:GEN-569; 03-25-2021)

a. OBO must approve of the proposed project (e.g., refurbishment of the representational rooms in the COM residence). Working in consultation with the COM, OBO must determine the appropriate scope of the desired project. To do so, OBO is responsible for:

(1) Surveying the property;

(2) Deciding to what extent the project proposal is consistent with long-term plan for the property; and

(3) Developing cost estimates for the proposed project.

b. If OBO approves a project proposed by post, it will submit a project approval memorandum to the appropriate regional bureau indicating the approved scope of work and the estimated cost.

c. Once the project is approved, the COM or other Department official may propose a method of fund raising (e.g., personal gift or solicitation of friends and/or business acquaintances) and whether it would be conducted personally or by private individuals on his or her behalf. The COM or other Department official submits a written proposal to the Under Secretary for Management via the applicable regional bureau seeking authority to raise funds for the OBO approved project. The Action Memo to the Under Secretary should include:

(1) A description of the project, the OBO survey, and all project approval documentation;

(2) The estimated cost of the project;

(3) A list of proposed donors and the S/GP vetting report of each potential donor;

(4) The solicitation letter, method of solicitation, and how much each donor will be asked to give; and

(5) What will happen if sufficient funds are not raised to cover the entire proposed project.

d. All solicitation proposals for OBO approved projects should adhere to the following:

(1) CGFS/EDCS should clear solicitation letter;

(2) All checks should be made payable directly to the Department of State and sent under cover of a donor letter to CGFS/EDCS; and

(3) The solicitation letter should set the conditions requested by the donor such as access to the property.

2 FAM 962.6-3 Domestic Gift Fund Processing Procedures

(CT:GEN-569; 03-25-2021)

After M approves gift fund proposal:

(1) CGFS/EDCS receives donation (e.g., check, stock proceeds, materials, and/or services) or donation is received via wire transfer and recorded by CGFS. CGFS/EDCS enters it into the Gift Fund Database;

(2) CGFS/EDCS staff follows up with the receiving bureau or donor, telephonically or in writing, to ensure all pertinent information is included for review;

(3) CGFS/EDCS staff determines whether the donor/donation has been approved for solicitation or acceptance in the gift fund proposal Action Memo to the Under Secretary:

(a) If the donor/donation has been pre-approved in the Action Memo, CGFS/EDCS deposits donation in accordance with approved procedures, and the Bureau of Budget and Planning allots funds to appropriate bureau; and

(b) If the donor/donation has not yet been vetted by S/GP and approved in the Action Memo to the Under Secretary, the bureau for which the gift is being accepted must follow the process outlined in 2 FAM 962.1 in order to vet and clear the donor/donation. Once the approval of the donation has been confirmed, CGFS/EDCS deposits (and/or CGFS records the wire transfers) donation in accordance with approved procedures, and the Bureau of Budget and Planning allots funds to appropriate bureau;

(4) CGFS/EDCS drafts an acknowledgment letter to the donor on behalf of the Department.

2 FAM 962.7 Gifts for Representational Purposes Abroad

(CT:GEN-621; 06-26-2025)

a. If a gift is accepted by post, the management officer must report the gift in the Gift Fund Registry, with the exception of those gifts listed in 2 FAM 964, subparagraph a(3).

b. Management officers at post may accept gifts to be used for representational purposes in their countries of assignment only in accordance with the following principles:

(1) As a general rule, a gift may not be accepted for representational purposes abroad, unless the gift:

(a) Is donated for a trade promotion or Fourth of July event that meets the criteria set forth in 2 FAM 962.7, subparagraph b(3)(a), or 2 FAM 962.8, as appropriate; or

(b) Is donated by a U.S. cultural, scientific or educational nonprofit group for an event that meets the criteria set forth in 2 FAM 962.7, subparagraph b(3)(b); or

(c) Does not exceed in value $10,000 per year from any one donor; or

(d) In the case of tickets of any value to cultural, entertainment or sporting events, if attendance by U.S. Government employees has been determined to further the interests of the United States and its mission abroad, following the procedures in 2 FAM 962.7, paragraph c; or

(e) Is authorized in a specific case by the Under Secretary for Management;

(2) For the purpose of 2 FAM 962.7, subparagraph b(1)(c), “one donor” means:

(a) A person and his or her immediate family;

(b) A corporation, members of its board of directors, and its majority shareholders; or

(c) A partnership, joint venture, or other association and its partners or members;

(3) Trade promotion events include:

(a) Events held abroad to introduce a new-to-market U.S. firm or product line, to publicize a trade mission, to open an industry exhibition or otherwise to promote U.S. exports, assist U.S. exports, or assist U.S. businesses abroad; and

(b) Events held abroad on behalf of U.S.-based cultural, educational, or scientific organizations or associations, whether or not such groups are formally incorporated. Some examples are functions to introduce visiting scholars or artists, receptions to open a cultural event (e.g., dance festival, photography exhibit), and events held for the purpose of promoting an educational conference.

(4) An official authorized to accept gifts may allocate donated funds, goods, and services to defray the costs of a trade promotion event or nonprofit event described in 2 FAM 962.7, subparagraphs b(3)(a) and b(3)(b), if:

(a) The event clearly advances U.S. interests;

(b) The post is willing to perform similar services for competing U.S. groups who ask and are similarly qualified;

(c) The official authorized to accept gifts concludes that an objective person would not have reasonable grounds to believe that the donor has obtained an unfair advantage or improper influence over post by funding this representational activity, or that personal, financial, partisan political, or other such considerations were involved in the provision of such representational event; and

(d) The event complies with all regulations that apply to representational activities paid for with appropriated funds (e.g. Standardized Regulations, Chapter 300 on representational activities abroad).

Chapter 300 on representational activities abroad).

c. With respect to the acceptance of tickets for and/or attendance at cultural, entertainment or sporting events serving representational purposes abroad, regardless of the section being offered the tickets, prior COM or deputy COM (DCM) approval must be obtained before tickets are accepted. Upon such approval, gifts of tickets on behalf of the Department may be accepted, subject to the following conditions:

(1) The tickets are for an event co-sponsored by post; or

(2) A written determination has been made by the COM, DCM or other designated official that:

(a) Explains how and why attendance at the event by Department employees is necessary to further the Department’s representational interests; and

(b) Confirms that the Department’s interests in attendance outweigh any concerns that the gift of attendance may appear to improperly influence Department employees in the performance of official duties (relevant factors that should be considered in making this determination include the importance of the event, the nature and sensitivity of any pending matter affecting the interests of the donor, the significance of the employee’s role in that matter, the purpose of the event, the identity of other attendees and the market value of the tickets);

(3) For COM attendance at such events, the ticket value will determine who should make the written determination:

(a) For the COM to accept tickets with a per ticket value exceeding $75, the relevant regional executive director or deputy director should make this written determination;

(b) For the COM to accept tickets with a per ticket value of $75 or less, the management officer at post should make the written determination; and

(c) The approving official may consult or request guidance from L/M and L/EFD as necessary.

d. At the direction of COM and subject to their approval, unconditional monetary gifts may be solicited and accepted to a generalized Representational Event Fund (REF) for use in approved Representational activities at post. REF funds may not be applied to the official July 4 Events, and Posts must continue to follow the process and restrictions outlined in 2 FAM 962.8 for official July 4 fundraising. All REF gifts must be reported to the Gift Fund Registry in line with 2 FAM 964(a)(3). In approving REF solicitation and acceptance plans, COM will follow the process and apply the principles outlined in 2 FAM 962.1-1, to include the following:

(1) Review of a due diligence report keyed to the donation amount, in line with 2 FAM 962.1-1(a) - (c). Posts will request due diligence reports from E/GP when necessary, in line with 2 FAM 962.1-1(c);

(2) Approval by COM via an Action Memo documenting the factors listed in 2 FAM 962.1-1(d)(1) - (13);

(3) COM will generally not approve solicitation plans that raise concerns noted in 2 FAM 962.1-1(e) - (h);

(4) COM must ensure that use of REF funds complies with all regulations that apply to representational activities paid for with appropriated funds (e.g. Standardized Regulations, Chapter 300 on representational activities abroad); and

(5) Posts must seek concurrence from L/M, L/EFD, and CGFS/EDCS for REF solicitations and acceptances in the following circumstances:

(a) Solicitations or acceptance from a foreign government, with concurrence from the appropriate regional bureau Assistant Secretary;

(b) Solicitations or acceptance of funds over $5,000 from any one donor during the fiscal year, with "one donor" having the same meaning articulated in 2 FAM 962.7(b)(2); and

(c) Any acceptance which requires the Department to sign a donor agreement

2 FAM 962.8 Gifts for July Fourth Events Abroad

(CT:GEN-569; 03-25-2021)

a. Management officers at post may accept cash and in-kind donations for official embassy-sponsored July Fourth events in their host countries and must report these donations in the Gift Fund Registry. In addition, ambassadors and other principal officers at post may solicit, or authorize the solicitation of, such donations without prior authorization by the Under Secretary for Management, consistent with the following guidelines:

(1) Donations may be solicited and accepted from a U.S. citizen, a U.S. organization or U.S. company (including foreign subsidiaries, franchisees, or distributors), or a foreign company that meets the criteria in 2 FAM 962.8, subparagraph a(2) only when the individual, organization, or company is neither seeking substantial assistance from post (e.g., nonroutine consular assistance or nonroutine commercial advocacy or assistance) nor would be substantially affected by a pending or reasonably anticipated post official action;

(2) Post may solicit contributions only from the following two types of foreign companies:

(a) Host-country companies that have:

(i) Significant investment in the United States;

(ii) Employ a significant number of employees in the United States; and

(iii) Have an established long-term commitment to maintaining an economic presence in the United States; and

(b) Foreign companies that were formerly U.S.-owned and have strong U.S. brand recognition;

(3) Posts should not seek to raise more funds than required for this year’s official Fourth of July event;

(4) In accordance with U.S. tobacco policy and to avoid an appearance of endorsement, no tobacco companies may be solicited;

(5) When post solicits donations, no donor may be impermissibly preferred over another, and no appearance of unfair advantage or improper influence may result from acceptance of a particular donation. Post must show no preference among U.S. donors in receiving donations by, for example, accepting donations from one U.S. firm and refusing donations from a competing firm, unless such a distinction is justified based on the criteria listed in 2 FAM 962.8, subparagraphs a(1) and a(6);

(6) The official authorized to solicit and accept gifts must determine that a reasonable person would not conclude that the donor has obtained an unfair advantage or an improper influence over the ambassador or the post through its donation, or that personal, financial, partisan political, or other such considerations were involved in the provision of such a donation. No employee may imply that a donor will receive any advantage or preference from the U.S. Government as a result of the donation, including a promise to intervene with the host government, a commitment to invite the donor to official functions, or an assurance that the donor will have preferential access to official facilities. Likewise, no employee may suggest that a donor will be disadvantaged as a result of not making a donation;

(7) U.S Government officials who have an ownership interest in or a prior business relationship with a public or closely held company should not solicit from that company. In such situations, it may be appropriate for a different U.S. Government official without such a relationship to solicit that company. Post may consult L/EFD as needed;

(8) Post should seek to accept contributions from a broad array of eligible organizations and companies. No donor may co-host the official Fourth of July event with the U.S. Government or be designated as a sole sponsor of the event. Given the diversity of the Department’s mission overseas, a representational event celebrating the national day of the United States should, more than any other day, celebrate the diversity of the U.S. Government’s interest and goals. Co-hosting our national day with an outside group might be construed as singling out one area of our particular mission, running a significant risk of criticism or even enmity from other groups or persons whose interests also support the Department’s mission;

(9) Acceptance of a donation from one entity that is significantly larger than contributions from other sources should also be avoided. In such a case, post should closely scrutinize the circumstances of the donation and determine whether all or only a portion of the contribution should be accepted. Donations should not be accepted if they would create an appearance that a donor will be advantaged in U.S. Government actions if it gives or will be disadvantaged if it does not;

(10) All contributions received for the Fourth of July, whether cash or in-kind, should be given as unconditional gifts and reported in the Gift Fund Registry. Donors may express a preference that donations be used for the Fourth of July celebration:

(a) Generally, post should not sign donor agreements. However, if a donor requests that post sign a donor agreement in order to receive a donation, post should review the agreement to ensure that it does not require post to take actions inconsistent with the requirements of 2 FAM 962.8 and also does not contain problematic clauses and restrictions listed in 2 FAM Exhibit 960(B). After such review, post should send the donor agreement to L/M and CGFS/EDCS for clearance before signing;

(b) If a donor agreement can be signed, signature on behalf of the Department may be made by the management officer for whom entering into such agreements is within the scope of his or her duties. (These documents are generally intended by the donor to be binding contracts. However, they are not acquisition contracts and therefore are not subject to the Federal Acquisition Regulation. Because these are not acquisition contracts, they do not need to be signed by a warranted contracting officer.);

(11) Written solicitation for cash or in-kind gifts should avoid making any promises that could result in an appearance of preference or unfair advantage, or that would be inconsistent with other guidance in this section. Written solicitations should not indicate a specific dollar amount that an individual donor is expected to make but may mention the general cost of the event. Donors should not receive special recognition keyed to the amount of the contribution;

(12) Post officials should seek to solicit local or regional representatives of U.S. companies, rather than corporate headquarters in the United States. Under exceptional circumstances, post may request in a written memorandum through the regional bureau addressed to the Under Secretary for Management, with clearances from the regional bureau, CGFS/EDCS and L/EFD, an exception to permit solicitation of a U.S. firm’s U.S. headquarters. Requests should include the basis for permitting the exception, such as the options for in-country solicitation being very limited;

(13) Post officials should not solicit airline tickets or other travel-related services without the approval of the Under Secretary for Management;

(14) Fourth of July donations may be used for:

(a) Reasonable honoraria for local entertainment;

(b) Lodging, meals, and incidental expenses for U.S. military bands or other U.S. entertainers who are in country at the time of the official Fourth of July event; and

(c) Under exceptional circumstances, post may seek the Under Secretary’s approval to use donated funds for entertainers’ travel expenses. Requests should indicate compelling reasons why approval should be granted (e.g., favorable cost comparison, appropriate music for Fourth of July celebration);

(15) Post may have themed official events that showcase a particular U.S. regional area or aspect of U.S. culture. In such situations, post may solicit for food and other modest theme-related items, as well as for the cost of transporting such items to post. For example, for a theme highlighting New England, post could solicit for New England clam chowder, including necessary costs to transport such items. However, close scrutiny should be given to whether identifying one U.S. location is consistent with the purposes of an official Fourth of July event. For example, identifying the home area of the chief of mission may create the appearance that the event is for reasons other than celebration of the national day of the United States. The good judgment of post leadership should be exercised. In these cases, it may be appropriate to solicit regional U.S. companies for such in-kind gifts;

(16) Post should consider the scale of the event given economic circumstances. Any significant expansion of the event must be cleared in advance with CGFS/EDCS and L/M;

(17) Control over donor recognition must be retained by post. Donors should not receive special recognition keyed to the amount of the contribution. Donor recognition should be limited to a tasteful listing of donor names, perhaps displayed on a modest-sized placard near the entrance of the reception areas and/or in the program. If the chief of mission believes that it can be tastefully done, he/she may authorize the display of brand name logos or the like on serving tables, uniforms, or in similar places, so long as equal opportunity is given to all entities donating. Donors may not be recognized on invitations. Any promotional giveaways should be strictly limited to items of nominal value (e.g., balloons, individual beverage containers). Other forms of promotional activity such as product showcases or donor promotional displays or sale of such items are generally not appropriate;

(18) Cash donations must be reported to the Department (via the Gift Fund Registry). The record must include the date received, the donor information and any relevant affiliation, the amount of the donation, the authority under which the gift was accepted, and its disposition. If the gift is not recorded in the Gift Fund Registry, the bureau's executive office will not allot funds;

(19) In-kind gifts, such as cash donations, for official Fourth of July events are accepted as gifts to the Department and, therefore, must be reported to the Department (via the Gift Fund Registry) and controlled as U.S. Government property. Post should check with L/M to determine if a particular donation is authorized. A complete list of donors and the cash equivalent (fair-market value at the time and place of donation) of the in-kind gifts must be entered into the Gift Fund Registry. The date of donation, receiving bureau, fund program, and donor information must also be appropriately logged in the Gift Fund Registry; and

(20) Donations of services may warrant the use of a gratuitous services agreement. Posts should coordinate with L/EMP under these circumstances.

b. A solicitation under this section must also follow the same tenets set forth in 2 FAM 962.1 as if the ambassador or other principal officer were the Under Secretary for Management (see 2 FAM 962).

c. The July Fourth event must comply with all regulations and conditions that apply to representational activities paid for with appropriated funds, including those conditions governing attendance (e.g., Standardized Regulations, Chapter 300 on representational activities abroad).

d. Nonofficial Fourth of July celebrations include any event other than the official Fourth of July representational event, no matter where the event takes place. Examples are those events hosted primarily for U.S. Government employees only or events hosted by individuals or sponsored by employee associations:

(1) 2 FAM 960 does not provide authority for employees or their family members to solicit or accept gifts on behalf of the U.S. Government for nonofficial Fourth of July celebrations. Employees and family members should solicit for nonofficial Fourth of July events either in their personal capacity or on behalf of an employee association or other outside organization only if the solicitation fully conforms to the government-wide Standards of Ethical Conduct (including 5 CFR 2635.202 on gifts and 5 CFR 2635.808 on fundraising) and does not conflict with official solicitation efforts;

(2) Employee associations may accept unsolicited gifts for nonofficial Fourth of July events if it is made clear to the donor that the event is not the official Fourth of July representational event. Acceptance of the gift and accompanying accounting practice must be recorded separately from the official event. Acceptance criteria should be consistent with the guidelines of 2 FAM 962;

(3) Nonofficial events may be held on Embassy grounds as long as it is clear that the event is not the official Fourth of July representation event;

(4) A fee may be charged for the nonofficial event to cover costs, but in no case should the proceeds be deposited as official U.S. Government funds;

(5) Vendors may sell products at nonofficial events; and

(6) Post should consult the annual Fourth of July cable for reporting and accounting procedures, as well as any updated information regarding the guidance contained in 2 FAM 962.8.

2 FAM 962.9 Gifts for Public Diplomacy Purposes Abroad, including Attendance at Certain Cultural/Entertainment Events

(CT:GEN-452; 04-28-2016)

a. Public affairs officers (PAOs) and their subordinates at post are authorized to solicit and accept gifts for public diplomacy purposes abroad (as defined in 2 FAM 961.4(5)) subject to the following conditions:

(1) The PAO must follow the same tenets set forth in 2 FAM 962.1 as if the PAO were the Under Secretary for Management (see 2 FAM 962);

(2) Any solicitation should be targeted at a broad array of individuals and entities, including nonfederal sources where appropriate. No preference shall be shown among similarly situated individuals or entities in soliciting and accepting donations. No solicitation shall promise any U.S. Government benefit in exchange for donations;

(3) When soliciting from U.S. companies, posts should solicit local representatives of such companies in their country of assignment rather than the corporate headquarters;

(4) In those instances in which solicitation “campaigns” are contemplated for specific public diplomacy (PD) programs, such campaigns shall be conducted during a finite period of time and for a specific targeted amount not to exceed a total of $150,000 per program rather than throughout the year for an indefinite period of time and an unspecified targeted amount (for campaigns in excess of this amount, Under Secretary for Management approval is needed);

(5) COM or deputy COM (DCM) approval must be obtained before a solicitation is undertaken or donations are accepted. Donations from any one donor may not exceed $75,000 per program (for individual donations in excess of this amount, Under Secretary for Management approval is needed);

(6) All applicable Department reporting and accounting requirements must be followed according to guidelines indicated in 2 FAM 964 and 2 FAM 965; and

(7) If a post has questions about the appropriateness of a draft solicitation letter, talking points to be used in telephone calls, or other issues, advice should be sought from its regional bureau.

b. When personally engaged in fundraising for PD programs, COMs may, without the need to receive prior authorization from the Under Secretary for Management, sign letters and make short remarks to a broad group of otherwise permissible companies or nationals to solicit them for a PD program for a specific targeted amount not to exceed a total of $150,000 per program. COMs may similarly thank donors for their contributions in an appropriate manner.

c. With respect to the solicitation and acceptance of tickets for and/or attendance at cultural, entertainment, or sporting events serving PD purposes abroad, prior COM or DCM approval must be obtained. With such approval, PAOs and their subordinates at post are authorized to solicit and accept gifts of tickets on behalf of the Department, subject to the following conditions:

(1) The tickets are for an event co-sponsored by post; or

(2) A written determination has been made by the PAO that:

(a) Explains how and why attendance at the event by Department employees is necessary to further the Department’s PD programs or interests; and

(b) Confirms that the Department’s interests in attendance outweigh any concerns that the gift of attendance may appear to improperly influence Department employees in the performance of official duties (relevant factors that should be considered in making this determination include the importance of the event, the nature and sensitivity of any pending matter affecting the interests of the donor, the significance of the employee’s role in that matter, the purpose of the event, the identity of other attendees and the market value of the tickets); and

(3) For COM attendance at such events, the ticket value will determine who should make the written determination:

(a) For the COM to accept tickets with a per ticket value exceeding $75, the relevant regional executive director or deputy director should make this written determination in consultation with the bureau’s public diplomacy leadership;

(b) For the COM to accept tickets with a per ticket value of $75 or less, the management officer at post should make the written determination in consultation with the public affairs officer; and

(c) The approving official may consult or request guidance from L/PD, L/M, and L/EFD as necessary.

2 FAM 962.10 Gifts for Entertainment Events

(CT:GEN-460; 08-18-2016)

a. The solicitation or acceptance of gifts to the Department for entertainment events must be approved in advance. In appropriate circumstances, tickets for entertainment events may be solicited and/or accepted as a gift to the Department under the PD or the representational purposes provisions above (see 2 FAM 962.9 and 2 FAM 962.7, respectively). In appropriate circumstances, tickets for entertainment events may also be accepted through a post’s community liaison office (CLO) (see 2 FAM 962.11). In all other cases, an Action Memorandum to the Under Secretary for Management, outlining the desired goal, process, and circumstances, consistent with the provisions in 2 FAM 962 would be required. Such gifts must be recorded in the Gift Fund Registry.

b. Please note that in narrow circumstances, tickets to an entertainment event may be accepted as a personal gift to the employee under the provisions of 5 CFR 2635 and 11 FAM 600. Such tickets may never be solicited. Please consult L/EFD for guidance. Such gifts are not to be entered into the Gift Fund Registry.

2 FAM 962.11 Gifts Accepted by the CLO for Health, Morale, and Welfare of Department Employees Abroad

(CT:GEN-452; 04-28-2016)

The community liaison office (CLO) is an official component of U.S. mission and is subject to the same rules and regulations that apply to all Department employees, including ethics provisions prohibiting the personal acceptance of gifts from outside sources (See 11 FAM 610). The CLO’s ability to accept gifts or fundraise in his or her official capacity for the health, morale and welfare of Department employees abroad is limited to the following provisions:

(1) CLOs may accept unsolicited gifts of tickets or admission to entertainment events provided the management officer determines in writing:

(a) The gift is necessary and appropriate to support the health, morale and welfare of Department employees and family members; and

(b) The donor of the gift does not currently have a nonroutine matter or request for action at post, and otherwise does not appear to be offering the gifts to curry favor or preference with Department employees or as a quid pro quo for recent official action;

(2) The management officer at post should establish a fair and even-handed approach for the distribution of such gifts to Department employees and family members, showing no special preference based on superiority or position; and

(3) The CLO may also organize appropriate, self-supported social events for the welfare and moral of Department employees and may seek voluntary contributions from participating Department employees to cover the costs of these events.

2 FAM 962.12 Gifts of Travel

(CT:GEN-468; 03-15-2017)

a. Under certain circumstances as defined in this section, the Department may accept unsolicited donations other than cash to defray the cost of travel for official purposes (gifts of travel), including travel, subsistence, and related expenses.

b. The management officer at post is authorized to approve gifts of travel within the country of assignment and the executive director of the relevant bureau is authorized to approve gifts of travel outside of a country of assignment and travel of all persons stationed in Washington, DC.

c. When a Department authorizing official approves a gift of travel under this section, the traveling employee must be issued official travel orders in advance of travel.

d. Acceptance of gifts of travel from a nonfederal source:

(1) For travel offered in conjunction with a “meeting or similar function,” as defined by the Federal Travel Regulations at 41 CFR 304-2.1, the appropriate Department authorizing official must conclude that the donation is for travel that:

(a) Is to a conference, seminar, speaking engagement, symposium, training course, or similar event that takes place away from the employee’s official station;

(b) Relates to the employee’s official duties;

(c) Represents a priority use of the traveling employee’s time;

(d) Is for the minimum time necessary to carry out U.S. Government business; and

(e) Is from a nonfederal source that is not disqualified on conflict of interest grounds. In appropriate cases, the authorizing official may qualify acceptance of the offered travel by limiting the type or character of benefits that may be accepted;

(2) For travel offered for reasons other than a “meeting or similar function,” the authorizing official must conclude that, in addition to the requirements set forth at paragraph d(1) of this section:

(a) A reasonable person would not believe that the traveling official or the Department would lose objectivity as a result of accepting the travel donation; and

(b) The traveling official’s attendance at or participation in the event outweighs any concern that acceptance of the donation may or may reasonably appear to improperly influence the official in the performance of her duties;

(3) A nonfederal source is disqualified on conflict of interest grounds for the purpose of 2 FAM 962.12, subparagraph d(1), if a Department authorizing official determines that acceptance of the donation under the circumstances would cause a reasonable person with knowledge of all the relevant facts to question the integrity of Department programs or operations. The following factors should guide such a determination:

(a) The identity of the nonfederal source;

(b) The purpose of the travel;

(c) The identity of other expected participants;

(d) The nature and sensitivity of any matter pending at the Department or post affecting the interests of the nonfederal source;

(e) The significance of the employee’s role in any such matter; and

(f) The monetary value and character of the travel benefits offered by the nonfederal source.

e. The Department may accept a gift of travel for an employee’s spouse. All limitations and requirements of this part apply to the acceptance of payment from a nonfederal source for travel expenses and/or agency reimbursement of travel expenses for the spouse. The Department may determine that the spouse’s presence at an event is in the interest of the agency if the spouse will:

(1) Support the mission of the Department or substantially assist the employee to carry out official duties;

(2) Attend a ceremony at which the employee will receive an award or honorary degree; or

(3) Participate in substantive programs related to the agency’s programs or operations.

All such gifts of travel must be authorized by L/EFD, in addition to the appropriate Department authorizing official.

f. If the payment or ticket was paid in full directly by the nonfederal source or reimbursed to the Department by the nonfederal source, the provisions of the Fly America Act do not apply.

g. Accommodation other than coach class may be authorized when payment is from a nonfederal source, provided that all requirements of 41 CFR 301-10.123, 41 CFR 301-10.162, or 41 CFR 301-10.183 are met.

h. In general, full-time executive branch presidential appointees, including ambassadors, may not travel on aircraft or use overnight accommodations owned, chartered, or maintained by a company primarily for its use if the company is regulated by or doing business with the Department. While exceptions to this rule do exist for certain types of travel, the White House Counsel generally must authorize such exceptions. Individuals seeking such authorization must first contact L/EFD with answers to the following questions:

(1) Is the aircraft owned, chartered, or maintained by a company for its own use or has it been chartered or leased by the company from a charter company for a specific occasion?

(2) Are other travel arrangements or accommodations practically available?

(3) Does the offer of travel or accommodations result from the business activities or employment of the presidential appointee’s spouse and, if so, is it clear that such benefits have not been offered or enhanced by the appointee’s official position?

(4) Is the company regulated by, doing business with, or seeking to do business with a relevant post or bureau(s) of the Department, and, if so, what is the nature of that regulation or business?

(5) Could the presidential appointee affect the interests of the company by the performance or nonperformance of his or her official duties and, if so, how?

(6) Does an official purpose exist for the travel and, if so, what is that official purpose?

(7) Does the travel constitute a priority use of the presidential appointee’s time?

(8) Is the travel for the minimum time necessary to carry out official purposes?

(9) What is the nature and approximate monetary value of the travel benefits offered by the company?

2 FAM 962.13 Gifts of Club Memberships

(CT:GEN-431; 11-07-2014)

As a general matter, the Department does not accept gifts of club membership. In some unusual cases, the Department may approve the acceptance of a gift of a free club membership as a gift to the Department. The Department will generally only do so when it appears that access to the club would substantially advantage the official in the conduct of foreign affairs to a degree that overcomes any appearance of improper advantage. Requests for approval to accept such memberships should be directed to the relevant Department executive office for approval by the Under Secretary for Management.

2 FAM 962.14 Gifts to the Foreign Service National Emergency Relief Fund

(CT:GEN-577; 02-02-2022)

CGFS/EDCS may accept monetary gifts to the Department for the Foreign Service National Emergency Relief Fund, a Fund that was created to respond to crises and humanitarian requests on behalf of locally employed (LE) staff working for the U.S. Government. The Fund assists LE staff of all U.S. government agencies in a host country. Contributions should be made by check, credit card, or through payroll deductions. All contributions to the Fund are tax-deductible and 100 percent of all contributions are allocated for current and future disbursements. Checks should be made payable to the U.S. Department of State and earmarked for the Foreign Service National Emergency Relief Fund. Correspondence should be sent to the following address: The FSN Emergency Relief Fund, Gift Fund Coordinator, U.S. Department of State, 2201 C Street NW, CGFS/EDCS, Rm. 7427B, Washington, DC 20520. Secure on-line electronic donations may be made via the U.S. Treasury’s website. Requests to make a one time or recurring payroll deduction can be made through the Payroll Customer Support Portal. LE staff wishing to contribute should contact their management office for currency exchange assistance. CGFS/EDCS has authorized reverse accommodation exchange for emergency fund contributions. For additional information, please visit the CGFS/EDCS website.

2 FAM 962.15 Fundraising for Local Charities Abroad

(CT:GEN-431; 11-07-2014)

a. Chiefs of mission may authorize employees, and family members at post to solicit cash or in-kind donations on behalf of local charities (e.g., by writing letters, making telephone calls) without prior authorization by the Under Secretary for Management in cases where the purpose for fundraising is for local use, the activity is in the clear foreign policy interest of the United States, and there is very little or no appearance of preference, or use of public office for private gain. Any fundraising activity must target the community at large, beyond the post. A local chapter of an international charitable organization may be considered a local charity under this provision if the purpose for the fundraising is for local use. Neither post employees nor the Department should accept or receive such contributions directly. The chief of mission and his or her spouse may participate personally in the solicitation only with the concurrence of L/EFD and the deputy assistant secretary of the relevant regional bureau. See also 3 FAM 4123.4.

b. When a chief of mission solicits or authorizes a solicitation pursuant to 2 FAM 962.15, the chief of mission must consider the same tenets set forth in 2 FAM 962.1 as if the chief of mission were the Under Secretary for Management (see 2 FAM 962).

2 FAM 962.16 Relationship to Donors

(CT:GEN-431; 11-07-2014)

a. No employee may make any commitment to an actual or prospective donor that implies that the donor will receive any advantage or preference from the U.S. Government as a result of the donation, including a promise to intervene on behalf of the donor with the host government, a commitment to invite the donor to official functions, or an assurance that the donor would have preferential access to official facilities. In the course of his or her official duties, no U.S. Government employee may afford any donor preferential treatment as a result of a donation. However, a U.S. Government employee, in the course of his or her official duties, should not place a donor at a disadvantage because of his or her donation. In this regard, an ambassador remains free to invite any individual, including a donor, to stay at his or her official residence for reasons unrelated to the donation of the gift, including a friendship between the ambassador and that individual.

b. A donor may be given appropriate recognition (such as by a plaque) once a donation has been properly accepted. Any expense associated with such recognition should be charged to gift funds allocated to the project, if possible, or to another appropriate account.

2 FAM 962.17 Unconditionality of Gifts

(CT:GEN-452; 04-28-2016)

a. Under the guidance of the Under Secretary for Management, officials authorized to accept gifts on behalf of the Department shall allocate gifts in a manner that furthers public purposes and fulfills the needs of the Department.

b. The Department of State Basic Authorities Act, Section 25 authorizes the Department to accept conditional and unconditional gifts with the approval of the Under Secretary for Management. For both accounting and allocation purposes, the Department strongly prefers that gifts to the Department be offered without conditions (NOTE: The terms “conditional” and “unconditional” are derived from Section 25 and approximate the meaning of the accounting terms “restricted” and “unrestricted”):

(1) Conditional gifts: A conditional gift is a gift offered to the Department on the condition that the Department agrees to use the gift in the manner specified by the donor. When it accepts a conditional gift, the Department is legally bound to honor the donor’s terms. However, Section 25 of the Basic Authorities Act bars the Department from accepting any gift conditioned on an expenditure of funds that will not be met by the gift or income from the gift “unless such expenditure has been approved by Act of Congress.” An example of this is if an individual offers the Department $6,000 to be used only for the purchase of brass doors. The brass doors cost $10,000. Under the statute, the gift may be accepted only if Congress has appropriated to the Department at least $4,000 that can be spent on refurbishment activities such as the purchase of brass doors; and

(2) Unconditional gifts: An unconditional gift may be used by the Department for any lawful purpose. However, in making unconditional gifts, donors may express nonbinding preferences on how they wish their gifts to be used by the Department:

(a) One example of this is if an individual offers $5,000 to the Department and states his or her wish that it be used to help refurbish Embassy Paris facilities. The Department may accept the donation as an unconditional gift and may state its intent to put it to the donor’s preferred use, if possible. By so doing, the Department undertakes no legal obligation to use the gift as the donor prefers; and

(b) Another example is if a company offers the Department a telephone switchboard system that will aid the Department in hosting an international conference. The Department may accept the donation as an unconditional gift and may state its intent to use the switchboard system at the conference if possible. By so doing, the Department undertakes no legal obligation to use the gift as the donor prefers.

c. Because Department policy strongly favors unconditional gifts, the donor should be asked to submit to the Department, either prior to or upon making the gift, a donor letter, (see 2 FAM Exhibit 960(A)). Such a letter, while allowing the donor to express a preference for the use of a gift that he and/or she has donated, makes clear that the gift is unconditional. If the donor declines to submit such a letter and states that the offer is conditioned on the Department’s use of the gift for the specified purpose, the gift may be accepted only by the Under Secretary for Management after consideration of the limitation on conditional gifts in the Basic Authorities Act.

d. When a nonbinding preference has been expressed, officials authorized to accept gifts on behalf of the Department should, in the first instance, consider utilizing gifts for the purpose suggested by the donor. A different use may be made, however, where a higher priority exists. Officials should inform the prospective donor prior to acceptance of the donor’s gift if there is a reason to believe that the donor’s expressed preference will not be met.

2 FAM 963 GIFT OFFICER RESPONSIBILITIES

(CT:GEN-460; 08-18-2016)

a. The management officer at post will serve as gift officer for official gifts accepted at post. The management officer may designate an alternate with the concurrence of the bureau executive director. The designee may be no more than one rank below the designating officer.

b. Gift officers are responsible for maintaining gift controls, improving accountability, and providing a single point of contact for questions.

c. Officers are responsible for:

(1) Approving Gift Fund Registry entries;

(2) Accepting gifts for the U.S. Government and handling them according to established law, regulations, and procedures;

(3) Providing simple advice to embassy employees and referring questions to the Office of the Legal Adviser; and

(4) Promoting embassy efforts to ensure that embassy employees observe gift rules and regulations.

2 FAM 964 Gifts Officer and REPORTING REQUIREMENTS

(CT:GEN-569; 03-25-2021)

a. The gift officer must maintain a record in the Gift Fund Registry of all official gifts and donations received, excluding those listed in 2 FAM 964, paragraph c. Gifts to be listed in the Gift Fund Registry include:

(1) Gifts accepted under 3 FAM 4122.1;

(2) Gifts of artwork accepted under an authority other than 2 FAM 962.5;

(3) Gifts for representational purposes abroad (2 FAM 962.7);

(4) Gifts for July Fourth events abroad (2 FAM 962.8);

(5) Gifts for public diplomacy purposes abroad, including attendance at certain cultural/entertainment events (2 FAM 962.9);

(6) Gifts for entertainment events (2 FAM 962.10);

(7) Gifts accepted by the CLOs for health, morale, and welfare of Department employees abroad (2 FAM 962.11);

(8) Gifts of travel that do not fall under 2 FAM 962.12, subparagraph d(1) (i.e., gifts of travel that are not accepted under 31 U.S.C. 1353; see 2 FAM 962.12);

(9) Gifts of club memberships (2 FAM 962.13);

(10) Gifts to the Foreign Service National Emergency Relief Fund (2 FAM 962.14); and

(11) Gifts accepted under any other authority, including gifts accepted following submission of an Action Memo to M under 2 FAM 962.1.

b. Gift officers must identify the gift, date received, the name of the donor and any relevant affiliation, the amount of the gift (if cash) or the value (if in-kind), the authority under which the gift was accepted and its disposition in the Gift Fund Registry. If the gift is not recorded in the Gift Fund Registry, the bureau's executive office will not allot funds. Domestically, donors must complete a Donor Letter (2 FAM Exhibit 960(A)) and submit it to the appropriate bureau executive director. Overseas, donors must complete a Donor Letter and submit it to the management officer at post.

c. The following gifts are reported elsewhere and do not need to be reported in the Gift Fund Registry:

(1) Gifts of travel that fall under 2 FAM 962.12, subparagraph d(1) (i.e., gifts of travel accepted under 31 U.S.C. 1353). These are reported to L/EFD (see subparagraph d(2) of this section);

(2) Gifts from foreign governments and international organizations (2 FAM 962.3), including gifts offered as personal gifts to employees that cannot be accepted under the Foreign Gifts and Decorations Act because they exceed minimal value and are accepted on behalf of the Department. These are reported to the Office of Protocol within 60 days of acceptance;

(3) Gifts of real property (2 FAM 962.4). These are reported to OBO (see 2 FAM 962.4-3, paragraph b);

(4) Gifts of artwork accepted under 2 FAM 962.5. These are reported to OBO/AIE (see 2 FAM 962.5); and

(5) Gifts of embassy refurbishment (2 FAM 962.6-1). These are reported to CGFS/EDCS (see 2 FAM 962.6-1, paragraph a).

d. Consistent with 31 U.S.C. 1353, for gifts of travel that exceed $250 in value and involve participation in a conference, seminar, speaking engagement, symposium, training course, or similar event, each bureau and post must submit Form SF-326, Semiannual Report of Payments Accepted, from a Non-Federal Source, which is available on the Directives Management website, the Department’s official site for all forms. Reports should be sent bi-annually in consolidated format to L/EFD by no later than April 30 and October 31 of each year, for the respective periods October 1- March 31 and April 1-September 30. The report should include the following information:

(1) The name and position of the traveling official;

(2) The name of the donor;

(3) The nature of the event to which the employee is traveling;

(4) The time and place of the travel;

(5) The amount and method of payment (including an itemization of the benefits funded by the donor);

(6) The nature of the expenses;

(7) The name of the accompanying spouse, if applicable; and

(8) Where payment has been made in-kind, the report must provide the amount paid by the nonfederal source or a reasonable approximation of the market value of the benefit. In the case of benefits with no commercial value, posts should, in the case of private air transportation, report the cost of first class airfare or, if necessary, chartering an aircraft commercially in similar circumstances, and, in the case of lodging, report the maximum applicable per diem rate for lodging.

2 FAM 965 ACCOUNTING

(CT:GEN-431; 11-07-2014)

a. Unless the Under Secretary for Management approves otherwise, monetary gifts allocated for a specific purpose must be used in accordance with the accounting procedures that apply to appropriated funds allocated for the same purpose. Since gifts are “no year” funds, they may be obligated, de-obligated, and re-obligated without fiscal year limitation.

b. Posts receiving representational gifts of cash should deposit such gifts in the form of either U.S. dollars or local currency. Posts must exercise proper internal controls over all transactions, provide a complete audit trail, and, otherwise, follow accounting procedures governing appropriated funds. Refer to 4 FAM 383.1 (Available Receipts) for additional guidance.

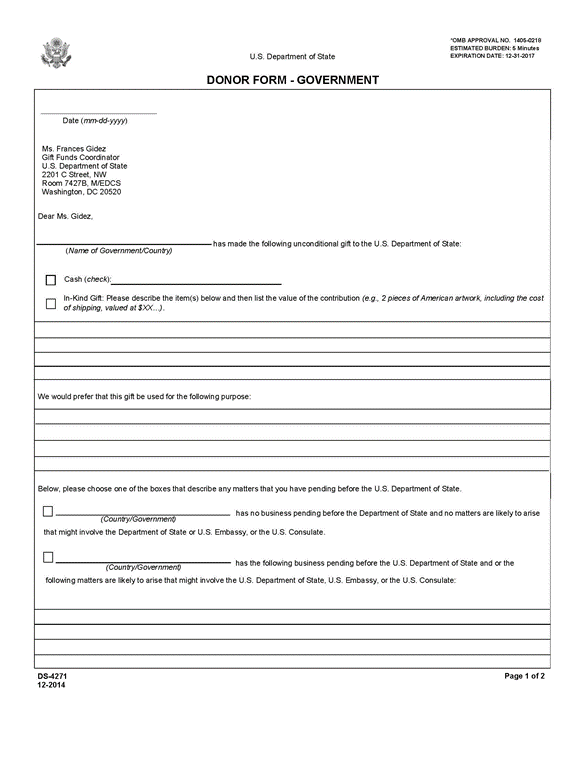

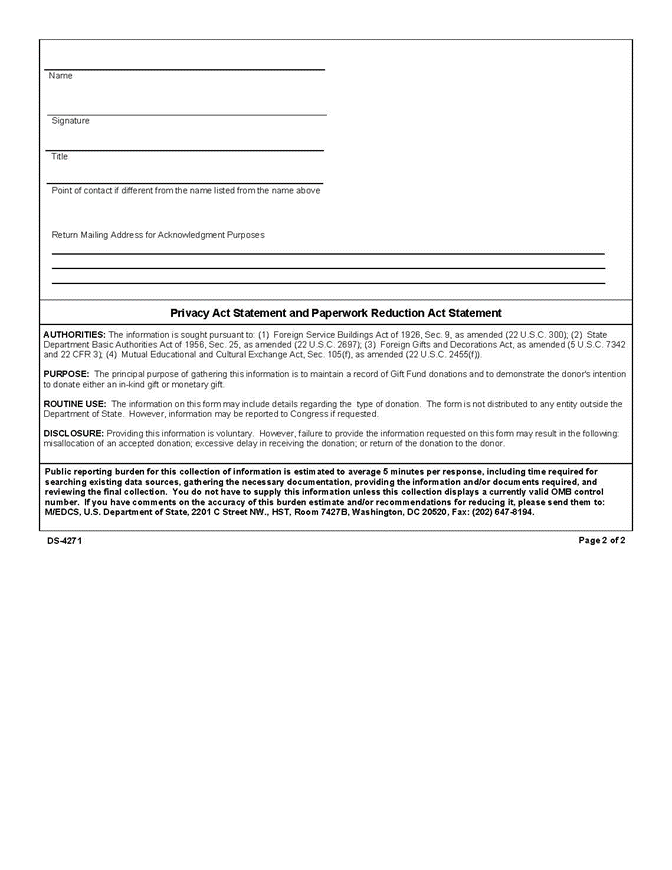

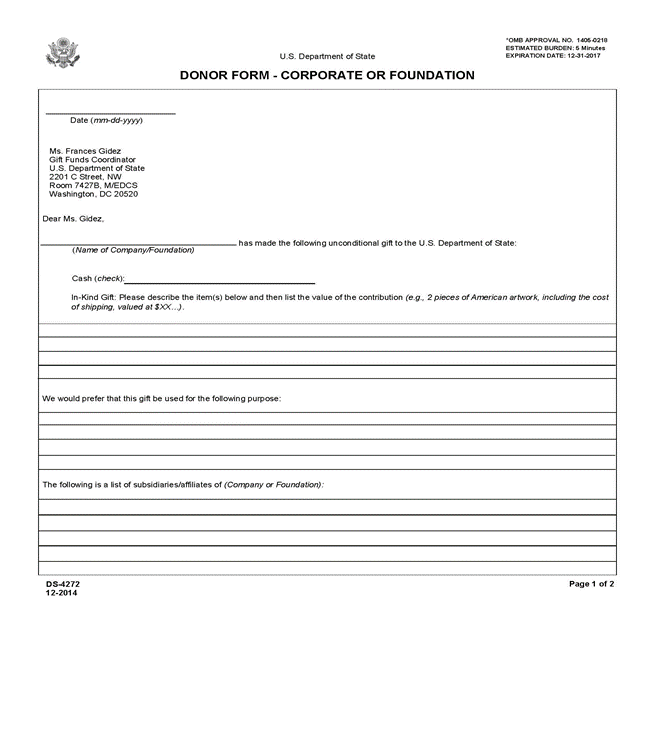

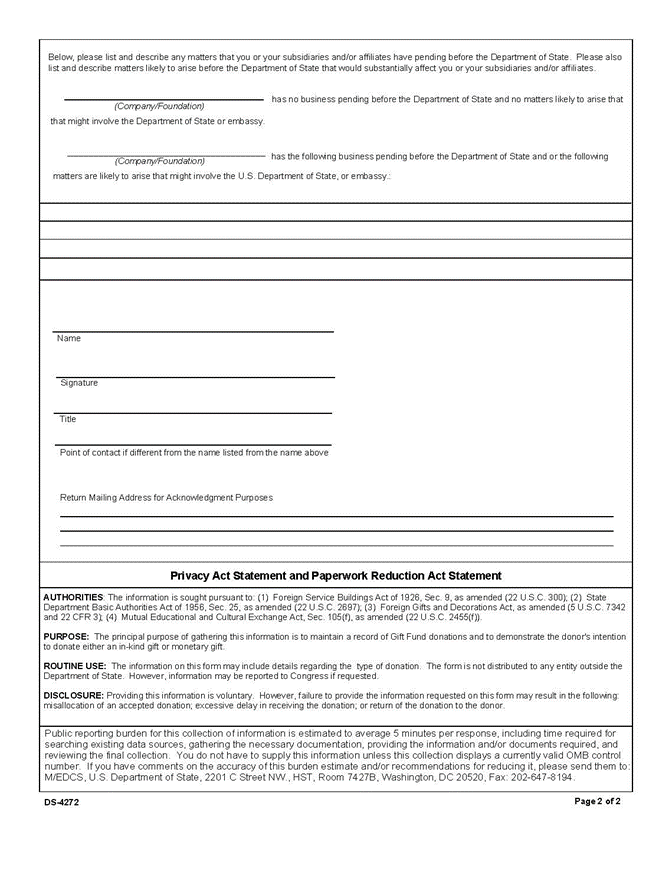

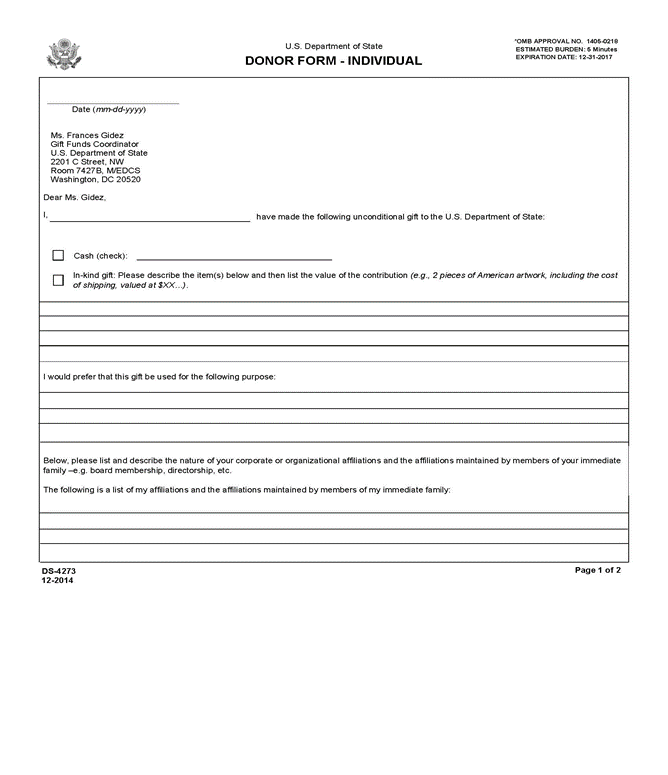

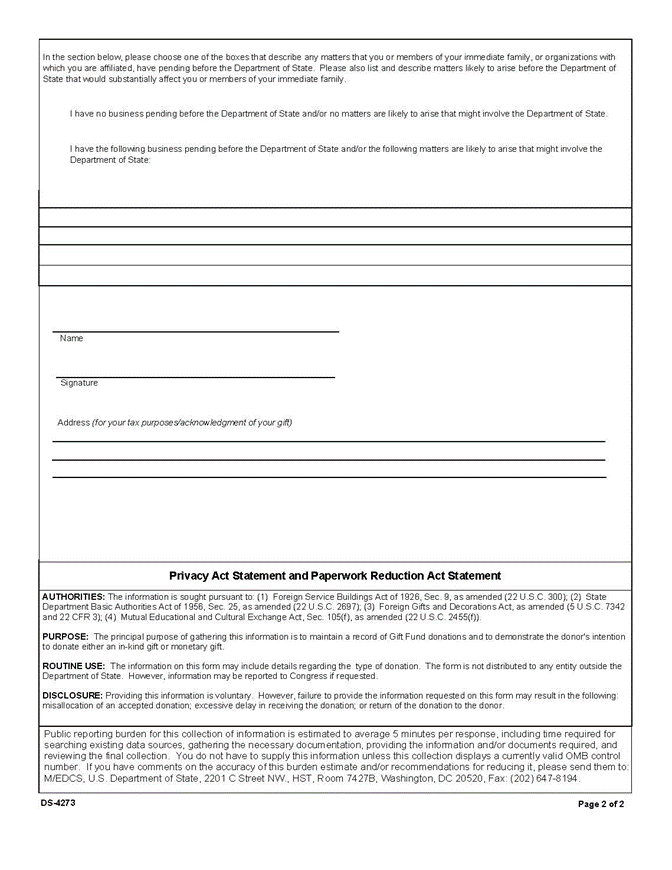

2 FAM Exhibit 960(A)

Sample Donor Letters

(CT:GEN-439; 02-19-2015)

Form DS-4271

Form DS-4272

Form DS-4273

2 FAM Exhibit 960(B)

Donor Agreements Clauses/Restrictions

(CT:GEN-439; 02-19-2015)

The following is a nonexhaustive list of clauses or restrictions that cannot be included in donor agreements:

(1) Clauses that set out the jurisdiction under which the agreement is to be governed, unless it is U.S. law;

(2) Clauses that ask the signer to confirm that he or she is not an officer, agent, or representative of any government;

(3) Insurance clauses;

(4) Clauses that grant the donor the right to determine how the donor is recognized at the event, or are otherwise at odds with the restrictions on donor recognition in 2 FAM 962.8, subparagraph a(17);

(5) Any quid pro quo for invitations (e.g., “In consideration of our donation of $____, the Embassy will provide ___ invitations to the Fourth of July event.”);

(6) Clauses that specify that the donation is to be used only for the Fourth of July event, or clauses that stipulate that the donation may be refunded in whole or in part. All donations must be unconditional;

(7) Clauses that grant the donor the right to veto post’s acceptance of donations from other donors;

(8) Clauses that grant the donor the right to refer to itself as a “sole sponsor” or “co-host”;

(9) Clauses that require the Department to maintain a separate account for a donor’s donation, grant the donor access to accounting records in regards to the donor’s donation, or require a separate report be provided to the donor regarding use of its donation;

(10) Indemnification clauses;

(11) Confidentiality clauses (a clause binding the Department to keep the agreement confidential);

(12) Clauses that restrict what the Department may say about the donor;

(13) Clauses that agree to allow the donor to use its donation for promotional purposes;

(14) Clauses that agree to allow the donor to use the Department or embassy seal; and

(15) Clauses that allow the donor to speak at the event.