4 FAH-2 H-800

CASHIERING AND FISCAL IRREGULARITIES

CASHIERING

(CT:DOH-43; 03-17-2025)

(Office of Origin: CGFS/FPRA/FP)

4 FAH-2 H-811 INTRODUCTION

(CT:DOH-39; 05-17-2024)

This subchapter prescribes the guidance on cashier operations abroad, as they pertain to the U.S. disbursing officer (USDO) and requirements of the cashier supervisor. Additional guidance on cashiering is found in 4 FAM 390 (Cashier Operations) and the Cashier User Guide (CUG).

4 FAH-2 H-812 ROLES AND RESPONSIBILITIES OF CASHIERS AND CASHIER MANAGERS

(CT:DOH-39; 05-17-2024)

a. Cashiers are:

(1) Accountable for the imprest fund cash advance used in cashier operations. The cashier must keep complete and accurate records of the funds and is personally and legally responsible for the safety of those funds;

(2) Accountable for the full amount of funds being held at any given time. Funds may consist of cash, uncashed U.S. Government checks, sales slips, invoices, or other receipts for cash payments, unpaid reimbursement vouchers, or interim receipts for cash entrusted to other individuals for specific purposes; and

(3) Responsible for depositing local currency cash and checks drawn on foreign banks with the locally designated depositary. These deposits should be immediately entered into the system.

b. Cashier supervisors: In accordance with 4 FAM 390, the financial management officer (FMO) or cashier’s U.S. citizen supervisor is responsible for:

(1) Determining the need for cashier operations including imprest fund payments and collection activities;

(2) Initiating and processing documentation for the designation, change, and revocation of cashiers and changes in the amount of the advance;

(3) Performing monthly unannounced verifications and reviews of cashier activities;

(4) Providing guidance, support, and overall supervision to individual cashiers on the operational requirements of the cashier function and in resolving operational problems; and

(5) Ensuring that both the principal and alternate cashiers are adequately trained in basic cashier fundamentals and automated cashiering operations.

c. U.S. disbursing officer (USDO) and CGFS cashier monitors:

(1) The cashier’s advance originates with the USDO and forms part of the USDO’s personal accountability. The USDO has fiscal authority over the cashier, whereas the cashier supervisor is responsible for supervisory oversight of the cashier. The USDO should verify and be assured that the advance amounts issued to cashiers are safeguarded and properly controlled. This assurance process involves a thorough review of the monthly cashier documentation by the cashier monitors that includes:

(a) Form DS-3058, Cashier’s Reconciliation Statement (also known as FSC-365);

(b) The accompanying form DS-3059, List of Items on Hand and List of Transmittals in Transit (also known as FSC-99);

(c) Form GFS-72, Cash On Hand Worksheet for the U.S. dollar (USD) and local currency units (LCU);

(d) The ACDC.013, Cashier Activity Report;

(e) The verifying officer’s checklist; and

(f) Form DS-7629, Statement of Designated Depositary Account, and copy of bank statement if cashier has a cashier checking account.

The USDO is responsible for notifying posts when unannounced verification documentation is late, inadequate, or when there are anomalies in the cashier reports and/or verifications.

(2) Cashier monitors are responsible for:

(a) Reviewing advances of Class A and B cashiers (all agencies), alternate Class A and B cashiers, and subcashiers with advance amounts over $10,000;

(b) Administering the cashier correspondence course and exam;

(c) Determining cashier advance amounts and any temporary advances;

(d) Sending and reviewing system cashier activity reports;

(e) Assuring that form DS-3058 advance verifications are submitted monthly by the cashier’s U.S. citizen supervisor or the cash verification officer (CVO);

(f) Quality reviewing form DS-3058 advance verification package and documentation;

(g) Following up on problems identified during a review of form DS-3058, Cashier's Reconciliation Statement, and form DS-3059, List of Items on Hand and List of Transmittals in Transit, and corrective action taken by the post;

(h) Cashier training from CGFS and post;

(i) Entering all required information into the cashier monitor’s database (see 4 FAH-2 H-819);

(j) Reviewing cashier operations on site; and

(k) Recommending revocations actions to the USDO when cashier activity is not in compliance with Department policies and procedures.

4 FAH-2 H-813 CASHIER DESIGNATIONS and REVOCATIONS

(CT:DOH-43; 03-17-2025)

U.S. disbursing officers (USDOs) are responsible for designating cashiers, including alternate cashiers, for all agencies with cashiers operating abroad. The designations for cashiers for agencies other than Department of State must also have approval of the Office of Global Disbursing Operations (CGFS/DO). The principal or alternate cashier must have a current designation before he/she may serve as a cashier. The USDOs designate Class A and B cashiers, including their alternates, based on cashier qualifications as defined in 4 FAM 390. Cashiers abroad responsible for change-making purposes are normally designated as subcashiers. The USDO designates subcashiers only when their advance amount is over U.S. dollar equivalent (USDE) 10,000. The financial management officer (FMO), agency supervisor, or management officer at post designates subcashiers with advances of USDE 10,000 or less.

4 FAH-2 H-813.1 Cashier Designation Procedures

(CT:DOH-39; 05-17-2024)

a. Agencies with cable capabilities should send their request to the appropriate servicing U.S. disbursing officers (USDOs). Agencies that are unable to send the request via cable may use form DS-4013 (formerly form SF-211), Request for Change or Establishment of Imprest Fund, or by official letter/memorandum.

b. The official authorized by the agency to make the designation request must sign the request (form DS-4013, letter, or memorandum, as appropriate) or approve an official message to the USDO requesting the designation. The USDO must have the official’s identifying information, as described in (1) and (2) below, on file. This information is compared to that on the request before any authorization is made:

(1) For Department of State: The Office of the Associate Comptroller (CGFS/S) delegates a blanket authorization to request designations to all financial management officers (FMOs) or management officers assigned to the post from which the request is being made. Clearance of the requesting cable by this official, confirmed by a statement in the text, satisfies compliance with this requirement. The USDO will maintain a current list of all Department of State FMOs or management officers assigned to every post they service. The USDO will consult this list when a request is received. If the requesting official’s name is not on the list, the USDO will clarify with the post. Department of State FMOs or management officers are not required to have their signatures on file with the USDO;

(2) For agencies other than Department of State: Each agency is responsible for determining the individual(s) authorized to request designation or advance amount changes. An official letter, signed by the agency headquarters, must be on file with CGFS/S and each servicing agency before any cashier designation request can be authorized. This letter should state the following:

(a) How the agency will make requests; i.e., via official cable from post, cable from headquarters, form DS-4013, official letter from post, or letter from headquarters;

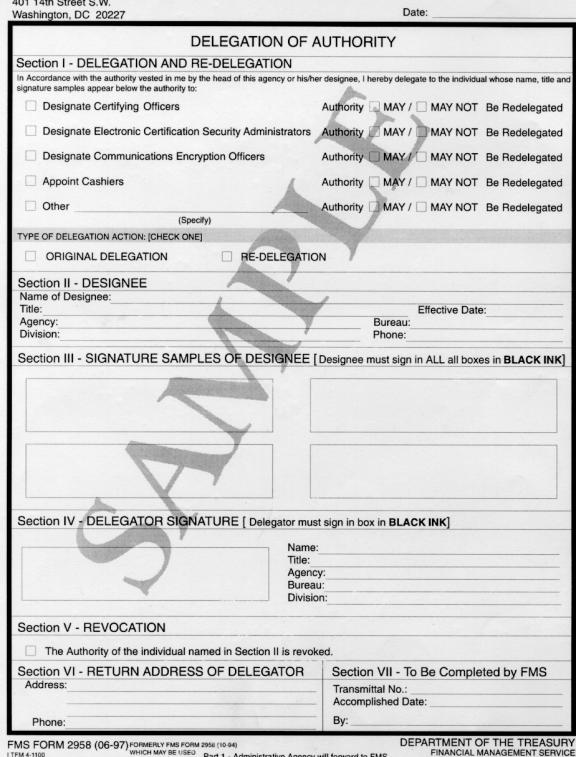

(b) The name, office designation, or position title of the official(s) authorized by the agency to make the request. If desired, Department of Treasury form FMS-2958, Delegation of Authority, may be used for this purpose. Refer to 4 FAH-2 Exhibit H-813 at the end of this subchapter for an example of Treasury form FMS-2958;

(c) Any additional requirements or information that the agency would like the USDO and the Office of Global Disbursing Operations (CGFS/DO) to review prior to authorization of the agency’s request; and

(d) The office symbol used for cable correspondence at both the post level and headquarters level (if applicable). If the agency does not have cable capabilities, include the appropriate fax and phone numbers and mailing addresses in this letter.

c. For a new cashier operation, the designation request must include the name of the cashier, type of cashier (A, B, or subcashier), whether the cashier will be a principal or alternate cashier, the agency name, post name, effective date of designation, and the amount of operating advance required. (See 4 FAH-2 H-815 to determine how much is an adequate amount of advance.) In addition, the request must cite the waiver conditions needed to justify the operation of an imprest fund (see 4 FAM 390). If the request is for designating a new cashier for an existing cashier operation, the request should also include the cashier code assigned to the operation:

(1) The request must identify the employee status (e.g., direct hire, personal services agreement (PSA), or personal services contractor (PSC)), and include a statement that the cashier meets the cashier responsibilities as specified in 4 FAM 393.1. These include having the integrity to assume responsibility for U.S. Government funds; the ability to perform fiscal services; and the ability to work with little supervision. The cashier must read, write, and speak English with sufficient fluency to understand and carry out the duties and responsibilities of the cashier function and must complete a Bureau of the Comptroller and Global Financial Services (CGFS)-sponsored or -approved cashier course and pass the examination (see 4 FAH-2 H-814). The request should also include a statement indicating that security measures consistent with 4 FAM 393.4-3 have been established to protect the advance;

(2) A cashier is normally a direct-hire, permanent employee. Cashiers may be employees of other U.S. Government agencies located at the post. An exception has been made for certain personal services agreement (PSA) and personal services contract (PSC) employees to be designated as Class B cashiers. PSA and PSC cashiers must have special language in their PSA agreement/PSC contract that addresses accountability issues:

(a) The exception for PSA and PSC employees applies only to the Department of State and Agency for International Development (AID), since these agencies have specific authority from Treasury to have PSA and PSC employees as cashiers. Other agencies may not use PSAs and PSCs as cashiers without specific authority from Treasury and a confirmation that the agency has agreed to indemnify Treasury for any losses by these employees. For non-State or AID agencies, the required documentation must be on file with CGFS/F/WO prior to submitting any designation request for a PSA or PSC cashier, and the requesting agency must confirm in the designation request that PSA or PSC employment documentation is consistent with the required documentation for a Department of State cashier (see 4 FAM 393.2-1);

(b) Requests for a PSA or PSC cashier designation must identify the employee to be designated, and the PSA agreement or PSC contract must meet the requirements identified in 4 FAM 393.2-1. The servicing USDO and the Office of Global Disbursing Operations (CGFS/DO) may request additional documentation as needed for the designation decision;

(c) After confirming the authenticity of the request, as in subparagraph c(2)(b), the USDO will designate the cashier via cable. For agencies other than Department of State, a copy of the cable will be sent to the headquarters office symbol identified in the agency letter required by 4 FAH-2 H-813.1 subparagraph b(2). If the post or agency does not have cable capabilities, the USDO will fax a copy of the official cable to the appropriate offices; and

(d) For new designations, the cashier should contact the CGFS cashier monitor to request the advance specified in the designation. The advance to the cashier is in U.S. dollars. The amount of local currency units is expressed in the designation cable and tracked by the cashier in U.S. dollars. See 4 FAH-2 H-815 for more information on cashier advance amounts.

4 FAH-2 H-813.2 Cashier Revocation Procedures

(TL:DOH-23; 02-22-2007)

a. When post determines that the cashier will no longer serve as a cashier, the financial management officer (FMO) or agency supervisor must request the revocation of the cashier designation, following the same procedures as for designation requests. When the request is processed by the U.S. disbursing officer (USDO), a cable is sent to the post confirming the revocation and listing all current active cashiers.

b. The USDO has the authority to revoke any cashier designation for cause if it is believed that the U.S. Government funds advanced to them are not being properly safeguarded or are being mismanaged.

4 FAH-2 H-814 CASHIER EXAMINATION

(CT:DOH-39; 05-17-2024)

a. All cashiers, both Department of State and other agencies, must take a Bureau of the Comptroller and Global Financial Services (CGFS)-sponsored or -approved course and pass the examination. All permanent designations must be in accordance with 4 FAM 393.2-1.

b. When a temporary designation has been authorized, but training and examination have not been completed, the USDO will automatically revoke the temporary designation when it expires. The cashier supervisor may request an extension of the temporary designation by providing a justification to the USDO at least 15 days prior to the expiration date. The USDO may accept or reject the requested extension based on knowledge of the situation.

c. The cashier examination will be sent by the USDO to the cashier supervisor when requested. The exam is sent back to and graded by the USDO, who will in turn notify the cashier’s supervisor of the results. Once the cashier passes the exam, the designation is changed from temporary to permanent. The USDO will send a cable to indicate the change in cashier status.

4 FAH-2 H-815 CASHIER ADVANCES

(CT:DOH-26; 10-07-2010)

a. Cashiers are given funds, known as cashier advances, to use in executing their official duties. Cashiers are accountable for all amounts advanced. The maximum amount of the advance (authorized amount) is specified in the cashier designation. The authorized advance represents the maximum amount of funds that the cashier should have on hand when making payments, accommodation exchanges, and receiving collections. This advance should not exceed one month’s expenditures. This advance is referred to as the permanent advance.

b. Occasionally, a cashier may need additional funds temporarily (normally for 30 days or less) to support a special activity such as a congressional delegation (CODEL). This advance has to be approved by the USDO and is referred to as a temporary advance and must be returned to the USDO when the special activity is over (see 4 FAH-2 H-815.2).

4 FAH-2 H-815.1 Permanent Advances

(CT:DOH-43; 03-17-2025)

a. Initial permanent advance for a cashier:

(1) The FMO or agency supervisor at post must determine the initial permanent advance amount for a new cashier operation and state that amount in the designation request to the USDO. A cashier's advance should be sufficient to meet daily cash requirements. How much is sufficient depends on many factors. These factors include:

(a) Availability of local depository for cashing advance checks;

(b) Turnaround time for receiving electronic funds transfer (EFT) replenishments, replenishment checks or cash from the servicing USDO; and

(c) Volume of business conducted by the cashier.

(2) While it is essential for the cashier to have sufficient cash on hand to meet daily requirements, the cashier should not store excessive amounts of cash at post. The advance should be enough for 1 week's transactions plus replenishment time.

b. Reviewing the size of the advance:

(1) The FMO at post should review the cashier advance every 6 months but not less than annually, or as required by the servicing USDO. The FMO’s review of the advance should be consistent with 4 FAM 393.4-2 and include the following steps:

(a) Calculate average daily vendor and other cash payments based on form DS-7635 (formerly OF-1129), Cashier Reimbursement Voucher and/or Accountability Report, and certified cash vouchers;

(b) Calculate average daily accommodation exchange payments;

(c) Calculate average daily collections;

(d) Calculate turnaround time for replenishment (the time required for request to reach the servicing USDO and EFT replenishments, replenishment checks, or cash to arrive at post);

(e) Identify the frequency of requests for replenishment;

(f) Identify the number of emergency replenishment requests in the past 6 months; and

(g) If the advance appears to be too low, determine whether an increase in the frequency of replenishment requests would provide the cashier with adequate funds.

(2) If the FMO determines that an increase (or decrease) to the advance is needed, the FMO must document the findings and provide written justification to the servicing USDO for the request. The cable must include:

(a) Name of cashier;

(b) Class B, Class A, or alternate;

(c) Office location of cashier (FMO, general services office (GSO), etc.);

(d) U.S. dollar (USD) amount of present advance;

(e) U.S. dollar amount of proposed advance;

(f) Date of last increase, decrease, or adjustment to the cashier's advance;

(g) Total accommodation exchange payments per month for 6-month period (report as U.S. dollar equivalent);

(h) Total vendor and other cash payments per month for 6-month period;

(i) Total number of cash collections;

(j) Number of EFT and local currency replenishments per month for 6-month period;

(k) Number of U.S. dollar replenishments per month for a 6-month period;

(l) Total number of emergency telegraphic replenishments requested for 6-month period;

(m) Method of accommodation exchange (by cashier, bank, or other source);

(n) Average turnaround time for replenishments (by currency if varied);

(o) List of other agencies with cashiers at post;

(p) For Class B cashier, number of subcashiers and total amount of advances to subcashiers (in U.S. dollars); and

(q) Other justification for the increase (or decrease). This might include an increase to or decrease in the exchange rate, which could cause the advance to exceed or be less than the authorized U.S. dollar equivalent of the advance.

(3) The USDO is required to review every cashier advance at least once a year to determine whether the advance is adequate:

(a) To ensure all cashier advances are reviewed annually, the USDO should establish a schedule for the year to review a certain number of cashiers each week, as an ongoing process;

(b) The USDO reviews transactions processed by the cashier for a 6-month period to make an initial determination of what an adequate advance amount should be. This is accomplished with output from the financial management system's disbursing module, which the Office of Global Disbursing Operations (CGFS/DO) makes available as a guide or tool for the cashier monitors. When working with the disbursing data and input from the cashier monitors, the USDO should take into consideration additional information known about a post, such as the cashier has large collections that are used as replenishments, etc. Final decisions should not be based solely on the disbursing data since it is only a tool for analysis. In general, the information reviewed by the USDO is the same as that reviewed by the FMO, except that the transactions are extracted from official USDO records;

(c) When the review is completed, the USDO sends the results of the analysis along with any additional information used to make his/her determination of the advance amount to the FMO or agency supervisor. The FMO may agree with the new advance amount or comment by providing additional information; and

(d) The USDO then makes a final decision on the advance amount. If there is a change from the previously authorized amount, the USDO sends a cable either increasing or decreasing the amount of the advance, with instructions on how the cashier should change his/her advance amount (i.e., deposit funds, request more advance funds, etc.). At the same time, the USDO will send new designation cables for all active cashiers for that cashier code, noting the new authorized advance amount. The USDO must also remember to change this information in the cashier database.

4 FAH-2 H-815.2 Temporary Cashier Advances

(CT:DOH-26; 10-07-2010)

a. There are times when an event at the post (VIP visit, ship visit, etc.) may cause a temporary need for cash in excess of the advance. In these instances, a temporary increase in the advance amount may be necessary.

b. The FMO or agency supervisor must request the temporary advance at least several weeks before the event, if known, to allow processing of the request. It is not required to include all the information in the temporary advance request as is required for a permanent advance increase. However, the request must contain valid justification for the additional funds. A cashier may have more than one temporary advance at one time. Each temporary advance is assigned a different number in the cashier’s database program, and each advance should be issued, tracked, and closed separately.

c. Normally, temporary advances are approved for short periods, such as 30 days or less. All temporary advances must have a date at which time it is to be returned to the USDO (referred to as the invalid date). Temporary advances may not be outstanding longer than the invalid date unless the USDO officially extends the invalid date by cable notification. Temporary advances can be issued for longer time periods but must be fully justified. If the temporary advance is needed for more than 6 months, the USDO should discuss with the FMO the option of increasing the permanent advance, rather than having a long-term temporary advance.

4 FAH-2 H-816 VERIFICATION OF THE CASHIER’S PERMANENT ADVANCE

4 FAH-2 H-816.1 U.S. Citizen Supervisor and Management at Post

(CT:DOH-39; 05-17-2024)

a. The cashier’s U.S. citizen supervisor must conduct an unannounced cashier verification using form DS-3058, Cashier’s Reconciliation Statement, at least once a month in accordance with requirement in 4 FAM 397.1-2. This verification is to ensure that the cashier is in compliance with Department of Treasury and Department of State regulations and that post has established effective internal controls to prevent U.S. Government funds from being stolen or misused.

b. There must be at least one form DS-3058, Cashier's Reconciliation Statement, and one form DS-3059, List of Items on Hand and List of Transmittals in Transit package submitted to the USDO that is dated for each month of the year. This package must include a properly completed form DS-3058 (also known as FSC-365); form DS-3059 (also known as FSC-99); the U.S. dollar (USD) and local currency unit (LCU) cash-counting worksheet; the ACDC.013 report; the checklist for verifying officers (Cashier User Guide, Chapter 13); and if the cashier has a cashier checking account, form DS-7629, Statement of Designated Depositary Account, and a bank statement. The verification must be signed by both the verifying officer and the cashier. Posts using the automated cashier system should use the reconciliation menu options to create and print form DS-3058 and form DS-3059 reports.

c. If the principal cashier is on leave, the monthly unannounced cashier verification for that month will be performed with the alternate cashier.

d. You must submit all completed documentation to the servicing USDO within 5 workdays after completing the verification. The work requirement for the cashier’s supervisor must include an element covering this internal control responsibility.

e. Post management must ensure that the monthly unannounced cashier verification is completed even when the cashier’s normal supervisor is on leave or there is a staffing gap. It is required that an alternate be designated to perform this task in the absence of the financial management officer (FMO) or management officer and that the designation be included on the “post designations” list. This will ensure that the alternate U.S. citizen cashier supervisor is well acquainted with the cashier internal control guidelines and verification process.

4 FAH-2 H-816.2 U.S. Disbursing Officer (USDO) and Cashier Monitors

(CT:DOH-43; 03-17-2025)

a. The U.S. disbursing officer (USDO) provides the funds advance to the cashier and is responsible for monitoring post management’s compliance with cashier internal controls. The USDO staff (cashier monitors) tracks the receipt of all monthly unannounced cashier verification documents from post and reviews the supporting documentation. The USDO is required to notify post management when the monthly unannounced cashier verification documentation is not received according to the following guidelines:

(1) If the cashier verification documents (form DS-3058, Cashier's Reconciliation Statement, also known as FSC-365, and form DS-3059, List of Items on Hand and List of Transmittals in Transit, also known as FSC-99, are not received within 60 days of the last verification, the USDO sends a cable notifying the cashier supervisor. If the verification was completed, the post is requested to submit the package by the fastest means possible. If it was not, the U.S. citizen supervisor is requested to perform the verification and send the completed package immediately;

(2) If the cashier verification documents (form DS-3058 and form DS-3059) are not received within 75 days after the previous cashier verification, the USDO will request the management officer or counselor, or the other agency representatives, to verify the status of the cashier verification. Copies of a past-due verification may be submitted if an immediate issue requires resolution and a copy is acceptable to the cashier monitor. However, original verification documents must follow within 15 days to ensure that the copy is valid. Post will be asked to respond by cable the same day the notification cable is received. The USDO will advise post management to perform the verification immediately if it has not been completed. The appropriate regional bureau, executive officer, other agency headquarters, and the director of the Office of Global Disbursing Operations (CGFS/DO) will also receive a copy of this notification;

(3) If the cashier verification documents (form DS-3058 and form DS-3059) are not received within 90 days after the previous cashier verification, the USDO will notify, as appropriate, the deputy chief of mission (DCM) and other agency representatives. The USDO will hold cashier replenishment requests from the post until the cashier verification documentation is received. The appropriate regional bureau, executive officer, other agency headquarters, and the director of CGFS/DO will also receive a copy of this notification.

b. By February 15 each year, the USDO will send an annual “report card” to post management comparing the actual number of verifications (form DS-3058) received from post during the previous calendar year to the number of months the cashier was serviced by the post. If a cashier was serviced by the USDO for the entire 12 months of the year, the post should submit 12 copies of form DS-3058 (one for each monthly unannounced cash verification). Send the report by official cable, listing all serviced cashiers and their form DS-3058 submission record. The text and calculations for this cable can be automatically produced in the cashier’s database program:

(1) The purpose of this annual report is to summarize cashier supervisor compliance and advise post management of information that could impact the embassy’s annual risk assessment questionnaire;

(2) If a post has submitted 12 or more copies of form DS-3058 (FSCs-365), the USDO will send a cable to the post acknowledging receipt of the required number of cash verifications. If a cashier has submitted 10 or fewer, the USDO will notify the individual posts that they were not in compliance with the requirements and that they must comply in the following year. The USDO should personally contact each cashier supervisor that has submitted fewer than six copies of form DS-3058 during the year to discuss reasons why he/she did not comply with the requirement, and what needs to be done in the next year to ensure improvement.

c. Review of form DS-3058 verification documents. The USDO must ensure that the cashier monitors review cashier documentation submitted with the form DS-3058 verifications. The monitors use a cashier monitor checklist (i.e., Monthly Checklist for Verifying Officer), which contains questions pertaining to the verification documents. The checklist is available from the servicing USDO and is also contained in the Cashier User Guide. The cashier monitor should follow up with the cashier supervisor for any “no” answers on the checklist. If the cashier or cashier supervisor does not respond to inquiries from the cashier monitors, the USDO should become personally involved in future correspondence. If problems continue, the USDO should contact the Office of Global Disbursing Operations (CGFS/DO) for assistance.

4 FAH-2 H-816.3 Foreign Service Nationals (FSNs) and Others as Verifying Officers for the Monthly Form DS-3058 Reconciliations

(CT:DOH-39; 05-17-2024)

The Department of State has implemented a program whereby, under certain conditions described in 4 FAM 397.1-2, a locally employed staff can be allowed to perform and sign the monthly form DS-3058, Cashier’s Reconciliation Statement.

4 FAH-2 H-816.4 Cashier Monitor Visits to Post

(CT:DOH-26; 10-07-2010)

The U.S. disbursing officer (USDO) will establish a schedule for travel to posts for on-site cashier reviews and training. Each cashier should be visited once every 5 years if there is no indication of problems with the cashier. Cashiers with occasional or recurring problems should be visited more often. A trip report should be completed after each visit and filed in the cashier’s official file. Visits to post that are not on the established schedule are sometimes recommended. The following situations may warrant a nonroutine (emergency) visit to post by the cashier monitor:

(1) Cashier is not submitting form DS-3058 for 3 months or more;

(2) Serious out-of-balance condition continues for an extended period of time; and

(3) Existence of suspicious transactions.

4 FAH-2 H-817 USE OF THE AUTOMATED CASHIER SYSTEM

(CT:DOH-37; 08-10-2017)

a. All Department of State Class A or B cashiers are required to use the automated cashier system, where hardware and software capabilities are available. Other agency cashiers are encouraged to use Department of State automated software but may use comparable automated software or spreadsheet-formatted forms to use in their cashier operations.

b. Using the automated cashier system improves cashiering practices and significantly decreases the possibility of fraudulent activity by the cashier. The automated cashier system fully automates the cashiering activity and handles all cashier window operations such as official collections, accommodation exchange, deposits, and payments. The automated cashier system simplifies the cash verification process and reduces substantially the amount of time it takes to perform verification. The automated cashier system incorporates several security and internal control features, making it more difficult for the cashiers to manipulate the outcome of a verification. Additionally, temporary advances and outstanding debit vouchers are monitored by the system, and the International Cooperative Administrative Support Services (ICASS) statistics are automatically computed.

c. The current version of the automated cashier system prepares transmittals when requested and generates an electronic 1166, Voucher and Schedule of Payments, and files, with the exception of U.S. dollar (USD) deposits, credit card deposits, and emergency transfers, for automatic transmission to CGFS Charleston or Bangkok.

4 FAH-2 H-818 CASHIER TRAINING

(CT:DOH-33; 07-22-2013)

a. Cashier and cashier supervisory training is periodically scheduled at CGFS Bangkok, CGFS Charleston, and CGFS Office of Financial Support and Training (Paris). Post management should take advantage of these training opportunities as part of their efforts to strengthen internal controls at posts. Transferring financial management officers (FMOs) should visit CGFS Charleston or Bangkok (depending on which center services their post) for consultation and discussions pertaining to the overall cashier operation at the new post.

b. U.S. disbursing officers (USDOs) should establish a cashier training program for all employees who operate as cashiers, supervise a cashier, provide guidance to a cashier, or monitor a cashier. This includes employees from posts, as well as from Global Financial Services (CGFS). Classes should be scheduled as far in advance as possible to allow participants time to make travel arrangements. Consider the following types of training when developing the training program:

(1) Cashier training for both new and more advanced cashiers;

(2) Cashier training in the automated cashier system for both new automated cashier program users and more advanced users;

(3) Cashier training for cashier supervisors in basic cashiering operations; how to perform the monthly form DS-3058, Cashier’s Reconciliation Statement; and in automated cashier system procedures and techniques;

(4) Cashier training for cashier monitors in basic cashiering operations and the automated cashier system; and

(5) On-site training at posts when needed in basic cashiering, automated cashier system (installations or training), or supervisory techniques.

4 FAH-2 H-819 USE OF the cashier database

(CT:DOH-43; 03-17-2025)

a. The cashier database tracks cashier designations and advance information and provides a tool for monitoring the cashier reconciliation reports. It also further defines the cashier monitor’s tasks and standardizes the position’s responsibilities. All CGFS cashier monitors should use this program.

b. The database automatically tracks when late-notice cables should be sent to cashier supervisors who have not submitted required reports. When form DS-3058 and form DS-3059 verifications are received, the monitor enters information that identifies whether the verification package includes all required documents and completes a “checklist” of questions covering information on the form DS-3058 and form DS-3059 reconciliation. Some of these questions include whether the cashier is in balance; has any long outstanding in-transit items or debit vouchers (bad checks); or has reconciled his/her bank account (if relevant).

c. The U.S. disbursing officers (USDOs) should run the management reports in the cashier’s database at least once a month to determine how well the cashier monitors are performing their duties. The program provides information on many areas, including any cashiers with outstanding temporary advances, temporary designations, debit vouchers or fiscal irregularities, as well as information on cashiers who have not submitted their forms DS-3058 and form DS-3059 each month.

d. The programming staff at the CGFS Charleston help desk maintains the database. Direct all problems with the database, or suggestions for enhancements, to that office. CGFS Bangkok should forward its database file to the help desk on a quarterly basis.

4 FAH-2 Exhibit H-813

Treasury Form FMS 2958

(CT:DOH-33; 07-22-2013)