8 FAM 704.5

PHYSICAL PRESENCE AND RESIDENCE CALCULATORS

(CT:CITZ-93; 04-05-2023)

(Office of Origin: CA/PPT/S/A)

8 FAM 704.5-1 INTRODUCTION

(CT:CITZ-93; 04-05-2023)

a. The physical presence/residence calculators are five spreadsheets contained within a single Microsoft Excel file. They use simple built-in functions to calculate physical presence or residence in the United States and provide basic data-checking. When a user enters a pair of dates, it calculates the number of days between them. The calculator then sums up the total number of days and divides by 365 to get the total number of years.

|

NOTE: Leap years will show as 1.003 years in the calculation, because the calculator is based on calendar days. |

b. The physical presence/residence calculators provide a reliable means of calculating physical presence and residence for acquisition at birth abroad cases. Consistent calculations help:

(1) Reduce arithmetic errors;

(2) Ensure standardized adjudication at every post and passport agency/center; and

(3) Ensure that citizenship laws are uniformly applied.

c. The latest physical presence/residence calculators are on CA Web, on the Adjudication page, under the heading “Citizenship, Legitimation & Custody.”

d. Previously, there were separate calculators for use with passport applications (form DS-11) and Consular Report of Birth Abroad (CRBA) applications (form DS-2029). These have been combined into one file in the latest version since physical presence and residence are calculated the same regardless of whether the application is for a passport or CRBA. Each spreadsheet serves as a calculator for a different physical presence or residence requirement.

8 FAM 704.5-2 When to use the calculators

(CT:CITZ-93; 04-05-2023)

a. Passport specialists must use the most recent physical presence/residence calculator when adjudicating a case that requires establishing physical presence/residence.

b. You must attach a completed, printed copy of the calculator to the form DS-11 or form DS-2029.

c. You do not need to annotate evidence recorded on the attached calculator on the form DS-11 or form DS-2029.

d. If a form DS-2029 and form DS-11 are submitted concurrently, attach the calculator to the form DS-2029 only.

e. If an applicant’s citizenship was already established on a prior application and is not in doubt, you are not required to use a calculator.

f. Your adjudicative decision must be based on the law and applicable guidance in 8 FAM, not solely on the calculator. For full guidance on adjudicating residence and physical presence, see 8 FAM 301.7.

g. The physical presence/residence calculators are owned by the Office of Adjudication (CA/PPT/S/A). Contact AskPPTAdjudication@state.gov with questions related to the calculators.

h. Training on the physical presence/residence calculators is available from Passport Services' Office of Career Management (CA/PPT/S/CM).

8 FAM 704.5-3 Using the PHYSICAL PRESENCE AND RESIDENCE CALCULATORS

(CT:CITZ-93; 04-05-2023)

a. The physical presence/residence calculator file contains five worksheets. The worksheets require you to input the same information--the primary difference being physical presence or residence. However, the worksheets do perform different calculations based on the age of the transmitting parent and number of years of physical presence or residence required to acquire U.S. citizenship based on the law of acquisition. Consequently, you must ensure you are using the correct worksheet to avoid a calculation error:

(1) 5 years, 2 after 14 (presence) (Immigration and Nationality Act (INA) of 1952 section 301(g) as amended (see 8 FAM 301.7-9), and Section 309(c) (see 8 FAM 301.7-10(E));

(2) 10 years, 5 after 14 (presence) (INA of 1952 section 301(g) as amended (see 8 FAM 301.7-9));

(3) 10 years, 5 after 16 (residence) (Nationality Act of 1940 (NA) Section 201(g) (see 8 FAM 301.6-2), NA Section 205 (see 8 FAM 301.6-5(A)), and INA 301(g) (see 8 FAM 301.6-5(c)), see 8 FAM 307.1-8 for retention requirements;

(4) 10 years, 5 after 12 (residence) (NA 201(i) (see 8 FAM 301.6-2), NA Section 205(i) (see 8 FAM 301.6-5(c), and INA Section 301(g) (see 8 FAM 301.6-4)), see 8 FAM 307.1-8 for retention requirements; or

(5) 1 continuous year (presence) (INA Section 301(d) (see 8 FAM 301.7-8), and Section 309(c) (see 8 FAM 301.7-10(E)).

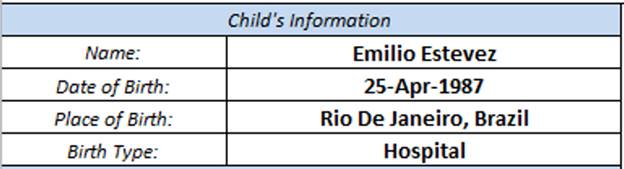

b. In the "Child's Information" block, you must include the child's name and date/place of birth (the calculator limits the birth date range based on the law of acquisition). The "Birth Type" line allows you to select whether the birth took place in a hospital, with a midwife, at home, or another location. You should complete the "Birth Type" line if that information is available on the foreign birth certificate. Otherwise, it may be left blank.

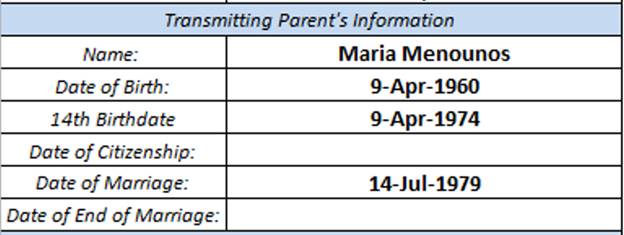

c. In the "Transmitting Parent's Information" block, you must enter the transmitting parent's name as it appears on the citizenship worksheet, date of birth, and the date the parent acquired U.S. citizenship. The physical presence calculator will determine the transmitting parent's 12th, 14th, or 16th birthdate automatically. You must complete the "Date of Marriage" and "Date of End of Marriage" lines if the transmitting parent is or was married to the other biological parent (see also 8 FAM 304.3 for guidance on assisted reproductive technology and gestational parents).

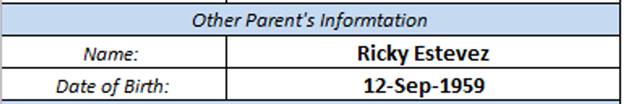

d. In the "Other Parent's Information" block, you must enter the other parent's name and date of birth (unless you are using the one year of continuous physical presence tab).

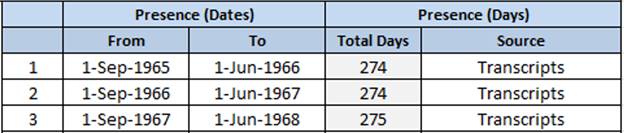

e. In the "Residence (Dates)" or "Presence (Dates)" block, you must enter the dates when the transmitting parent resided or was physically present in the United States and select or briefly annotate the information source (e.g., "school records") (see 8 FAM 303.4-3 regarding evidence of residence and physical presence).

f. In the "Adjudicator Notes" block, you may enter any additional information pertinent to the case.