FISCAL IRREGULARITIES

(CT:FIN-502; 05-08-2025)

(Office of Origin: CGFS/FPRA/FP)

4 FAM 371 GENERAL POLICY

4 FAM 371.1 Scope and Applicability

(CT:FIN-477; 06-28-2021)

a. This subchapter contains policies related to fiscal irregularities of an accountable officer of the Department of State. Specific guidance regarding the reporting of overseas cashier fiscal irregularities is provided by 4 FAM 397.3 and Chapter 15 of the Cashier User Guide.

b. Each instance of a fiscal irregularity (defined in section 4 FAM 371.3) that involves Civil Service or Foreign Service personnel must be investigated thoroughly, in accordance with the policies in this subchapter, to:

(1) Determine and report in detail the circumstances of the irregularity;

(2) Achieve restoration of amounts due to the United States; and

(3) Prescribe remedial measures to strengthen internal controls.

c. Fiscal irregularities include those disclosed by examining disbursement and collection transactions; any custodial responsibility (such as cash counts); or any other internal reviews or Office of Inspector General reviews, including audits, inspections, and investigations conducted as part of the normal course of business.

d. A fiscal irregularity of an accountable officer from another agency is subject to the policies of that agency and will not be reviewed under the Department of State’s fiscal irregularity process.

4 FAM 371.2 Authorities

(CT:FIN-484; 06-30-2022)

The authorities for this subchapter are contained in:

(1) 31 U.S.C. 3526, Settlement of accounts;

(2) Title 7 of the Government Accountability Office (GAO) Policy and Procedures Manual for the Guidance of Federal Agencies, Chapter 8, Settlement Officers;

(3) 31 U.S.C. 3527, General authority to relieve accountable officials and agents from liability;

(4) 31 U.S.C. 3528, Responsibilities and relief from liability of certifying officials; and

(5) 15 Op. Off. Legal Counsel 80 (1991), Comptroller General’s Authority to Relieve Disbursing and Certifying Officials from Liability.

4 FAM 371.3 Definitions

(CT:FIN-484; 06-30-2022)

Accountable officer: Any government officer or employee who by reason of employment is responsible for or has custody of government funds. Accountable officers encompass such officials as certifying officers, disbursing officers, collecting officers, and other employees who by virtue of their employment have custody of government funds.

Fiscal irregularity: An occurrence in which there is:

(1) A physical loss or deficiency: a shortage of public funds in an account, including imprest or similar funds, resulting from such things as (1) theft (burglary, robbery, embezzlement, etc.), (2) loss in shipment, and (3) destruction by fire, accident, or natural disaster. An unexplained shortage (i.e., a shortage of funds with no apparent reason or explanation) is also treated as a physical loss; or

(2) An improper payment: a disbursement of public funds that is found by an appropriate authority to be illegal, improper, or incorrect in accordance with applicable law and regulation. Improper payments may result from fraud, forgery, alteration of vouchers, improper certifications, and other improper practices. Improper payments may also be caused by human and/or mechanical error during the payment process.

4 FAM 372 reporting and resolution of fiscal irregularities due to Physical Loss or Deficiency OF FUNDS

4 FAM 372.1 Physical Loss or Deficiency of Funds Fiscal Irregularity Report of Investigation

(CT:FIN-502; 05-08-2025)

a. The principal officer at post or the head of each Department bureau and office is responsible for the initial investigation within the organization for any fiscal irregularity where there is a physical loss or deficiency of funds and for reporting the results of the investigation.

b. As soon as it is determined that the probability of a fiscal irregularity exists due to a physical loss or deficiency of funds, the principal officer of an embassy or head of a Department bureau or office, as appropriate, notifies the Department's Bureau of the Comptroller and Global Financial Services (CGFS), Attention: Director, Office of Financial Policy (CGFS/FPRA/FP), by unclassified cable or memorandum (unless circumstances warrant a higher classification). The communication should be under the subject: INVESTIGATION OF FISCAL IRREGULARITY and provide all facts available and applicable recommendations. If all facts are not yet available, the report should indicate the same and state when a final report will be forwarded.

c. At a subordinate consular post, the principal officer prepares a report to the embassy. The embassy is responsible for investigating the consular post’s report and submitting the fiscal irregularity report of investigation.

d. If theft, fraud, or malfeasance is suspected in a fiscal irregularity at post, a copy must be sent to the regional security officer (RSO) and a determination made regarding Office of the Inspector General (OIG) notification and involvement. If theft, fraud, or malfeasance is suspected in a fiscal irregularity at a Department bureau or office, a copy must be sent to the appropriate security officer within the bureau or office and a determination made regarding OIG notification and involvement. Suspected fraud and subsequent reporting to OIG should be handled in accordance with the Department of State Authorities Act of FY 2017.

e. Final reports on investigation of all fiscal irregularities where there is a physical loss or deficiency of funds should include the following information:

(1) A detailed statement of facts that includes the type of irregularity, date, amount, and names and positions of individuals involved and their supervisor;

(2) A citation of pertinent supporting documents, such as receipts, pay records, contracts, vouchers, etc.;

(3) A description of how the irregularity occurred and how it affected the accountable officer’s account;

(4) Detailed information on procedural deficiencies, if known, and the corrective action taken, or to be taken;

(5) Information as to the restitution obtained or contemplated from the responsible individual(s);

(6) Information on collection actions taken;

(7) Identification of an appropriation or fund to be charged if an account adjustment is deemed necessary;

(8) Information showing that there was a reasonable basis for relying on the procedures and controls in an automated system if a relief request is based on the loss resulting from such reliance;

(9) A written statement by the accountable officer demonstrating that the loss or deficiency of funds occurred without any fault or negligence on his/her part or a notation by the agency that the accountable officer chooses not to submit a separate statement; and

(10) Principal officer at post or head of Department bureau or office determination for a physical loss or deficiency of $500 or less, or a recommendation to the Committee of Inquiry into Fiscal Irregularities for a physical loss or deficiency of funds in excess of $500. The recommendation should address accountable officer relief of liability for the physical loss or deficiency of funds and be based on the investigation results under the 31 U.S.C. 3527 relief standard:

(a) The physical loss or deficiency of funds occurred while the accountable officer was carrying out official duties or that the loss was attributable to the act or omission of a subordinate of the accountable officer; and

(b) The physical loss or deficiency of funds was not the result of fault or negligence on the part of the accountable officer.

f. The principal officer at post or head of Department bureau or office should consider whether the circumstances justify assigning the employee in question other duties pending completion of investigation or final decision by CGFS and/or OIG.

g. In cases of loss resulting from physical loss or deficiency of public funds in the accounts of an accountable officer, CGFS will notify the Department of the Treasury. The Department of the Treasury is responsible for notifying the GAO in accordance with 31 U.S.C. 3526.

4 FAM 372.2 Resolution of a Fiscal Irregularity Due to Physical Loss or Deficiency of Funds

(CT:FIN-484; 06-30-2022)

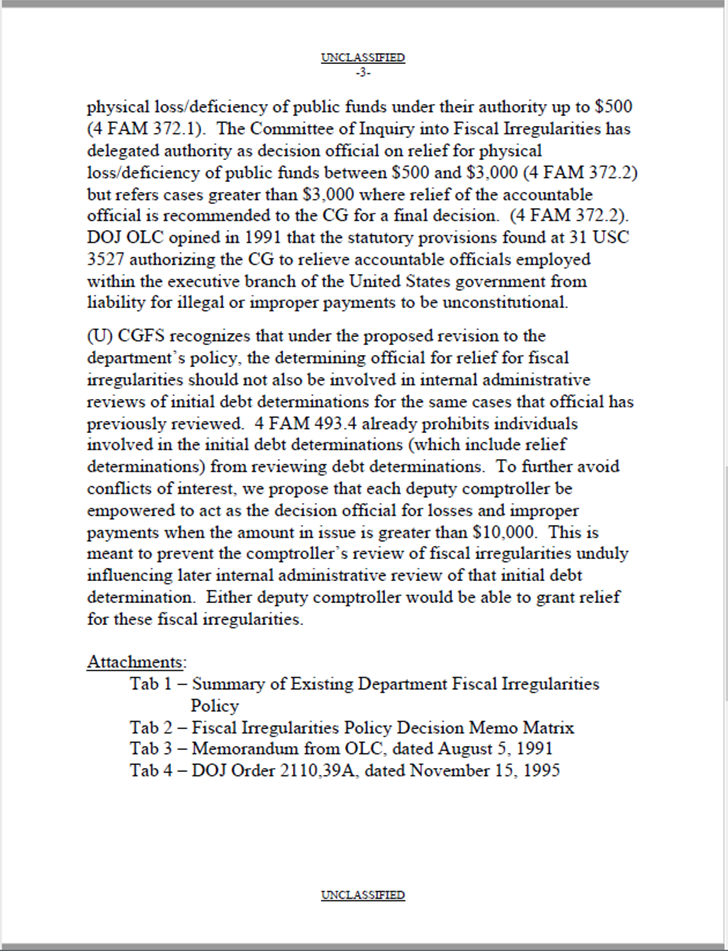

a. By law, accountable officers are held strictly liable for the unrecoverable physical loss or deficiency of public funds. Consistent with Department of Justice (DOJ) Office of Legal Counsel (OLC) opinion, the Department may relieve present or former accountable officials of this pecuniary liability and is responsible for the resolution of its own fiscal irregularity cases. (See 4 FAM Exhibit 372.2.)

b. As described in 4 FAM 374, the Committee of Inquiry into Fiscal Irregularities ("committee") is the unit within the Department that has the authority to grant relief to an accountable officer for a physical loss or deficiency of public funds of $10,000 or less. However, where the physical loss or deficiency is greater than $10,000, the committee will seek a determination from a Department of State Deputy Comptroller.

c. The Department has delegated to the principal officer at post and head of Department bureau or office the authority to grant relief to an accountable officer for a physical loss or deficiency of public funds of $500 or less under the provisions of Department of State Delegation of Authority No. 354.

d. The committee evaluates cases of physical loss or deficiency of public funds in excess of $500 and makes one of the following determinations:

(1) That the fiscal irregularity did not occur by reason of willful intent to defraud the Government or fault or negligence on the part of the accountable officer. The committee can grant relief where there is a physical loss or deficiency of up to and including $10,000. If the report of investigation recommends granting relief for a physical loss or deficiency in excess of $10,000 and the committee concurs, it will submit the fiscal irregularity case to a Department of State Deputy Comptroller for determination on granting relief;

(2) That the fiscal irregularity did occur because of fault and/or negligence on the part of the accountable officer. The committee will direct the appropriate post or domestic office to initiate collection action, and, if the committee so determines, refer this matter to the Bureau of Global Talent Management (GTM) for disciplinary action; or

(3) That the fiscal irregularity did occur because of fraud, malfeasance, or other possible criminal activity. In this case the committee will refer the case to the OIG, if it has not already been so referred by the relevant post, bureau, or office. No further action will be taken on the case until the OIG notifies the committee of the result of the investigation or notifies the committee that the OIG will not pursue an investigation.

e. See 4 FAM 375 for committee procedures, administrative support, and actions after committee determinations.

4 FAM 373 reporting and resolution of fiscal irregularities due to improper payment

4 FAM 373.1 Improper Payment Fiscal Irregularity Report of Investigation

(CT:FIN-502; 05-08-2025)

a. The principal officer at post or the head of each Department bureau or office is responsible for the initial investigation within the organization for any fiscal irregularity where there is an improper payment and for reporting the results of the investigation.

b. The management, financial management, or program/grants officer at the post, bureau, or office responsible for the allotment, activity, or program under which an improper payment arises is responsible for undertaking appropriate initial recovery processes (e.g., adjusting a subsequent vendor invoice payment) or collection measures in accordance with 4 FAM 493.1.

c. As soon as it is determined that an improper payment is unrecoverable through initial recovery processes or collection measures, or once an improper payment remains unrecovered for one year or greater, the probability of a fiscal irregularity exists and the principal officer of an embassy or head of a Department bureau or office, as appropriate, notifies CGFS, Attention: Director, Office of Financial Policy (CGFS/FPRA/FP), by unclassified cable or memorandum (unless circumstances warrant a higher classification). The communication should be under the subject: INVESTIGATION OF FISCAL IRREGULARITY and provide all facts available and applicable recommendations. If all facts are not yet available, the report should indicate the same and state when a final report will be forwarded.

d. At a subordinate consular post, the principal officer prepares a report to the embassy. The embassy is responsible for investigating the consular post’s report and submitting the fiscal irregularity report of investigation.

e. If theft, fraud, or malfeasance is suspected in a fiscal irregularity at post, a copy must be sent to the regional security officer (RSO) and a determination made regarding OIG notification and involvement. If theft, fraud, or malfeasance is suspected in a fiscal irregularity at a Department bureau or office, a copy must be sent to the appropriate security officer within the bureau or office and a determination made regarding OIG notification and involvement. Suspected fraud and subsequent reporting to OIG should be handled in accordance with the Department of State Authorities Act of FY 2017.

f. Final reports on investigation of all fiscal irregularities where there is a loss of funds as result of improper payment should include the following information:

(1) A detailed statement of facts that includes the type of irregularity, date, amount, and names and positions of individuals involved and their supervisor;

(2) A citation of pertinent supporting documents, such as receipts, pay records, contracts, vouchers, etc.;

(3) A description of how the irregularity occurred and how it affected the accountable officer’s account;

(4) Detailed information on procedural deficiencies, if known, and the corrective action taken, or to be taken;

(5) Information as to the restitution obtained or contemplated from the responsible individual(s);

(6) Information on collection actions taken;

(7) Identification of an appropriation or fund to be charged if an account adjustment is deemed necessary;

(8) Information showing that there was a reasonable basis for relying on the procedures and controls in an automated system if a relief request is based on the loss resulting from such reliance;

(9) A written statement by the accountable officer demonstrating that the loss of funds as a result of improper payment occurred without any fault or negligence on his/her part or a notation by the agency that the accountable officer chooses not to submit a separate statement; and

(10) Principal officer at post or head of Department bureau or office determination for an unrecoverable improper payment of $100 or less, or a recommendation to the Committee of Inquiry into Fiscal Irregularities for an unrecoverable improper payment in excess of $100. The recommendation should address accountable officer relief of liability for the loss of funds as result of improper payment and be based on the investigation results under the applicable relief standard provided in 31 U.S.C. 3528 (b):

(a) The certification was based on official records and the official did not know, and by reasonable diligence and inquiry could not have discovered, the correct information; or

(b) The obligation was incurred in good faith, no law specifically prohibited the payment, and the U.S. Government received value for payment.

g. The principal officer at post or head of Department bureau or office should consider whether the circumstances justify assigning the employee in question other duties pending completion of investigation or final decision by CGFS or OIG.

h. In cases of loss resulting from improper payment in the accounts of an accountable officer, CGFS/FPRA/FP is responsible for notifying GAO within 3 years from the date the fiscal irregularity is identified in accordance with 31 U.S.C. 3526 and Title 7 of the GAO Policy and Procedures Manual for the Guidance of Federal Agencies, Chapter 8, Settlement Officers.

4 FAM 373.2 Resolution of Fiscal Irregularities Arising from Improper Payment: Certifying Officers

(CT:FIN-484; 06-30-2022)

a. By law, certifying officers are held strictly liable for the unrecoverable loss of funds as result of improper payment. Relief is discretionary. Consistent with DOJ OLC opinion, the Department may relieve present or former accountable officials of this pecuniary liability and is responsible for the resolution of its own fiscal irregularity cases. (See 4 FAM Exhibit 372.2)

b. As described in 4 FAM 374, the Committee of Inquiry into Fiscal Irregularities ("committee") is the unit within the Department that has the authority to grant relief to an accountable officer for an improper payment of $10,000 or less. Where the improper payment is greater than $10,000, the committee will seek a determination from a Department of State Deputy Comptroller.

c. The Department has delegated to the principal officer at post and head of Department bureau or office the authority to grant relief to an accountable officer for an unrecoverable improper payment of $100 or less under the provisions of Department of State Delegation of Authority No. 354.

d. The committee evaluates cases of improper payments in excess of $100.

e. When considering whether to grant relief to a certifying officer, the following determinations apply:

(1) That the certification was based on official records and the official did not know, and by reasonable diligence and inquiry could not have discovered, the correct information;

(2) That the obligation was incurred in good faith, no law specifically prohibited the payment, and the U.S. Government received value for payment;

(3) Where it is determined that the fiscal irregularity did occur because of fault or negligence on the part of the accountable officer, the committee will direct the appropriate post or domestic office to initiate collection action, and, if the committee so determines, refer this matter to GTM for disciplinary action; or

(4) Where it is determined that the fiscal irregularity did occur because of fraud, malfeasance, or other possible criminal activity, the committee will refer the case to the OIG and take no further action until the OIG notifies the committee of the result of the investigation or notifies the committee that the OIG will not pursue an investigation.

f. Relief of the certifying officer from liability does not affect the liability or authorize relief of the beneficiary or recipient of the improper payment nor does it diminish the government’s duty to pursue collection action against the beneficiary or recipient.

g. See 4 FAM 375 for committee procedures, administrative support, and actions after determinations.

4 FAM 373.3 Resolution of Fiscal Irregularities Arising from Improper Payment: Disbursing Officer

(CT:FIN-502; 05-08-2025)

a. By law, a disbursing officer in the executive branch is responsible for disbursing money only in accordance with vouchers certified by the head of the spending agency or an authorized certifying officer and for examining the vouchers to the extent necessary to determine they are in proper form and certified and approved. The disbursing officer is liable for deficiencies in his/her accounts resulting from illegal, improper or incorrect payments. Relief from liability is discretionary. Consistent with DOJ OLC opinion the Department may relieve present or former accountable officials of this pecuniary liability and is responsible for its own FI cases (See 4 FAM Exhibit 372.2).

b. As described in 4 FAM 374, the Committee of Inquiry into Fiscal Irregularities (“the committee”) is the unit within the Department that has the authority to grant relief to an accountable officer for an improper payment of $10,000 or less. Where the improper payment is greater than $10,000, the committee will seek a determination from a Department of State Deputy Comptroller.

c. The Department has delegated to the Principal Officer at post and the head of the applicable bureau or office the authority to grant relief to an accountable officer for an improper payment of $100 or less pursuant to Department of State Delegation of Authority 374.

d. The committee evaluates cases of improper payments in excess of $100.

e. Relief may be granted to a current or former disbursing officer from liability for deficiencies in his/her accounts resulting from illegal, improper or incorrect payments, upon a determination that the payment was not the result of bad faith or lack of reasonable care by the disbursing officer:

(1) Where it is determined that the fiscal irregularity did occur because of fault, lack of good faith or reasonable care on the part of the accountable officer the committee will direct the appropriate post, bureau or office to initiate collection action, and if the committee so determines, refer the matter to GTM for disciplinary action; and

(2) Where it is determined that the fiscal irregularity did occur because of fraud, malfeasance or other possible criminal activity, the committee will refer the case to the Office of the Inspector General (OIG) and take no further action until the OIG notified the committee of the result of the investigation or notifies the committee that the OIG will not pursue an investigation.

f. Relief of the disbursing officer from liability does not affect the liability or authorize relief of the beneficiary or recipient of the improper payment nor does it diminish the government’s duty to pursue collection action against the beneficiary or recipient.

g. See 4 FAM 375 for committee procedures, administrative support, and actions after determinations.

4 FAM 374 COMMITTEE OF INQUIRY

4 FAM 374.1 Scope of Authority

(CT:FIN-477; 06-28-2021)

a. The Department has a Committee of Inquiry into Fiscal Irregularities. The committee makes decisions concerning fiscal irregularities and functions as a reviewing and coordinating body to ensure compliance with the Department’s policy stated in 4 FAM 370.

b. The committee ensures that reported cases of suspected fraud or malfeasance involving fiscal irregularities have been referred to OIG for investigation by the appropriate office.

c. The committee primarily concerns itself with determining the fiscal liability of accountable officers. The committee should refer matters involving disciplinary or prosecution action to the appropriate Department bureau or office.

4 FAM 374.2 Establishment and Membership

(CT:FIN-502; 05-08-2025)

a. The committee has a standing membership of one representative from the Bureau of Global Talent Management; one representative from the Office of the Legal Adviser, General Management (L/M); and one representative from the Office of the Deputy Chief Financial Officer (CGFS/DCFO). The CGFS/DCFO representative serves as permanent chairperson of the committee.

b. A quorum of members must be present for the committee to make determinations. A quorum only exists when every member of the committee is represented at a meeting.

c. A member of the committee must not take part in the consideration of any matter in which:

(1) The member has a personal financial interest;

(2) The accountability or responsibility of a person directly supervised by the member is at issue;

(3) The accountability or responsibility of a supervisor of the member is at issue; or

(4) The member's impartiality might otherwise reasonably be questioned. In such case, the head of the bureau or office represented designates a substitute member. If, for the same reasons, such bureau or office head should not designate a substitute member, the designation is made by the next higher official who is not so disqualified.

4 FAM 375 COMMITTEE PROCEDURES

4 FAM 375.1 Responsibilities

(CT:FIN-477; 06-28-2021)

a. The Chairperson of the committee is responsible for:

(1) Calling all meetings of the committee;

(2) Presiding over the committee sessions, ensuring that a quorum is present;

(3) Designating one employee from the financial policy staff to provide administrative support; and

(4) Signing the final written determinations of the committee.

b. The administrative staff member is responsible for:

(1) Advising members of the time, place, and agenda for all meetings;

(2) Preparing and distributing written summaries of the meetings, including committee decisions and actions to committee members; and

(3) Maintaining committee case files.

c. The committee members are responsible for:

(1) Reviewing and discussing case facts;

(2) Determining if the accountable officer is liable; and

(3) Determining whether relief should be granted or recommended in accordance with the procedures listed in 4 FAM 375.3 and recording those decisions in writing. The chairperson of the committee signs all final written decisions of the committee.

4 FAM 375.2 Administrative Support

(CT:FIN-477; 06-28-2021)

The offices represented on the committee may provide staff assistance to enable the committee to complete its assignments promptly and efficiently.

4 FAM 375.3 Actions After Determinations

(CT:FIN-502; 05-08-2025)

a. CGFS/FPRA/FP will notify the post, bureau, or office by official email or cable, with copy to the U.S. disbursing officer (USDO) if an overseas fiscal irregularity, of the committee or Deputy Comptroller determination on granting accountable officer relief of liability and actions that must be taken.

b. If the accountable officer was not granted relief, the post, bureau, or office must designate a point of contact at the post (management officer or equivalent) or bureau or office (executive officer) for the fiscal irregularity case. The point of contact is responsible for communicating with the accountable officer, the USDO if an overseas fiscal irregularity, and CGFS/FPRA/FP. The designated contact must notify the accountable officer of the decision within 15 days of the official email or cable date.

c. Should the accountable officer request the Department to reconsider the determination, he/she must request the facts used by the determining official (committee or Deputy Comptroller) concerning the fiscal irregularity case. The point of contact will request the information from CGFS/FPRA/FP by official email or cable. The accountable officer will have 30 days from receipt of the facts to prepare documentation that presents facts not contained in the fiscal irregularity case. The accountable officer must send documentation for reconsideration to the point of contact to forward to CGFS/FPRA/FP for reconsideration by the determining official. All appeal requests with any additional documentation must reach the determining official within 60 days of the original decision. The determining official will reconsider the case only if there is new information presented that may affect the original determination. The determining official’s decision will be communicated by official email or cable to the point of contact who will inform the accountable officer.

4 FAM 376 Cashier Overages

(CT:FIN-502; 05-08-2025)

a. A cashier overage of funds identified in daily cashier reconciliation or monthly verification of funds is not considered a fiscal irregularity as defined in 4 FAM 371.3. The cashier supervisor is responsible for completing an investigation into the cause of the overage; making restitution available to any identified payers that have not received proper change; and documenting the results of the investigation in writing to include how the overage occurred, actions taken to correct the overage, and actions taken to prevent an overage from reoccurring.

b. The Class B cashier must perform a collection using General Receipt Form OF-158 to the Treasury general fund receipt account 19 1060, Forfeitures of Unclaimed Money and Property for the overage amount. The cashier supervisor must sign the Form OF-158 as approving official.

c. The cashier supervisor must notify the Office of Global Disbursing Operations (CGFS/DO) cashier monitor of the cashier overage and actions taken by unclassified official email, include copies of the investigation memorandum and completed Form OF-158, and retain the documentation in his/her official records.

4 FAM 377 through 379 unassigned

4 FAM Exhibit 372.2

Action Memo for Under Secretary Bass (M) on Department Policy Concerning Relief

of Accountable Officers

(CT:FIN-484; 06-30-2022)