6 FAH-5 H-300

Cost Distribution System at Post

Budgeting in a Cost Distribution System

(CT:ICASS-107; 05-26-2021)

(Office of Origin: CGFS/ICASS)

6 FAH-5 H-311 General

(CT:ICASS-105; 05-17-2021)

(Applies to participating ICASS agencies)

a. This chapter outlines the established principles for budgeting in the International Cooperative Administrative Support Services (ICASS) cost distribution system as agreed between the service provider and customer agencies. A description of ICASS can be found in 6 FAH-5 H-010 ICASS Functions.

b. These principles are intended to ensure a consistent methodology for gathering and maintaining budget information to prepare accurate invoices and develop metrics to support management decision-making. It is essential that budgets be prepared using the concepts and guidelines provided in this Handbook.

6 FAH-5 H-312 Basic Principles for Cost Distribution in ICASS

(CT:ICASS-105; 05-17-2021)

(Applies to participating ICASS agencies)

a. Simple, Transparent and Consistent: The goal of the ICASS cost distribution system is to maintain a simple, transparent, and consistent approach to share equitably the administrative support costs for the overseas management platform.

b. Costs Shared in an Equitable Manner: All ICASS costs are distributed and shared by participating agencies based on head counts (capitation), workload counts (static or cumulative), or space occupied (see 6 FAH-5 H-331). ICASS redistribution costs at post are distributed using a pro-rata share formula (see 6 FAH-5 H-330). Costs budgeted and billed solely in Washington are distributed on either a pro-rata share formula or on another basis as approved by the Washington interagency ICASS Working Group (IWG) (see 6 FAH-5 H-331).

c. Direct Charge: Any costs, including overtime, that can be readily direct charged to a specific agency should not be included in the ICASS budget (see 6 FAH-5 H-313).

d. ICASS treated as an Agency: For the purposes of this Handbook, the term “agency” means any entity with an overseas presence identified with a unique ICASS “agency code.” The term, ”ICASS,” is also included as an agency to capture the costs of ICASS services consumed by the service provider(s). These costs are then billed to customer agencies through ICASS redistribution (see 6 FAH-5 H-330).

6 FAH-5 H-313 Direct Charging

(CT:ICASS-105; 05-17-2021)

(Applies to participating ICASS agencies)

a. Not all costs belong in ICASS. Any costs, including unplanned overtime, that meet the following criteria should be direct charged to a specific agency and should not be included in the ICASS budget. To be a candidate for direct charge billing, a task or service should be:

Clearly separable as a distinct activity attributable to a specific agency; Easy to price accurately without extensive accounting analysis; Mutually agreed between the customer and service provider; and Outside or beyond the scope of the post’s ICASS Memorandum of Understanding (MOU), the cost of which is not already included in the post’s ICASS budget.

b. For example, the rent, utilities, local guards, and furnishings of an operating leased, stand-alone, single agency-occupied office building are classic examples of clearly distinct activities that are billed through direct charging. Other examples that are clearly distinct and chargeable directly to one customer include a control room in a rented hotel room for a visiting delegation, a contract with a commercial firm to provide translation services solely for one agency, or the rental of vehicles to be used for a specific trade fair.

NOTE: Beginning in FY13 local guards for stand-alone, single agency-occupied office buildings will be included in the ICASS budget and will no longer be direct charged.

c. In contrast, the costs of inventorying, storing, and moving furniture to offices or residences for multiple agencies are indirect support costs properly included in ICASS. Similarly, the costs for building operating expenses (BOE) and cleaning or repair supplies for a shared operating leased office building are shared costs budgeted in the ICASS cost center 7860-Building Operations-Operating Non-Residential.

d. There are circumstances where it is appropriate for a service provider to direct charge while other posts will offer the same service under that post’s ICASS MOU. The key is to ensure that both the service provider and all the customers understand and agree in advance as part of the post’s MOU how these charges will be handled, and that the agreement is applied consistently to avoid favoring or disadvantaging one group of customers over another. A customer cannot be forced to take an ICASS service on a direct charge basis nor can a service provider be forced to provide a new or non-ICASS service via direct charge if it has neither the capability to offer nor interest in offering that service.

e. Direct charging of services performed by ICASS personnel involves a number of issues that posts should be sure to address in considering the four criteria outlined in paragraph a of this section. If a potential customer who did not subscribe to the reproduction cost center under ICASS wanted 500 copies of a brochure, having the technician run the job after hours so that the agency paid the overtime plus materials does not completely cover the full cost of the job. To pass along the full cost of performing this service, the post would have to assess the customer a portion of ICASS redistribution and 8790-Miscellaneous Costs which is not possible when direct charging. Under most circumstances, offering ICASS services to some agencies and direct charging others for those same services would be out of line with the first, second, and fourth criteria that justify direct charging. Posts should exercise care in circumstances where ICASS resources are limited, and contracted resources are needed to supplement in-house resources, so that all agencies that have paid into ICASS are treated fairly.

6 FAH-5 H-314 Budgeting ICASS Costs

(CT:ICASS-105; 05-17-2021)

(Applies to participating ICASS agencies)

a. In the ICASS Cost Distribution system there are budget items that require special consideration. These include costs for personnel, building operations, rent, office supplies, voice and mobile communication, and vehicle operations.

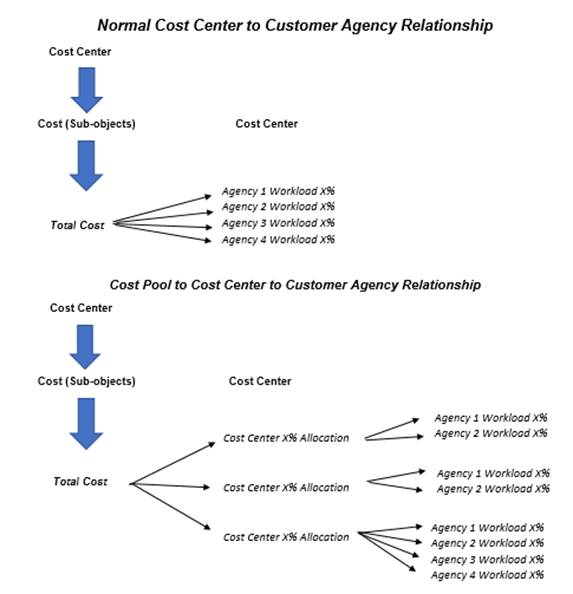

b. Cost Pools: Cost pools are a tool to facilitate the budgeting of funds to more than one cost center and reduce the number of strip codes required on spending documents. For example, the 9663-Vehicle Fuel, Oil and Supplies cost pool is used to budget fuel, oil, and other related expenses to support ICASS vehicles in multiple cost centers with dedicated vehicles. The total amount budgeted to the cost pool is allocated to the various cost centers that they service as a budgeted line item. For more details on the use of this particular cost pool, see 6 FAH-5 H-314.6 below. At the end of this subchapter, 6 FAH-5 Exhibit H-314 diagrams the rationale for a cost pool. Cost pool codes, just like cost center codes, serve as financial “function codes” for budgeting, obligating and expenditure purposes. For the list of function codes, see 4 FAH-1 H-520.

6 FAH-5 H-314.1 Personnel Costs

(CT:ICASS-105; 05-17-2021)

(Applies to participating ICASS agencies)

Personnel costs are included in virtually every cost center and are typically the largest portion of budgeted costs. Using the time allocation worksheets (see 6 FAH-5 Exhibit H-315 A and B), ICASS staff time is allocated to cost centers in which each employee spends time in providing particular ICASS services. Using the worksheets helps to ensure that all associated personnel costs are allocated correctly. Because of the wide range of employee-related costs, ICASS uses cost pools to simplify the accounting and budgeting processes for personnel costs. For example, costs associated with a General Services Officer (GSO) might include salary, allowances, educational travel, and rest and recuperation (R&R) travel, each as a separate line item that would have to be allocated to each cost center where the GSO allocates time. With a cost pool, all these costs are budgeted into one line item assigned to the GSO and then the total budgeted cost in the cost pool is spread to the cost centers using the GSO’s time allocation:

(1) Using 96XX-USDH Cost Pools: Every ICASS U.S. Direct-Hire (USDH) employee is assigned a unique cost pool number (see 4 FAH-1 H-520 for a list of cost pool/function codes). This cost pool captures all budgeted costs directly related to each ICASS USDH employee: salary, allowances, travel (e.g., Post Assignment Travel [PAT], education, R&R), residential rent and utilities, and office furniture and equipment;

NOTE 1: The cost of residential furniture, furnishings, and appliances for USDH ICASS positions is always budgeted in the USDH ICASS cost pool whether or not post has a residential furniture pool. This will ensure that the cost to support these ICASS positions is appropriately allocated to ICASS Redistribution. For details on furniture pools, see 6 FAH-5 H-341.8;

NOTE 2: All training and related travel (including workshop and conference travel) is budgeted in cost center 8790-Miscellaneous Costs. Travel related to intra-country ICASS support is also budgeted in cost center 8790-Miscellaneous Costs. Only travel that represents an allowance for USDH service providers (e.g., R&R, education travel, etc.) is budgeted in the USDH cost pools;

(2) Using 9661-LE Staff Wages, Benefits and Allowances Cost Pool for ICASS Regional Bureau Budget: The cost pool for Locally Employed (LE) Staff uses the same concept as the one for USDH but is limited only to salary and other compensation costs. This cost pool captures all costs related to: salary, benefits (i.e., retirement plan, health insurance, etc.), overtime and holiday pay, and allowances (where applicable). Unlike the process for the USDH employees, individual cost pools are not created for each LE Staff employee. However, LE Staff personnel costs are still spread to cost centers using the established time allocations for individual LE Staff employees. Costs for furniture, furnishings, and equipment used by LE Staff are budgeted in the Other Budget Items worksheet in the respective cost centers and not in the LE Staff cost pool; and

(3) Using 9662-LE Staff Wages, Benefits and Allowances Cost Pool for Local Guard Program: The cost pool for LE Staff for the Local Guard Program (LGP) follows the same principles as cost pool 9661 detailed above, including only salary and other compensation costs for these employees. Furniture, furnishings, and equipment costs for the LGP are budgeted in the LGP Other Budget Items worksheet and allocated to cost center 5826-Non-Residential Local Guard Program Services.

6 FAH-5 H-314.2 Building Operating Expenses: Supplies and Services

(CT:ICASS-105; 05-17-2021)

(Applies to participating ICASS agencies)

a. Building Operating Expenses (BOE) include the range of supplies and services that support the four Building Operations cost centers (7810, 7820, 7850, and 7860) and certain other cost centers that utilize non-office space (see chart in 6 FAH-5 H-314.2, subparagraph c(2) below). BOE includes utilities (including bulk fuel purchases), maintenance contracts, cleaning contracts, grounds care, related supplies, etc., for residential, office, and nonoffice space (see 6 FAH-5 H-341.12). Rent costs are not considered a “building operating expense” (see 6 FAH-5 H-314.3).

b. The following guidelines apply to BOE for residential and office space:

(1) Residential: Residential BOE is typically direct charged to the occupying agency whenever possible and practicable. In a shared residential building or compound, BOE is allocated to all tenant agencies, including ICASS, based on total net square meters assigned 6 FAH-5 H-341.12-2(D)). A cost pool may be used to facilitate budgeting for these shared costs (see 6 FAH-5 H-314.2, subparagraph (3) below). BOE attributed to an ICASS USDH in a shared residential building or compound is allocated to agency code 1901.0-ICASS and shared by all agencies through ICASS Redistribution (see 6 FAH-5 H-330);

NOTE: While BOE may be direct charged or performed by the landlord, some BOE for both shared and stand-alone residential properties are provided by ICASS. These budgeted costs (labor and materials) are allocated to 7810/7850 based on the time allocations of the ICASS employees and the BOE budgeted to 7810/7850;

(2) Office Space: Office space BOE is spread to all agencies, including ICASS, based on the total net square meters assigned (see 15 FAM Exhibit 238(1). BOE attributed to ICASS sections is allocated to agency code 1901.0-ICASS and shared by all agencies through ICASS Redistribution (see 6 FAH-5 H-330);

(a) Stand-alone Building: Costs for BOE supplies and services in a building solely occupied by one agency are direct charged to that agency;

NOTE: If the occupant/tenant of a stand-alone property wishes to subscribe to 7820/7860 services, a sub-cost center for the property must be established and appropriate costs and employee time should be allocated to that sub-cost center. This is done to ensure the occupant of the stand-alone property is not charged for services or costs that relate to other properties. The distribution factor for the sub-cost center would be the total net square meters of the stand-alone property;

(b) Shared Building: BOE for shared properties is allocated to all tenant agencies, including ICASS, based on the total net square meters assigned;

NOTE: A shared property is any building occupied by two or more ICASS customer agencies. ICASS does not need to be one of the tenants for a building to be considered a “shared” property;

(3) Using 9665-BOE Supplies and Services/Office and Residential Operations Cost Pool: BOE for shared office and residential property may either be budgeted directly in 7810/7820/7850/7860 (see NOTE 2 below) or budgeted using an optional cost pool, 9665-BOE Supplies and Services/Office and Residential Operations. When budgeting for BOE supplies and services for shared office and residential space, costs are allocated only in the four Building Operations cost centers, and any sub-cost centers, according to the relative total net square meters of each building type as outlined in the example below:

|

Hypothetical Space Allocation |

||

|

Property Type |

Total Sq Meters |

Percent |

|

7810-GO/Capital Lease-Residential |

2,200 |

17% |

|

7820-GO/Capital Lease-Non-Residential* |

3,400 |

26% |

|

7850-Operating Lease-Residential |

5,200 |

41% |

|

7860-Operating Lease-Non-Residential* |

2,000 |

16% |

|

TOTAL |

12,800 |

100% |

*Excludes warehouse/non-office space whose costs are budgeted using 9664-BOE Supplies and Services/Warehouse and Non-Office Operations cost pool. See 6 FAH-5 H-314.2, subparagraph c(2) below.

NOTE 1: The nonpersonnel cost pools (9663, 9664, and 9665) are used when there is a need to allocate costs more efficiently to two or more cost centers before the costs in those cost centers are allocated to customer agencies using the workload percentage distributions for those cost centers. See 6 FAH-5 Exhibit H-314 Rationale for Non-Personnel Cost Pools;

NOTE 2: At posts where there is more than one operating leased office or residential property and all have similar cost profiles, post may group the total BOE costs for all such properties and allocate a portion of the budgeted costs to each agency according to net square meters assigned (office or residential). However, if the costs for one property vary significantly from another (for example, one building has utility and other costs that are substantially higher than the other building), post should establish a sub-cost center for that property and allocate costs accordingly;

NOTE 3: Many posts may prefer to budget BOE costs for offices and residential properties directly in the 78XX cost centers and sub-cost centers and allocate the costs based on the total net square meters assigned or occupied to each agency. Other posts may prefer to use the 9665 cost pool (described above) to budget for these costs. Either method may be used;

NOTE 4: The same percentage distributions used to allocate BOE costs may also be used to allocate building operations staff time to cost centers.

c. In many posts, warehouse and other nonoffice properties may support more than one cost center. Because not all agencies subscribe to these cost centers, the IWG determined that the only equitable way to share the costs related to these types of properties is to allocate a portion of the budgeted costs to the cost centers and sub-cost centers directly supported:

(1) Warehouse and Non-Office Properties: BOE related to these properties are allocated to the respective cost centers and sub-cost center(s) according to the net square meters assigned as outlined below;

(2) Using 9664-BOE Supplies and Services/Warehouse and Non-Office Operations Cost Pool: BOE costs for warehouse/non-office properties are distributed using a required cost pool, 9664-BOE Supplies and Services/Warehouse and Non-Office Operations. To ensure consistency in budgeting, use of this cost pool is required for all posts with warehouse/non-office properties that support multiple cost centers and/or individual agencies that have dedicated storage space. This cost pool simplifies the budgeting of certain costs (e.g., utilities, maintenance contracts, cleaning contracts, grounds care, related supplies, etc.) and allows post to allocate these costs according to square meters assigned as outlined in the chart below. At Lite posts, the same methodology is used, and the costs are spread to the appropriate Lite cost centers:

(a) Warehouse Space Allocation: After budgeting costs to the cost pool, the next step is to determine the allocation of space in the warehouse or other non-office property to appropriately allocate the associated costs to the designated cost centers. For example, a 50,000 square meter operating lease warehouse (at a Standard post) might be divided as follows:

|

|

Warehouse Space Allocation |

|

|

Total Square Meters |

Function and Cost Center Assignment |

% of Total |

|

8,000 |

6132 - Vehicle Maintenance Services |

16% |

|

4,000 |

6133 - Administrative Supply Services |

8% |

|

1,500 |

6139 - Motor Pool Services |

3% |

|

5,000 |

6143 - Warehouse and Property Management Services |

10% |

|

10,000 |

6144 - Furniture & Appliance Pool Services |

20% |

|

10,000 |

7810/20/50/60 - Maintenance Shops |

20% |

|

4,000 |

7820/7860 - ICASS Office Space |

8% |

|

7,500 |

7820/60-0099 - Dedicated Storage |

15% |

|

50,000 |

|

100% |

NOTE 1: For a Standard post, the only cost centers, and related sub-cost centers, to which BOE for a warehouse or non-office property may be allocated are those listed in the chart immediately above (6132, 6133, 6139, 6143, 6144, and 7810/7820/7850/7860). If a warehouse/non-office facility contains space utilized by any other ICASS cost center including office space (i.e., office space for 6136-Shipping and Customs Services or 5624-Health Services, etc.), that space and associated BOE is allocated to the 7820/7860-Non-Residential Building Operations and the square meters workload count is assigned to agency code 1901.0 ICASS;

NOTE 2: At a Lite post, instead of the GSO cost centers shown above (6132, 6133, 6139, and 6143), allocations would be made to cost center 6145-General Services and/or sub-cost centers as appropriate for these services;

NOTE 3: When spreading the BOE associated with Maintenance Shops that support both residential and non-residential properties, post must establish appropriate percentages to allocate to each Building Operations cost centers (7810/7820/7850/7860);

(b) 7820/7860-0099-Dedicated Storage: Posts with a warehouse/non-office property that supports multiple cost centers as well as provides dedicated storage space for individual agencies must establish a sub-cost center, 7820/7860-0099-Dedicated Storage to distribute the warehouse BOE. This sub-cost center would include that portion of the warehouse that contains dedicated storage space (e.g., ICASS general storage, State-Program, DIA, USAID, etc.). The sub-cost center costs would be spread according to the net square meters assigned.

|

7820/7860-0099 Dedicated Storage |

|||

|

Agency Code |

Function |

Net Sq Meters |

% of Total |

|

1901.0 |

ICASS/Gen. Storage |

3,750 |

50% |

|

1900.0 |

State-Program |

1,500 |

20% |

|

9705.2 |

DIA |

750 |

10% |

|

7203.1 |

USAID |

1,500 |

20% |

|

|

TOTAL |

7,500 |

100% |

6 FAH-5 H-314.3 Rent Costs

(CT:ICASS-105; 05-17-2021)

(Applies to participating ICASS agencies)

Residential and nonresidential (i.e., offices, warehouses, etc.) rents have unique guidance depending on the type and use of the property. To ensure consistency in budgeting lease costs, posts must use the following guidelines:

(1) Residential: Operating lease residential rent costs for USDH ICASS personnel are budgeted in the respective cost pool of each USDH ICASS employee and are allocated to the cost centers according to their time allocation worksheets (see 6 FAH-5 H-314.1); and

(2) Office Space: Shared operating lease office rent costs are budgeted ONLY in the cost center 7860-operating lease Non-Residential Building Operations, or a related sub-cost center, and allocated to occupying agencies, including ICASS, according to the net square meters assigned. Rent costs for office space occupied by ICASS sections are allocated to agency 1901.0-ICASS and it is shared by all agencies through ICASS Redistribution. Office rent costs are not budgeted to any other individual cost centers;

NOTE: At posts where there is more than one operating leased office property and all have similar rent costs, post may allocate all the leases to cost center 7860 and spread the costs to tenant agencies according to net square meters assigned. However, if one property varies significantly in cost (for example, one building has rent costs that are substantially higher than the other building), post may establish a sub-cost center for the individual property and allocate costs accordingly;

(3) Warehouse and Non-Office Properties: Posts with warehouse and non-office operating lease properties spread the lease costs to the appropriate cost centers using the same percentage distribution developed for the required cost pool 9664-BOE Supplies and Services/Warehouse and Non-Office Operations as outlined in 6 FAH-5 H-314.2, subparagraph c(2):

|

|

Warehouse Space Allocation |

|

|

Total Square Meters |

Function and Cost Center Assignment |

% of Total |

|

8,000 |

6132 - Vehicle Maintenance Services |

16% |

|

4,000 |

6133 - Administrative Supply Services |

8% |

|

1,500 |

6139 - Motor Pool Services |

3% |

|

5,000 |

6143 - Warehouse and Property Management Services |

10% |

|

10,000 |

6144 - Furniture & Appliance Pool Services |

20% |

|

10,000 |

7810/20/50/60 - Maintenance Shops |

20% |

|

4,000 |

7820/7860 - ICASS Office Space |

8% |

|

7,500 |

7820/7860-0099 - Dedicated Storage |

15% |

|

50,000 |

|

100% |

NOTE 1: For a Standard post, the only cost centers, and related sub-cost centers, to which rent for a warehouse or non-office property may be allocated are those listed in the chart immediately above (6132, 6133, 6139, 6143, 6144, and 7810/7820/7850/7860). If a warehouse/non-office facility contains space utilized by any other ICASS cost center (including office space e.g., office space for 6136-Shipping and Customs Services or 5624-Health Services, etc.), that space and associated rent costs are allocated to cost center 7860-Non-Residential Building Operations, or the appropriate sub-cost center, and the square meters workload count is assigned to agency code 1901.0 ICASS;

NOTE 2: At a Lite post, instead of the GSO cost centers shown above (6132, 6133, 6139, and 6143), allocations would be made to cost center 6145-General Services and/or sub-cost centers as appropriate for these services;

NOTE 3: When spreading the rent costs associated with Maintenance Shops that support both residential and non-residential properties, post must establish appropriate percentages to allocate to each Building Operations cost center (7810/7820/7850/7860).

6 FAH-5 H-314.4 Administrative Supplies

(CT:ICASS-105; 05-17-2021)

(Applies to participating ICASS agencies)

The management of the overseas administrative supply operations differ significantly from post to post. The recommended method is to manage the operation within ICASS but direct charge customer agencies for the cost of the administrative supplies issued. Other posts manage the operation, and budget for the items issued within ICASS, and do not direct-charge. Other posts combine these methods. Depending on the method used, post will need to appropriately budget for the cost of the management as well as the cost of supplies issued. See 6133-Administrative Supplies Decision Chart immediately following this section for more implementation guidance:

(1) Centralized Operation: At posts with a centrally operated administrative supply system, the ICASS service provider procures the supplies, manages the record keeping, and issues administrative supplies for all ICASS customers. This falls under cost center 6133-Administrative Supplies Services at Standard posts. For all methods under the centralized operations, posts budget for all personnel costs (via time allocation), plus rent and BOE costs (if applicable) in cost center 6133. The distribution factor is the value of supplies issued;

(a) Direct-Charge: Posts that direct charge customers for the costs of administrative supplies do not budget for the cost of these supplies in cost center 6133. In order to address the cost of supplies issued to ICASS sections, post must establish a sub-cost center. This will isolate the cost of the supplies from the management of the service. In the sub-cost center post should budget only for the cost of administrative supplies that are issued to ICASS sections. The only subscriber to the sub-cost center will be ICASS agency 1901.0 ICASS and the distribution factor is the value of supplies issued;

(b) Supplies Funded Within ICASS: For posts that fund the cost of administrative supplies that are issued to all customer agencies within ICASS (i.e., no direct charging), the cost of the items is budgeted in this cost center. A sub-cost center is not required for this method. The distribution factor is the value of supplies issued;

(c) Combined Method of Direct Charge and ICASS Funded: Some posts use a combination of these two methods and centrally stock commonly used items and direct charge for special orders or for high-cost items such as toner or boxes of copier paper. For posts that use a combination of the two methods described immediately above, when some items are direct-charged and some are funded within ICASS, the cost of the items funded by ICASS must be budgeted in a sub-cost center. The only subscribers to the sub-cost center will be agency 1901.0 ICASS and any customer agencies that are not direct charged for the cost of the supplies. The purpose of the sub-cost center is to pass the cost of the items issued to the customer agencies. The distribution factor is the value of supplies issued. The main cost center, 6133, will pass the cost of the management of the operation to the customer agencies;

NOTE 1: Lite Posts - The administrative supplies service falls under cost center 6145-General Services. Due to the complexity, and number of variations in managing the administrative supply service as detailed above, it is recommended that Lite posts either direct charge for supplies issued or budget for the cost of items within cost center 6145;

NOTE 2: Standard Post - General use administrative supplies for ICASS sections are not budgeted in the individual cost centers. Expendable administrative supplies used by all ICASS offices are counted as workload for 1901.0-ICASS and these costs are shared by all agencies through ICASS Redistribution;

NOTE 3: Unique Items - Supplies that are unique to a cost center and not centrally stocked (e.g., CLO maps and guides, specialized Procurement Section folders, etc.) are budgeted in the cost center in which they are used;

(2) Decentralized Operation: Some posts may have a decentralized system in which each agency arranges to obtain its own supplies and the ICASS service provider is not involved in procuring or issuing the supplies except for those items needed by ICASS staff. At posts with a decentralized administrative supply system, each section obtains supplies using some type of purchase card or other ordering mechanism. For budgeting purposes, ICASS office supplies are budgeted to the 6133-Administrative Supply cost center at Standard posts or to 6145-General Services at Lite posts. At these posts, 1901.0-ICASS will be the only agency code with workload for this cost center because all service will be to support the processing of office supplies issued only to ICASS offices:.

|

Cost Center 6133-Administrative Supplies Services Decision Chart |

|||

|

|

Cost of Supplies Issued 100% Direct-Charged |

Cost of Supplies Issued 100% ICASS Funded |

Combination –Direct-Charged and ICASS Funded |

|

What to Budget in Main Cost Center 6133-0000 |

USDH Mgmt & LE Staff Time Allocation and Other Budget Items. Do not budget for cost of admin supplies. |

USDH Mgmt & LE Staff Time Allocation and Other Budget Items. Budget for cost of admin supplies. |

USDH Mgmt & LE Staff Time Allocation and Other Budget Items. Do not budget for cost of admin supplies. |

|

What to Budget in Sub-Cost Center 6133-XXXX |

Budget for cost of Admin Supplies for ICASS Sections only. |

Sub-cost center is NOT established – no budgeted costs. |

Budget for cost of Admin Supplies for ICASS Sections and items issued but not direct charged to customer agencies. |

|

How to Count Workload Main Cost Center 6133-0000 |

$ value of all supplies issued, both direct charged and issued to ICASS sections (sub-cost center). |

$ value of all supplies issued. |

$ value of all supplies issued, both direct charged and funded by ICASS in the sub-cost center. |

|

How to Count Workload Sub-Cost Center 6133-XXXX |

$ value of all supplies issued to ICASS sections funded in the sub-cost center. |

Sub-cost center is NOT established—no workload count. |

$ value of all supplies issued to ICASS sections and customer agencies funded in the sub-cost center. |

For details on cost center 6133 Administrative Services (Standard post), see 6 FAH-5 H-341.7-2. For details on Administrative Supply Services at a Lite post, that falls under cost center 6145 General Services, see 6 FAH-5 H-342.7-1, paragraph 2.

6 FAH-5 H-314.5 Voice and Mobile Communications Charges and Services

(CT:ICASS-105; 05-17-2021)

(Applies to participating ICASS agencies)

a. Long-distance telephone charges: All charges for official long-distance calls are direct-charged to the using agency to the extent possible. Based on prior years’ history, estimated costs for unidentifiable charges for official long-distance calls for all non-ICASS agencies are budgeted to cost center 6195–Telecommunications and Radio Services (Standard posts) or 6196–Information Management Services (Lite posts).

NOTE 1: At those posts at which local calls are metered and identifiable to a specific agency, related costs should be direct charged and not budgeted within ICASS.

NOTE 2: At those posts using a long-distance telephone service that charges a flat rate with unlimited usage, the annual service cost should be budgeted to cost center 6195 (Standard posts) or 6196 (Lite posts).

b. Mobile Communication Devices: The purchase of, and ongoing subscription charges for, official cell phones and/or other mobile communication devices are direct charged to the using agency.

c. ICASS Sections Long-Distance and Mobile Communication Device Charges: Beginning in FY12, all charges for official long-distance calls, local calls, and costs for mobile communication devices for ICASS sections are budgeted to cost center 8790-Miscellaneous Costs. But for those posts that do not direct charge customer agencies for telephone costs, the costs related to ICASS customers should remain in cost centers 6195 (Standard posts) or 6196 (Lite posts). See 6 FAH-5 H-341.9-3(B), Standard posts or 6 FAH-5 H-342.9-2, Lite posts.

6 FAH-5 H-314.6 Vehicle Operations

(CT:ICASS-105; 05-17-2021)

(Applies to participating ICASS agencies)

a. Passenger and Multi-Use Vehicles: All vehicles used to transport people (i.e., sedans, vans, etc.) and multi-use vehicles that are used both for transporting passengers and occasionally for transporting luggage, boxes, or other items are considered Motor Pool vehicles; their costs are budgeted in cost center 6139-Motor Pool Services at Standard posts and in cost center 6145-General Services at Lite posts.

b. Utility and “Special Use” Vehicles: Nonpassenger (i.e., warehouse truck, maintenance vans/carryalls, mail/pouch van, etc.) and other “special-use” (i.e., water truck, ambulance, etc.) vehicles are used to support ICASS services and unique post requirements. Replacement costs for these utility vehicles are budgeted directly in the cost centers they service. For example, if post has an ambulance, it would be budgeted in cost center 5624-Health Services; the water truck that services residential properties would be budgeted in cost center(s) 7810/7850-Residential Building Operations; and the carryalls for the maintenance section would be budgeted among the four Residential and Non-residential Building Operations cost centers.

c. Budgeting Vehicle Maintenance Costs: Specialized tools, equipment, and incidental and routine parts and supplies are budgeted in cost center 6132-Vehicle Maintenance Services (or 6145-General Services at a Lite post). Vehicles that support ICASS services are counted as workload for agency code 1901.0-ICASS. Specialized parts or supplies for a particular ICASS vehicle (i.e., tires for the water truck) are budgeted directly in the appropriate cost center(s). See 6 FAH-5 H-341.7-1(B), Standard posts, or 6 FAH-5 H-342.7-2, Lite posts.

d. Using 9663- Vehicle Fuel, Oil, and Supplies Cost Pool: For posts that have dedicated vehicles in more than one ICASS cost center, the 9663-Vehicle Fuel, Oil, and Supplies cost pool is a tool used to allocate grouped costs to multiple cost centers. All routine daily usage costs for ICASS vehicles (i.e., fuel, oil, washer fluid, etc.) are budgeted using the 9663-Vehicle Fuel, Oil, and Supplies cost pool and are allocated to cost centers based on their relative usage. Using a process similar to time allocations, post would determine an appropriate percentage of costs for these ICASS vehicles and allocate them to the relevant cost centers. The example outlined below is hypothetical and represents one post’s entire vehicle fleet; it uses kilometers to establish the percentages used for spreading costs. Post may use a different methodology if more appropriate.

|

Vehicle Fuel, Oil and Supplies Cost Pool Usage Calculations |

|||

|

Vehicle |

Function and Cost |

KM/ |

% of Total KM |

|

Ambulance |

5624-Health Services |

160 |

4% |

|

Water Truck |

7810/7850 GO/CL/OL Residential |

200 |

5% |

|

Warehouse Truck |

6143/6144 Warehouse and Property Management Services & Furn. Pool |

440 |

11% |

|

Electrician’s Van |

7820/7860 GO/CL/OL Non-Residential |

400 |

10% |

|

Plumber’s Van |

7820/7860 GO/CL/OL Non-Residential |

600 |

15% |

|

Mail/Pouch Van |

6192/6194 Pouching & Mail/Messenger |

200 |

5% |

|

Motor Pool |

6139-Motor Pool Services |

2,000 |

50% |

|

TOTAL |

|

4,000 |

100% |

NOTE 1: The percentages reflect the overall usage of these ICASS vehicles based on kilometers driven and represent the first step in establishing the basis for spreading all costs (excluding replacement costs). For those vehicles that support more than one cost center, these percentages must then be split to reflect the relative usage in each cost center. For example, for the Warehouse Truck in the above chart, post has determined that 55 percent of its usage relates to support for cost center 6144-Furniture Pool and 45 percent for cost center 6143-Warehouse and Property Management Services. When applying the percentages for this vehicle, the 55/45-percent split would be applied to the 11 percent overall share in the cost pool. In this example, the split between cost center 6144 and 6143 is 6 percent and 5 percent, respectively. While this methodology may not precisely capture the usage of these vehicles in each cost center, in a cost distribution system, it provides a transparent and consistent approach to equitably share these costs.

NOTE 2: The 9663-Vehicle Fuel, Oil, and Supplies cost pool is used to allocate costs only to cost centers with dedicated vehicles (including cost center 6139-Motor Pool Services).

6 FAH-5 H-314.7 Location Budgeting for Constituent Posts

(CT:ICASS-105; 05-17-2021)

(Applies to participating ICASS agencies)

a. Definition of Location Budgeting: Location budgeting refers to a separate budget, created within the overall mission ICASS budget, to isolate and account for costs of ICASS services provided to, or at, a constituent post (i.e., consulates, branch offices, etc.). In this section the terms “embassy budget” and “location budget” are used to distinguish between the two parts of the overall mission budget. To standardize the budget process for all missions with constituent posts, posts must use location budgeting in accordance with the guidance contained in this chapter:

(1) In some cases, the ICASS service, the employees providing the service, and the customers subscribing to the service are all based at the constituent post. Using a location budget isolates the costs of these services and invoices only the customers receiving services at that location;

(2) For those ICASS services provided to customers at constituent posts by staff based at the embassy, those same agencies will also share in the costs related to the embassy-provided services; and

(3) Invoices for agencies with a presence at a constituent post include costs for services received directly at the constituent post as well as costs for services provided by the embassy when they subscribe to embassy-provided services.

NOTE: Location budgeting is not used for a specific building or property (e.g., warehouse, annex, etc.) located in the same city as the embassy or a constituent post.

b. Mandatory for Building Operations and Local Guard Program: At a mission with constituent posts, post much activate appropriate cost centers for each location from the 78XX-Building Operations (BO) and 58XX-Local Guard Program (LGP) series. The amounts budgeted to these cost centers are billed to the agencies resident at the specified location(s).

c. Exceptions to Location Budgeting: As outlined below, in certain situations it is not necessary to use location budgeting:

(1) At multi-mission posts (i.e., Brussels, Vienna, Rome, Paris, etc.) where the embassy and other missions are essentially co-located in the same city, location budgeting is not required. If multi-mission posts need to isolate costs that are unique to a specific mission, post should use a sub-cost center; and

(2) At missions with American Presence Posts (APPs), post and the regional bureau must decide whether to activate a location budget.

d. Activating Other Cost Centers: It is a post decision to activate any additional cost centers at the location beyond the LGP and BO cost centers. There are key factors to consider in this process:

(1) Where is the service being provided: For some ICASS services, a portion of the service is provided at both the consulate and the embassy. For each cost center, post must select either the embassy or the location where all staff time, budgeted items, and workload for the constituent post are entered:

(a) Budget at a location example: A mission with a constituent post with its own medical unit activates cost center 5624-Health Services and budgets appropriate costs at the location. Medical personnel based at the embassy who also support the location health unit would allocate an appropriate portion of their time to the location health services cost center. All workload for Health Services at the location is captured only in the location budget;

(b) Budget at the Embassy example: The financial management staff based at a constituent post performs some vouchering services, but the vouchers are forwarded to the embassy for review and final processing. In this case, the constituent post financial management staff would allocate a portion of their time to the embassy vouchering/financial management cost center(s). There would be no vouchering/financial management cost center(s) activated at the location. The embassy budget would include all location workload for vouchering services. The financial management staff would allocate the balance of their time to the cost centers budgeted at the location or to other cost centers in the embassy budget; and

(c) For each example outlined above, post could make the reverse determination for the allocation of workload and employee time. These are examples only and are not intended to identify specific cost centers that should or should not be activated at a location;

(2) Who is providing the service?: If there are ICASS employees (either USDH or LE Staff) present at a location, they may allocate some or all their time to appropriate cost centers activated within the location budget or to appropriate embassy cost center(s). Employees (USDH or LE Staff) from the embassy who spend a measurable portion of their time in support of any of the cost centers activated at the location should allocate an appropriate amount of their time to the location-based cost center(s); and

(3) How is workload counted?: The ICASS Service Center uses capitation workload counts in Basic Package, Health Services, and CLO to calculate certain Washington based costs (see 6 FAH-5 H-331). In addition, workload counts in other cost centers are used for data analysis and metrics in a wide variety of applications. Consequently, posts must ensure there is no duplication of workload counts between the embassy and location budgets. Any workload counted in a location-based cost center may not/not be included in the related embassy cost center.

e. Creating a Location Budget: Below are the key elements that must be addressed for a location budget:

(1) Create a location code: Activate a location code in the ICASS software for each constituent post;

(2) Identify cost centers: Activate the cost centers that will be used at the location;

(3) ICASS employee costs and time allocation: Post must budget the costs for USDH, LE Staff, and LGP Staff based at a constituent post in the applicable location budget. For those services that are provided by staff at the constituent post, enter the ICASS employee time allocation in the appropriate location-based cost centers. For those services that are provided centrally at the embassy level, employees located at the constituent post that may support this service allocate time to the embassy cost center. For example, Basic Package is generally provided at the embassy for all mission USDH since the bulk of the work is performed by individuals based at the embassy. Those ICASS staff based at a constituent post who support Basic Package services would allocate a portion of their time to the embassy Basic Package cost center;

(4) Other Budget Items: Similar to staff costs, costs related to services provided at a location (i.e., rent, utilities, vehicles, etc.) are budgeted within the location budget cost centers, including 8790-Miscellaneous Costs, if activated; and

(5) Workload Counts: Post must collect the workload counts and enter them into the appropriate location budget in the distribution module of the ICASS software. ICASS service provider workload counts are especially important in the location budget since the costs of the services they receive are redistributed to only those agencies subscribing to services at the location. Posts with location budgets must ensure that workload for embassy-provided services are appropriately included in the embassy budget.

f. Modifications for Agencies at Constituent Posts: Post must establish an appropriate modification policy for cost centers activated at the location as well as for cost centers at the embassy. See 6 FAH-5 H-332.1 for guidance on the basis for modifications.

g. Miscellaneous Costs and ICASS Redistribution: The ICASS software uses each agency’s percentage share of the total costs to calculate its share of 8790-Miscellaneous Costs and ICASS Redistribution costs within the respective embassy or location budget:

(1) 8790-Miscellaneous Costs: Post must activate cost center 8790 in a location budget in order for these costs to be budgeted and spread to the customer agencies at the location; and

(2) ICASS Redistribution: ICASS Redistribution costs will only appear in a location budget when workload for 1901.0-ICASS is reflected in a location-based cost center.

h. Total Invoice Costs: The agency’s total costs from the location budget are added to its total costs in the embassy budget, if they subscribe to services provided by the embassy, to arrive at the total invoice costs.

i. Other Uses of Location Budgeting: Location Budgeting may also be used by posts providing regional services to share costs with customer agencies at another mission. For example, a post may provide 6150-Basic Package and 6445-Human Resources Services for a neighboring post. To appropriately allocate costs for these services, the servicing post would activate these two cost centers in a separate location budget and allocate time and costs accordingly. In such cases, the serviced post picks up no Miscellaneous Costs and ICASS Redistribution from the servicing post.

6 FAH-5 H-315 Time Allocation

(CT:ICASS-105; 05-17-2021)

(Applies to participating ICASS agencies)

a. Time Allocation: ICASS personnel costs typically constitute a major portion of the budgeted costs in each cost center. In developing the post budget, a time allocation worksheet is prepared for each ICASS employee, allocating his/her time to the appropriate cost center(s) and sub-cost center(s) in which that employee spends time in providing an ICASS service. (See 6 FAH-5 Exhibit H-315 at the end of this chapter for Time Allocation Worksheet templates). There are several basic principles to follow in completing time allocation worksheets:

(1) Ensure Equity/Transparency: ICASS is a cost distribution system and the goal of the time allocation process is to equitably and transparently allocate personnel costs across the cost centers. The basic concept is not a “billable hours” system but rather an effort to allocate employees’ time according to their overall functional responsibilities. The chart below is a useful guide for completing time allocation worksheets:

|

ICASS - Time Allocation Reference Tool |

|||

|

% of Time Per Year |

Amount of |

Amount of |

Number of DAYS or WEEKS in One Year |

|

1% |

24 minutes |

21 hours |

2.4 days |

|

5% |

2 hours |

105 hours |

2.5 weeks |

|

10% |

4 hours |

210 hours |

5.0 weeks |

|

15% |

6 hours |

312 hours |

8.0 weeks |

|

20% |

8 hours |

416 hours |

10.5 weeks |

|

25% |

10 hours |

520 hours |

13.0 weeks |

|

30% |

12 hours |

624 hours |

15.5 weeks |

|

35% |

14 hours |

728 hours |

18.0 weeks |

|

40% |

16 hours |

832 hours |

21.0 weeks |

|

45% |

18 hours |

936 hours |

23.5 weeks |

|

50% |

20 hours |

1,040 hours |

26.0 weeks |

|

60% |

24 hours |

1,248 hours |

31.0 weeks |

|

70% |

28 hours |

1,456 hours |

36.5 weeks |

|

80% |

32 hours |

1,664 hours |

41.6 weeks |

|

90% |

36 hours |

1,872 hours |

47.0 weeks |

|

100% |

40 hours |

2,080 hours |

52.0 weeks |

|

(Based on a 40-hour work week = 2,080 hours per year) |

|||

(2) Allocate Time by Functional Responsibilities: All ICASS employees’ time should be allocated according to the primary functional responsibilities outlined in their position descriptions, not according to the customers they serve. A general rule of thumb, although not mandatory, is to allocate time rounded to the nearest 5 percent, which represents 2 hours per week (i.e., 5, 10, 15, 20 percent, etc.). There are exceptions, such as a Management Counselor/Officer’s time allocation since this position typically has broad management oversight for many cost centers, especially in a Standard post environment:

(a) Personnel allocate their time according to their primary functional responsibilities. For example, the Health Care Practitioner would typically allocate all his or her time to cost center 5624-Health Services (see 6 FAH-5 H-341.3 c); a Motor Pool Driver would allocate all his or her time to cost center 6139-Motor Pool Services (or cost center 6145-General Services at a Lite post) unless he or she had designated functional responsibilities in another cost center;

(b) Supervisory personnel, either USDH (e.g., Management Officer, HRO, IMO, GSO, FMO, etc.) or LE Staff (e.g., Maintenance Supervisor, HR Supervisor, Financial Management Supervisor, etc.), allocate a portion of their time to each cost center they supervise;

(c) Employees’ time is not allocated according to the ICASS customers they serve. For instance, a Motor Pool driver who takes the cashier to the bank twice a week or picks up purchases for the Procurement Section is performing his or her job as a driver and would not allocate time to either the Cashiering or Procurement cost centers. At ICASS Standard posts, the kilometers driven for these functions is counted as workload for agency code 1901.0-ICASS and the associated costs are spread to customer agencies through ICASS Redistribution. At Lite posts, these costs are budgeted in cost center 6145-General Services and the costs are spread using the established capitation distribution factor; costs distributed to agency code 1901.0-ICASS are spread to customer agencies through ICASS Redistribution;

(d) In those posts where an employee, either USDH or LE Staff, has non-ICASS Dual Position Duties (see 6 FAH-5 H-341.14, 0000-Non-ICASS Dual Positions), a percentage of time is allocated to this cost center based on the portion of time spent performing the employee’s designated State Program duties. For example, at a small post a Management Officer is also assigned as the Deputy Chief of Mission (DCM). If he or she spends 40% of his or her time on DCM duties, then 40% would be allocated to cost center 0000-Non-ICASS Dual Position and 60% to the other ICASS cost centers that he or she supervises;

NOTE: Alternate Service Provider (ASP) posts use the non-ASP dual position cost center to allocate employee time spent performing program duties and not ASP administrative services. See 6 FAH-5 H-445.2;

(3) Minimize Large Fluctuations: In principle, to maintain consistency and predictability for invoicing, time allocations should not fluctuate significantly from year to year. It is anticipated that changes would result only from significant shifts in job responsibilities, the establishment/abolishment of positions, or significant changes in workload due to expanding or shrinking customer presence;

NOTE: If a position is vacant (and will be filled in the coming year) when time allocation worksheets are being prepared, the time allocations of the previous year are used to ensure continuity. Changes to the prior year’s allocations would be appropriate only if a change in position responsibilities is anticipated;

(4) Annual Review: Employee time allocations in the ICASS cost distribution system are very important. Generally, they should not fluctuate significantly from year to year. ICASS employees’ time allocation worksheets should be reviewed, updated, and approved annually by the employee’s ICASS supervisor:

(a) To ensure consistency with the principles outlined in this section, each supervisor must review and approve the time allocations for his or her employees;

(b) In conjunction with the annual May 1 workload count collection process, the service provider prepares finalized time allocation reports and submits them by June 1 to the Budget Committee for its review and approval by July 1; and

(c) The approved time allocations and workload counts are submitted to the ICASS Service Center annually in July (according to the schedule established by the ICASS Service Center);

(5) Changes to Time Allocations: Once approved by the Budget Committee in July, time allocations may not be changed unless the purpose of the change is to correct an error, add or subtract time allocations for new or abolished positions, or make adjustments if job responsibilities change when USDH officers (e.g., GSO, FMO, etc.) transfer. The Budget Committee must approve any changes before final invoices are prepared.

b. Basic Package Services: Time allocations to cost center 6150-Basic Package (BP) Services should reflect the percentage of time an employee spends on the BP services provided at post. Each post should carefully review the range of BP services and determine which apply at their post and ensure that employee time allocations are appropriately reflected. For example, if an LE Staff HR employee spends five percent (approximately two hours per week) of his or her time on various Basic Package services (e.g., generating reports from the post personnel system, coordinating the mission awards ceremony, preparing the duty officer list, etc.), he or she would allocate 95 percent of his or her time to the appropriate HR cost center(s) and 5 percent to Basic Package (see 6 FAH-5 H-341.1):

(1) The nature of the services in this cost center is such that many of the responsibilities are fulfilled by the Management Office. This should be reflected in the time allocations of the Management Officer and immediate staff;

(2) Basic Package (BP) and very important person (VIP) Visit Support: When establishing time allocations to BP in support of VIP visits (see 6 FAH-5 H-360), the primary factor to consider is the post’s volume of such visits. Time allocations to BP for VIP visit support will spread these costs to all participating agencies, so posts should be careful in applying the following guidelines:

(a) There are two types, or levels, of VIP visitors. The first type would include The President of the United States (POTUS), First Lady of the United States (FLOTUS), Vice President of the United States and/or spouse (VPOTUS), Supreme Court Justices, Congressional Delegations (CODELs), Cabinet-level members (SecState, SecDef, etc.) and State Governors, all of whom represent the U.S. government as a whole when they travel. (See 2 FAM 116.3-2). Because there is no specific sponsoring agency at post, costs for supporting such visits is borne, to a certain extent, by all ICASS agencies. The staff support required for these visits should be captured in time allocations to BP. In contrast, the second type is Cabinet-level VIPs who typically have a sponsoring agency at post. Support for these visits is provided by the ICASS platform, in conjunction with the sponsoring agency;

(b) Therefore, in deciding whose time can be allocated to BP, posts should consider the volume of visits in the first category and determine if a measurable portion of staff time is devoted to such visits, thus taking employees away from their normal duties;

(c) Employees who spend a measurable portion of their time on such duties should allocate their time accordingly. For example, four members of the Warehouse/Maintenance staff at a post are routinely called on to do control room set-up and baggage handling for VIP visits and these duties represent five percent of each employee’s time (see time chart in 6 FAH-5 H-315, subparagraph a(1) above). These employees should allocate 5 percent of their time to BP and the remainder to other ICASS cost centers in accordance with their responsibilities;

(d) Motor Pool support is an integral part of all VIP visits but that does not equate to a requirement to allocate driver time to this cost center; Motor Pool drivers typically allocate all their time to cost center 6139-Motor Pool Services (Standard posts) or cost center 6145-General Services (Lite posts). A few posts may have such a high number of VIP visits that their motor pool infrastructure is staffed accordingly. In such cases, drivers may allocate a representative portion of their time to BP in support of VIP visits; and

(e) Many posts have a Travel and Visitor Section staffed by a “core” visit team; these posts must determine the volume of VIP visits and, where appropriate, allocate a portion of this staff’s time to BP. Posts should not try to incorporate in BP-VIP Visit Support the range of services that is provided in other ICASS cost centers. For example, the procurement unit may process numerous purchase orders for rental vehicles for VIP visits. The fact that they are processing these purchase orders for a VIP visit does not equate to a time allocation to BP. They should allocate their time to cost center 6134-Procurement Services (or cost center 6145-General Services at a Lite post) and the workload is charged to either agency ICASS (for POTUS, VPOTUS, FLOTUS and CODELs) or the sponsoring agency (for Cabinet-level visits) through either a TDY invoice or by adding the cumulative workload count to the sponsoring/funding agency (see 6 FAH-5 H-360).

6 FAH-5 H-316 THROUGH H-319 UNASSIGNED

6 FAH-5 Exhibit H-314

Rationale for Non-Personnel Cost Pools

(CT:ICASS-107; 05-26-2021)

(Office of Origin: CGFS/ICASS)

6 FAH-5 Exhibit H-315(A)

Time Allocation Worksheet Standard Sheet

(CT:ICASS-105; 05-17-2021)

(Office of Origin: CGFS/ICASS)

|

STANDARD POST TEMPLATE |

|||

|

U.S. Embassy NAME HERE |

|||

|

FYXX ICASS Time Allocation by Cost Center as of May 1, 20XX |

|||

|

ICASS Employee Name: |

|||

|

Employee Position Code: |

|||

|

Name of Employee's Supervisor: |

|||

|

Name of ICASS Section: |

|||

|

Cost Center Name |

Cost Center Number |

Prior Year Time % |

Current Year Time % |

|

Basic Package Services |

6150-0000 |

||

|

Community Liaison Office Services |

6443-0000 |

||

|

Health Services |

5624-0000 |

||

|

Information Management Technical Support Services |

5458-0000 |

||

|

Residential Local Guard Program Services |

5821-0000 |

||

|

Non-Residential LGP/Single Agency Occupied Building Services |

5822-0000 |

||

|

Mobile Patrol Local Guard Program Services |

5823-0000 |

||

|

Non-Residential Local Guard Program Services (LE Staff only) |

5826-0000 |

||

|

Security Services |

5880-0000 |

||

|

General Services: |

n/a |

n/a |

|

|

Vehicle Maintenance Service |

6132-0000 |

||

|

Administrative Supply Services |

6133-0000 |

||

|

Procurement Services |

6134-0000 |

||

|

Reproduction Services |

6135-0000 |

||

|

Shipping and Customs Services |

6136-0000 |

||

|

Motor Pool Services |

6139-0000 |

||

|

Warehouse and Property Management Services |

6143-0000 |

||

|

Leasing Services |

6148-0000 |

||

|

Travel Services |

6462-0000 |

||

|

General Services: sub-cost center: |

xxxx-xxxx |

||

|

Furniture & Appliance Pool Services |

6144-0000 |

||

|

Information Management Services: |

n/a |

n/a |

|

|

Pouching Services |

6192-0000 |

||

|

Mail and Messenger Services |

6194-0000 |

||

|

Telecommunications & Radio Services |

6195-0000 |

||

|

Financial Management Services: |

n/a |

n/a |

|

|

Budgets and Financial Plans Services |

6211-0000 |

||

|

Accounts and Records Services |

6221-0000 |

||

|

Payrolling Services |

6222-0000 |

||

|

Vouchering Services |

6223-0000 |

||

|

Cashiering Services |

6224-0000 |

||

|

Human Resources Services: |

n/a |

n/a |

|

|

Human Resources - U.S. Citizens Services |

6441-0000 |

||

|

Human Resources: sub-cost center: Post Language Program |

6441-00XX |

||

|

Human Resources - Locally Employed Staff Services |

6451-0000 |

||

|

Building Operations: |

n/a |

n/a |

|

|

GO/CL Residential Building Operations |

7810-0000 |

||

|

GO/CL Non-Residential Building Operations |

7820-0000 |

||

|

OL Residential Building Operations |

7850-0000 |

||

|

OL Non-Residential Building Operations |

7860-0000 |

||

|

Miscellaneous Costs (Review guidance prior to use) |

8790-0000 |

||

|

Non-ICASS Dual Positions |

0000-0000 |

||

|

Total Must = 100% |

|||

Employee Signature and Date: __________________________________

Section Head Signature and Date: _______________________________

6 FAH-5 Exhibit H-315(B)

Time Allocation Worksheet

Lite Post

(CT:ICASS-105; 05-17-2021)

(Office of Origin: CGFS/ICASS)

|

LITE POST TEMPLATE |

|||

|

U.S. Embassy NAME HERE |

|||

|

FYXX ICASS Time Allocation by Cost Center as of May 1, 20XX |

|||

|

ICASS Employee Name: |

|||

|

Employee Position Code: |

|||

|

Name of Employee's Supervisor: |

|||

|

Name of ICASS Section: |

|||

|

Cost Center Name |

Cost Center Number |

Prior Year Time % |

Current Year Time % |

|

Basic Package Services |

6150-0000 |

||

|

Community Liaison Office Services |

6443-0000 |

||

|

Health Services |

5624-0000 |

||

|

Information Management Technical Support Services |

5458-0000 |

||

|

Residential Local Guard Program Services |

5821-0000 |

||

|

Non-Residential LGP/Single Agency Occupied Building Services |

5822-0000 |

||

|

Mobile Patrol Local Guard Program Services |

5823-0000 |

||

|

Non-Residential Local Guard Program Services (LE Staff only) |

5826-0000 |

||

|

Security Services |

5880-0000 |

||

|

Furniture & Appliance Pool Services |

6144-0000 |

||

|

General Services |

6145-0000 |

||

|

General Services: sub-cost center: |

6145-xxxx |

||

|

|

|

||

|

Budgets and Financial Plans Services |

6211-0000 |

|

|

|

Accounts and Records Services |

6221-0000 |

|

|

|

Vouchering Services |

6223-0000 |

|

|

|

Cashiering Services |

6224-0000 |

|

|

|

Human Resources Services |

6445-0000 |

||

|

Human Resources: sub-cost center: Post Language Program |

6445-0001 |

||

|

Building Operations: |

n/a |

n/a |

|

|

GO/CL Residential Building Operations |

7810-0000 |

||

|

GO/CL Non-Residential Building Operations |

7820-0000 |

||

|

OL Residential Building Operations |

7850-0000 |

||

|

OL Non-Residential Building Operations |

7860-0000 |

||

|

Miscellaneous Costs (Review guidance prior to use) |

8790-0000 |

||

|

Non-ICASS Dual Positions |

0000-0000 |

||

|

Total Must = 100% |

|||

Employee Signature and Date:

__________________________________

Section Head Signature and Date:

__________________________________