6 FAH-5 Exhibit H-335

ICASS Redistribution

(CT:ICASS-82; 09-13-2018)

COST DISTRIBUTION METHODS

(CT:ICASS-108; 11-30-2021)

(Office of Origin: CGFS/ICASS)

6 FAH-5 H-331 Distribution Factors

(CT:ICASS-82; 09-13-2018)

(Applies to participating ICASS agencies)

a. This chapter outlines the established principles for distributing costs to customer agencies in the International Cooperative Administrative Support Services (ICASS) cost distribution system as agreed to by the service provider and customer agencies (see 6 FAH-5 H-010 ICASS Functions for the background, organization, and operating principles of ICASS).

b. These principles are intended to ensure a consistent methodology for distributing costs in order to develop metrics for management comparisons. It is essential that all distribution data be entered into the ICASS Cost Distribution software using the concepts and guidelines provided in this Handbook.

c. The Standard and Lite ICASS systems use standardized distribution factors to distribute costs to participating agencies (see 6 FAH-5 H-320 for a comparison of the two methods). The interagency ICASS Working Group (IWG) in Washington DC, working with the ICASS Service Center (ISC), determines the distribution factors for each cost center and they may not be changed by posts. The purpose for standardizing distribution factors in these two systems is to minimize the differences in the final invoices and reports generated at posts and to facilitate worldwide comparisons of post administrative support costs. ICASS uses two types of distribution factors: static counts and cumulative counts.

6 FAH-5 H-331.1 Static Counts

(CT:ICASS-108; 11-30-2021)

(Applies to participating ICASS agencies)

Static counts are workload counts that are based on a “snapshot” of data on a particular date. In ICASS, static counts include capitation (head count), square meters occupied (residential properties) or assigned (nonresidential properties), or number of units serviced (i.e., devices, vehicles, leases, etc.). These counts are taken on May 1 of each year and the resulting workload count forms the basis for customer agency invoices for the upcoming fiscal year:

(1) Capitation: Many cost centers use capitation (head count) as the distribution factor to spread costs to all customer agencies. Because the staffing level at post may vary throughout the year, establishing an accurate count is an important part of the ICASS process. Capitation counts must use the authorized personnel system of record as the primary source of data. In ICASS, most capitation counts can be modified (see 6 FAH-5 H-332.1):

(a) ICASS Standard: Cost centers in ICASS Standard that use capitation include:

· 5624-Health Services (see 6 FAH-5 H-341.3);

· 5880-Security Services (see 6 FAH-5 H-341.6);

· 6143-Warehouse and Property Management Services (see 6 FAH-5 341.7-7);

· 6150-Basic Package Services (see 6 FAH-5 H-341.1);

· 6194-Mail and Messenger Services (see 6 FAH-5 H-341.9-2);

· 6222-Payrolling Services (see 6 FAH-5 H-341.10-3);

· 6441-Human Resources–U.S. Citizen Services (see 6 FAH-5 H-341.11-1);

· 6443-Community Liaison Office (CLO) Services (see 6 FAH-5 H-341.2); and

· 6451-Human Resources–LE Staff Services (see 6 FAH-5 H-341.11-2);

(b) ICASS Lite: Three groups of services provided in the Standard methodology are “bundled” into three cost centers in Lite and use capitation as the workload count: 6145-General Services (covers nine services), 6196-Information Management (covers three services), and 6445-Human Resources (covers two HR Services plus Payrolling Services). Lite cost centers that use capitation include:

· 5624-Health Services (see 6 FAH-5 H-342.3-4);

· 5880-Security Services (see 6 FAH-5 H-342.6-4);

· 6145-General Services (see 6 FAH-5 342.7-4);

· 6150-Basic Package Services (see 6 FAH-5 H-342.1-4);

· 6196-Information Management Services (see 6 FAH-5 H-342.9-4);

· 6443-Community Liaison Office (CLO) Services (see 6 FAH-5 H-342.2-4); and

· 6445-Human Resources Services (see 6 FAH-5 H-341.11-4).

(2) Unit or Square Meter Counts: Some cost centers use distribution factors that are directly related to the services provided, such as the number of supported devices, the number of leases maintained, or net square meters of space occupied (residential properties) or assigned (nonresidential). Cost centers that use “space occupied” or “space assigned” as the distribution factor use specific measuring methodologies outlined in 6 FAH-5 H-341.12 Building Operations:

(a) ICASS Standard: Cost centers in ICASS Standard that use this type of static count include:

· 5458-Information Management Technical Support Services (see 6 FAH-5 H-341.4-4);

· 5821-Residential Local Guard Program Services (see 6 FAH-5 H-341.5-1(D));

· 5822-Non-Residential LGP/Single Agency Occupied Building Services (see 6 FAH-5 H-341.5-2(D));

· 5823-Mobile Patrol Local Guard Program Services (see 6 FAH-5 H-341.5-3(D));

· 5826-Non-Residential Local Guard Program Services (see 6 FAH-5 H-341.5);

· 6132-Vehicle Maintenance Services (see 6 FAH-5 H-341.7-1(D));

· 6144-Furniture and Appliance Pool Services (see 6 FAH-5 H-341.8-4);

· 6148-Leasing Services (see 6 FAH-5 H-341.7-8(D);

· 6195-Telecommunications and Radio Services (see 6 FAH-5 H-341.9-3(D));

· 7810/20/50/60-Building Operations Services for Residential and Non-Residential Properties (see 6 FAH-5 H-341.12).

(b) ICASS Lite: Cost centers in ICASS Lite that use this type of static count include:

· 5458-Information Management Technical Support Services (see 6 FAH-5 H-342.4-4);

· 5821-Residential Local Guard Program Services (see 6 FAH-5 H-342.5-1(D));

· 5822-Non-Residential LGP/Single Agency Occupied Building Services (see 6 FAH-5 H-342.5-2(D));

· 5823-Mobile Patrol Local Guard Program Services (see 6 FAH-5 H-342.5-3(D));

· 5826-Non-Residential Local Guard Program Services (see 6 FAH-5 H-342.5-4(D));

· 6144-Furniture and Appliance Pool Services (see 6 FAH-5 H-342.8-4); and

· 7810/20/50/60-Building Operations Services for Residential and Non-Residential Properties (see 6 FAH-5 H-342.12).

6 FAH-5 H-331.2 Cumulative Counts

(CT:ICASS-108; 11-30-2021)

(Applies to participating ICASS agencies)

a. Cumulative counts track ongoing workload for a 12-month period. These counts are gathered from May 1 through April 30 and establish the workload count to be used in the budget for the subsequent fiscal year. It is recommended that customer agencies subscribe to all cost centers that use a cumulative count for the distribution factor. Because charges are assessed only when these services are used, there is no cost involved in simply subscribing to these services. However, subscribing to these services ensures their availability if, and when, they are needed (see 6 FAH-5 H-334 for information on collateral workload counts).

b. In ICASS, cumulative counts include the number of kilometers driven, number of strip codes processed, weight of pouches shipped, number of procurement actions processed, etc. All counts are accumulated in the course of daily work for accountability as well as for cost distribution purposes. Wherever possible, these counts are taken from authorized automated systems (e.g., cost centers in Financial Services use the authorized financial systems of record). In some cases, cumulative counts are based on an estimate of projected annual use, such as for newly arriving agencies at post whose workload is added in the next available budget (see 6 FAH-5 H-391). Cost centers that use cumulative counts include:

c. ICASS Standard: Standard cost centers that use cumulative counts include:

· 6133-Administrative Supply Services (see 6 FAH-5 H-341.7-2(D));

· 6134-Procurement Services (see 6 FAH-5 H-341.7-3(D));

· 6135-Reproduction Services (see 6 FAH-5 H-341.7-4(D));

· 6136-Shipping and Customs Services (see 6 FAH-5 H-341.7-5(D));

· 6139-Motor Pool Services (see 6 FAH-5 H-341.7-6(D));

· 6192-Pouching Services (see 6 FAH-5 H-341.9-1(D));

· 6211-Budgets and Financial Plans Services (see 6 FAH-5 H-341.10-1(D));

· 6221-Accounts and Records Services (see 6 FAH-5 H-341.10-2(D));

· 6223-Vouchering Services (see 6 FAH-5 H-341.10-4(D));

· 6224-Cashiering Services (see 6 FAH-5 H-341.10-5(D)); and

· 6462-Travel Services (see 6 FAH-5 H-341.7-9(D)).

d. ICASS Lite: Lite cost centers that use cumulative counts include:

· 6211-Budgets and Financial Plans Services (6 FAH-5 H-342.10-1(D));

· 6221-Accounts and Records Services (6 FAH-5 H-342.10-2(D));

· 6223-Vouchering Services (6 FAH-5 H-342.10-3(D)); and

· 6224-Cashiering Services (6 FAH-5 H-342.10-4(D)).

6 FAH-5 H-332 Adjustments to workload counts

(CT:ICASS-82; 09-13-2018)

(Applies to participating ICASS agencies)

The established distribution factors may not always accurately reflect a customer agency’s usage of, or need for, a particular service. A workload count may need some other adjustment to ensure that a customer agency’s count reflects the level of effort provided under a particular cost center. There are several ways to adjust workload counts to address these situations: modification, weighting, and the use of sub-cost centers. The policies governing the application of modifications and weighting are determined by the Washington, DC interagency ICASS Working Group (IWG), and are fixed in both ICASS Standard and Lite software systems; these may not be changed by post. Sub-cost centers are used only in those cases where modifications or weighting do not provide an equitable distribution of costs or to break out costs for a unique service (see 6 FAH-5 H-332.3).

6 FAH-5 H-332.1 Modifications and Modification Policies

(CT:ICASS-108; 11-30-2021)

(Applies to participating ICASS agencies)

a. Since not all customer agencies require the same level of services, certain cost centers allow for modifications of the workload counts. In each cost center outlined in 6 FAH-5 H-340, the “How to Count” section explains the respective distribution factor(s) and whether or not the workload count is modifiable. It also provides guidelines which describe the circumstances for granting a modification. Because modifications have a direct impact on all agencies’ invoices, they should be granted only in clearly documented situations. Working with the post budget committee (see 6 FAH-5 H-222.4-3) the service provider must establish a post-specific policy for granting modifications for each modifiable cost center, ensuring transparency and equity. The annual review of the post modification policy should be done in the February/March meeting of the post budget committee (see 6 FAH-5 Exhibit 223.5) in preparation for the development of workload counts for the upcoming fiscal year. Samples of post modification policies can be found on the ICASS website.

b. Post must review the core services outlined in each cost center in 6 FAH-5 H-340, and any additional essential post-specific circumstances, when establishing objective criteria for the granting of modifications. Once these criteria are established, the post budget committee does not need to review each individual agency request for modification if it meets one of the post’s established criteria. The budget committee should ensure that the criteria are uniformly applied by the service provider. The agency seeking a modification has the responsibility to justify and document the basis for all modifications requested.

c. In Standard or Lite, a modification to a workload count will reduce the cost of that service for the subscribing agency and create a corresponding increase for other subscribing agencies. The service provider must ensure that granting a modification represents an equitable sharing of the costs for that service. The following example shows in very basic form the effect of a modification on the cost of a service to a customer agency (it does not factor in ICASS Redistribution):

(1) Example without a modification: Post has budgeted $3,000 to this cost center and the total agency workload is shown in the first column. The modification factor is “1” for all agencies (i.e., full service).

|

Workload Count |

Modification Factor |

Modified Workload |

% Share Workload |

Agency Invoice |

|

10 |

1.0 |

10 |

33.3% |

$1,000 |

|

10 |

1.0 |

10 |

33.3% |

$1,000 |

|

10 |

1.0 |

10 |

33.3% |

$1,000 |

|

30 |

|

30 |

100.0% |

$3,000 |

Unit Cost is $3,000/30 = $100

(2) Example with a modification: The next chart takes the same cost center and modifies the workload for two of the agencies.

|

Workload Count |

Modification Factor |

Modified Workload |

% Share Workload |

Agency Invoice |

|

10 |

1.0 |

10 |

52.6% |

$1,579 |

|

10 |

0.6 |

6 |

31.6% |

$ 947 |

|

10 |

0.3 |

3 |

15.8% |

$ 474 |

|

30 |

|

19 |

100.0% |

$3,000 |

Unit Cost is $3,000/19 = $157.90

d. In ICASS, the only modification factors that may be applied to workload counts are as follows:

|

1.0 |

Full service |

|

0.6 |

Mid-level service |

|

0.3 |

Low-level service |

In establishing post policies for modifications, all relevant factors must be considered. Some cost centers cover services that are not typically used on a regular basis (e.g., Security Services) but are available when you need them (e.g., a new locally employed staff [LE staff] employee is being hired and needs a background check, or an employee is in a car accident and needs assistance with the local authorities) and are not otherwise available from any other source. Modification to this kind of cost center is difficult to justify and is allowable only in very limited circumstances. For example, all agencies must subscribe to the four mandatory cost centers: 5624-Health Services, 5880-Security Services, 6150-Basic Package Services, and 6443-CLO Services. These four cost centers are described as the “firehouse” equivalent in ICASS—the services are provided if and when you need them and exist as a basic platform serving all customer agencies. While all four cost centers are modifiable, the rationale for modification is very different for each one.

e. There are two basic reasons for a modification: An agency self-provides some of the services, or geographic proximity limits access to the services. If an agency believes it should get a modification, that agency must be able to document its justification as outlined below:

(1) Geographic proximity: The issue of geographic proximity is considered differently in each cost center and each post should establish appropriate criteria. For example, granting a modification in Basic Package Services would depend less on the amount of usage/access to services that an agency has because all Basic Package Services must be available to all employees. CLO Services, however, uses a similar distribution factor (head count), but whether a modification is given is more dependent on an agency’s ability to access those services. In CLO services, geographic proximity would play a more important role in determining a level of modification; and

(2) Self provision: Many agencies self-provide some of the services provided in ICASS, either using their own local staff or headquarters staff. For example, an agency might manage its own requirements for human resources (HR) services for LE Staff and only use the local compensation plan to set its salary and benefit levels. This would be an appropriate justification to modify the level of service in 6451-HR Services-LE Staff at the .3 level (see paragraph f for modifications at a Lite post). In another example, at a Standard post an agency has two LE Staff employees and it subscribes to 6451—Human Resources—LE Staff Services. Unless that agency “self-provided” a significant portion of the services outlined in this cost center, it would subscribe at the full level of service. The fact that the agency has only two employees would not be a justification for a modification.

f. Modifications in ICASS Lite: In ICASS Lite posts, modifications have an added level of complexity. Three of the 21 Lite cost centers contain a wide range of services and are equal to 15 of the cost centers provided in the Standard software system (see chart below). In Lite posts, it is recommended that service providers establish “bundles” of services in each cost center (particularly in the three “compressed” cost centers) as part of its policy on cost center modifications. In establishing “bundles” of services, post should consider the level of effort, time, and resource allocations required for each service so that each bundle represents an equal share of the costs (see 6 FAH-5 Exhibit 332). This will facilitate a standardized approach to granting modifications. Modification is the preferred method for adjusting customer agency workload counts at Lite posts.

|

Cost Center Comparison |

||

|

Service |

Standard |

Lite |

|

General Services |

9 cost centers |

1 cost center |

|

Human Resources (see Note 2) |

2 cost centers |

1 cost center |

|

Information Management |

3 cost centers |

1 cost center |

NOTE 1: Requests for additional workload count modifications not addressed in the post policy must be documented and submitted to the post budget committee who is responsible for reviewing and approving modification requests (see 6 FAH-5 H-222.4-3).

NOTE 2: The Human Resources cost center at a Lite post includes Payrolling Services. This function may be performed by HR or Financial Management staff and the time allocation process captures the staff time required for this service.

6 FAH-5 H-332.2 Weighting

(CT:ICASS-108; 11-30-2021)

(Applies to participating ICASS agencies)

In some cost centers, the use of a standardized distribution factor does not reflect either the level of effort required or the differing levels of service typically provided. To address these differences, ICASS uses certain weighting factors that are unique to, and mandatory in, the respective cost centers where they are used.

(1) The 6134-Procurement Services cost center in Standard uses a cumulative count (total number of executed procurement documents) combined with a weighting factor (see 6 FAH-5 H-341.7-3 Procurement Services); this cost center is not modifiable. This weighting factor is intended to reflect the increased level of effort required to process larger procurement actions (see 14 FAH-2 H-142 and 14 FAH-2 H-320 for information on roles and responsibilities in the contract process). In ICASS, the weighting factors for the Procurement cost center are:

|

Procurement Weighting Factors |

|

|

3 |

One procurement action greater than $250,000 |

|

2 |

One procurement action greater than $10,000 through $250,000 |

|

1 |

One procurement action of $10,000 or less |

(2) The 6143-Warehouse and Property Management Services cost center in Standard uses a static count of U.S. Direct Hire (USDH) and LE staff and weights the number of LE staff by a factor of 0.2. This weighting factor reflects the lower level of use of the services in this cost center by LE staff;

(3) The 6145-General Services cost center in Lite also uses a static count of USDH and LE Staff and weights the number of LE staff by a factor of 0.2. As above, this weighting factor reflects the lower level of use of the services in this cost center by LE staff;

(4) The 5458-Information Management Technical Services cost center in both Standard and Lite uses a two-tier static count comprised of devices serviced and OpenNet User IDs established. Because many agencies maintain their own computer networks and only need access to OpenNet for certain post operations, a weighting factor of 0.3 is applied to User IDs for those agencies (see 6 FAH-5 H-341.4-4); and

(5) The 6144-Furniture and Appliance Pool (FAP) Services cost center in both Standard and Lite provides for weighting the workload count for dedicated residences included in the FAP at 1.2 (see 6 FAH-5 H-512.5, paragraph f). This weighting factor offsets certain additional furniture and appliances often required in such properties.

6 FAH-5 H-332.3 Sub-Cost Centers

(CT:ICASS-108; 11-30-2021)

(Applies to participating ICASS agencies)

a. Purpose of a sub-cost Center: If modifications or weighting do not achieve an equitable distribution of costs, post may need to create a sub-cost center to separate a particular service(s) that is(are) not used by all agencies. For example, at a Lite post, one agency may subscribe to only two services in 6145-General Services (i.e., Shipping and Customs and Vehicle Maintenance). Post has determined that the 0.3 modification to this cost center does not accurately capture the costs for these services for this agency. To address this inequity, post could establish sub-cost centers for these two services. A sub-cost center is essentially the equivalent of creating a new cost center.

b. Time allocation, budgeting, and workload count: In preparing the budget, post must ensure that an appropriate percentage of staff time and costs are entered in the sub-cost center. Post will then need to capture the workload count for all agencies that subscribe to the sub-cost centers. In the example noted in paragraph a of this section, the distribution factor for 6145-General Services is based on capitation (head count) and this same distribution factor must be used in these sub-cost centers. The workload must be specific to the sub-cost center and the subscribing customer agencies.

NOTE: Sub-cost centers do not replace the main cost center which must always contain budgeted costs and workload counts.

c. Limitations: While the use of sub-cost centers can provide more precision in spreading certain costs, post must weigh these benefits against the additional time and effort required for budgeting, accounting, and tracking actual obligations. If the total employee time allocation to the proposed sub-cost center is only one percent, a sub-cost center should not be established as the amounts are so small that it would not be worth the time and effort to segregate these costs.

NOTE 1: In principle, sub-cost centers must use the same distribution factor as the “parent” cost center. For example, under 6145-General Services in a Lite post, the distribution factor for all sub-cost centers will be the number of USDH and other staff as counted in Basic Package plus the number of LE staff multiplied by a factor of .2. However, there are limited exceptions to this rule for standardized sub-cost centers (see paragraph e).

NOTE 2: An agency may subscribe to a sub-cost center without subscribing to the main cost center.

d. Option for Lite Posts: In addition to sub-cost centers, Lite posts also have the option to create up to three Standard GSO cost centers and use the applicable Standard distribution factor. If a Lite post exercises this option, it must review the remaining services in the 6145-General Services cost center to establish new guidelines for modifications (see 6 FAH-5 Exhibit H-332.1).

e. Standardized sub-cost centers: In order to isolate the costs of certain services, there are mandatory standardized sub-cost centers that must be used at both Standard and Lite posts. Posts that offer these services must use the standardized sub-cost center number, name, and distribution factor shown in 6 FAH-5 Exhibit 332.5 and outlined in detail in 6 FAH-5 H-341.15; these names and numbers are pre-programmed in the ICASS software. If a post does not offer these services, the sub-cost centers are not activated. Posts may activate other sub-cost centers, as needed.

6 FAH-5 H-333 Workload Counts

6 FAH-5 H-333.1 Timeline for Workload Counts

(CT:ICASS-101; 09-01-2020)

(Applies to participating ICASS agencies)

Workload counts play a key role in the ICASS process. It is the responsibility of both the service provider and the customer agencies to ensure their accuracy. Gathering the data, validating the information and entering it into the software are all done on a fixed timeline (outlined below; see 6 FAH-5 Exhibit 223.5) and, once established, the workload counts may be changed only in very limited circumstances. These workload counts form the basis for preparing agency invoices:

(1) January through March: Post ICASS budget committee (BC) meets to review and discuss the workload count methodology. The BC reviews and updates post's modification policy for the upcoming fiscal year and considers any workload count modification requests that fall outside its policy. This will ensure that all customer agencies and the service providers have a shared understanding of modifications. The service provider should also begin the process of reviewing time allocations in preparation for the June 1 review by the BC;

(2) May 1: The service provider collects and records the workload counts, including all approved modifications, for each agency (see 6 FAH-5 H-331.1 for static workload counts taken on May 1 and 6 FAH-5 H-331.2 for cumulative workload counts);

(3) June 1: The service provider furnishes to each customer agency a series of reports that include the agencies' workload counts and ICASS time allocations that will be used in the upcoming fiscal year. The BC must review the service provider time allocations and any remaining workload count modification requests that fall outside post policy. Agencies have 30 days to review and approve these documents;

(4) July 1: The customer agencies must provide the service provider written approval of the workload counts and time allocations. Once finalized, these counts will be used in the initial and final budget submissions for the upcoming fiscal year; and

(5) Mid July: Posts submit to the ICASS Service Center the annual ICASS workload and time allocation data. Based on this information, a report is provided to customer agencies in Washington as a preliminary indication of any shifts in workload counts or levels of service and their potential impact on agency invoices.

6 FAH-5 H-333.2 Calculating Workload Counts

(CT:ICASS-108; 11-30-2021)

(Applies to participating ICASS agencies)

a. Workload counts are taken on May 1 of each year and form the basis for customer agency invoice calculations for the upcoming fiscal year. This is a critical step in the ICASS process that ensures fairness and equity in sharing ICASS costs.

b. There are two types of workload counts used in ICASS, and within each category there are variations, depending on the cost center.

(1) Static counts: There are two types of static counts: capitation and unit or square meter counts (see 6 FAH-5 H-331.1):

(a) Capitation counts represent a “snapshot” of post staffing for both USDH and LE Staff as of May 1. Posts should use the official system of record to start this process and work with customer agencies to establish accurate workload counts. In principle, if a position was filled during the current fiscal year, it will be counted for the upcoming fiscal year, even if it is temporarily vacant on May 1 (see 6 FAH-5 Exhibit H-333.2):

· An agency that has existing vacant positions must revalidate them and advise the FMO if they will or will not be filled in the upcoming fiscal year. If they will not be filled for the entire upcoming fiscal year, they are not counted. If they are to be filled for any portion of the upcoming fiscal year, they are counted.

· If an agency plans to not fill an existing position in the upcoming fiscal year, the FMO must be notified, and the position will not be counted.

· If all positions for an agency will not be filled in the upcoming fiscal year, the agency will receive no workload counts for the year and there will be no invoice.

· These counts are fixed and can only be changed in limited circumstances (see 6 FAH-5 H-333.3).

(i) Family members: For workload counts in 5624-Health Services and 6443-CLO Services, posts must use the family size of the current incumbent of a position (or, for vacant positions, the family size of the recently departed incumbent), even if the employee will be replaced soon. Actual workload counts for the new arrivals will be captured in the following year’s Data Call. This methodology is based on policy established by the IWG.

(ii) Eligible Family Members (EFM)/Expanded Professional Associates Program (EPAP): Workload counts for EFMs and EPAP employees are counted like LE staff and assigned to the employing agency. EFMs and EPAPs are on the orders of the sponsoring employee and are counted as family members as outlined in paragraph (i).

(iii) Seasonal hires: Many posts employ high school or college age dependents during the summer or school holidays. Since this is generally for very limited time periods, employees in summer hire positions are not counted in any cost center. Members of Household (MOH): MOH are not included in any workload counts. If an MOH is hired for an EFM position, they are counted as outlined in paragraph (ii).

(b) Unit/square meter counts: These counts are based on a “snapshot” of post operations as of May 1. While post may know of upcoming changes that may affect these counts, the policy is to establish the count based on data as of May 1. See exceptions noted in paragraph c below.

(2) Cumulative Counts: Cumulative counts are based on workload that was generated during the prior year (see 6 FAH-5 H-331.2). For example, the Procurement Services cost center workload counts reflect all procurement actions from May 1 of the previous year through April 30 of the current year. This prior year total is the workload count that will be used for the upcoming fiscal year (see NOTE 3 in paragraph c(1) below). These counts are fixed and are typically based on automated reports.

· NOTE: Cumulative counts for TDYers are charged to the funding agency at post and included in their regular ICASS invoice. Cumulative counts are included on TDY invoices ONLY when there is no funding agency at post (see 6 FAH-5 H-363.1-5, subparagraph c(4)).

c. When gathering the May 1 workload counts, various circumstances may require additional consideration and review:

(1) Abolished positions: If an agency officially (in writing) informs the service provider that a position (either USDH or LE Staff) currently receiving ICASS services will be abolished in the upcoming fiscal year, the agency’s workload counts directly related to the abolished position are removed from the May 1 workload count. If the position will be subscribing to ICASS services for a portion of the next fiscal year (i.e., October 1 through September 30), then the following formula should be applied at both Standard and Lite posts to pro-rate capitation workload counts:

|

Length of Time Position Exists and Receives ICASS Services |

Adjustment to Workload Count |

|

Position will receive services for 6 months or more |

1.0 count |

|

Position will receive services for 3 months to less than 6 months |

0.5 count |

|

Position will receive services for less than 3 months |

No workload count |

If a position was counted in the May 1 Data Call but during the next fiscal year the agency notifies the service provider (in writing) that the position is being abolished, the workload counts directly related to this position are adjusted using the same formula outlined above. This may be done at either the Initial or Final Budget. Six months’ notice is not required as long as the abolishment does not result in the agency’s total withdrawal from the service or from post.

NOTE 1: For USDH positions, each agency is responsible for preparing the NSDD-38 notification to abolish a position and informing the post human resources office of this action. Until the NSDD-38 is processed, the position will remain in the official record and be included in Capital Security Cost Sharing (CSCS) calculations. Submission of the NSDD 38 is not a prerequisite for removing the position from post ICASS workload counts. For LE staff positions, the agency is responsible for notifying, in writing, the HRO and FMO of the position(s) being abolished. For both USDH and LE Staff positions, the HRO will remove abolished positions from the official record when these actions have been completed.

NOTE 2: Pro-rata calculations are done off-line and entered into the software. This adjustment is different from a modification (see 6 FAH-5 H-332.1).

NOTE 3: No adjustments are made to cumulative counts unless an agency totally withdraws from the service. In this case, the agency must give the service provider six months’ notice of its intent to withdraw from service (by April 1 or October 1). In the case of total withdrawal from service, adjustments to cumulative workload counts should follow a similar pro-rata formula that is fair and equitable to all customer agencies. When an agency totally withdraws from post effective April 30, it will receive no invoice in the following fiscal year.

(2) New positions: ICASS workload counts for new positions present unique challenges (see 6 FAH-5 H-392). While not all services necessarily start on the same date, for the purposes of calculating the workload counts for new positions, post will use a start date beginning three months prior to the expected arrival of the employee. Based on this start date, the workload counts are added to either the Initial or Final budget using the guidance in paragraphs (a) and (b) below. New positions that are filled after submission of the Final Budget will not be invoiced in that fiscal year. If timing allows, the workload counts for the agency should be included in the Data Call plan; otherwise, they must be included in the Initial Budget in the following fiscal year.

(a) Static Counts: Cost centers and sub-cost centers with static workload counts are prorated based on the established start date for the new position in accordance with 6 FAH-5 H-333.2, subparagraph c(1). Workload counts are entered for all cost centers to which the agency will be subscribed.

(b) Cumulative Counts: For cost centers and sub-cost centers with cumulative workload counts, post must develop an estimate of usage for the applicable portion of the year based on similarly sized agencies at post and input from the new agency. Workload counts are entered for all cost centers to which the agency will be subscribed. For growing agencies (i.e., a new position for an existing customer agency), no adjustments are needed, and the additional workload will be captured in the following year.

(c) Local Guard Program (LGP): The same guidance applies to all LGP cost centers except for 5821-Residential Guards and 5822-Single Agency Occupied Building. For these two cost centers, post should include the estimated costs (based on guard hours) in the Initial or Final Budget if target funds are available and assign the workload to the new agency. If target funds are not available, post should direct charge the agency for the guard services provided.

(3) Part-time positions: Many U.S. Government agencies have authority to employ both U.S. and non-U.S. citizens in a status other than full-time permanent (FTP) direct-hire (DH). To ensure equity, ICASS workload counts for employees who do not have full-time work schedules may need to be adjusted to reflect a reduced level of services in certain cost centers. The level of services provided to full-time and part-time employees in the Human Resources and Payrolling cost centers are the same, so no adjustment is required. However, in General Services at a Lite post, the level of services may be less for a part-time employee. In such cases, post could pro-rate the workload count by multiplying it by .5 in an off-line calculation. Agencies are responsible for documenting and requesting an adjusted ICASS workload count for less than full time employees (see 6 FAH-5 H-352.11 for more information).

(4) Double Encumbered Positions: Positions that are double encumbered occur when an officer assigned to replace an incumbent arrives at post before the current incumbent departs. This creates a temporary double encumbering of a single position. Double encumbering of a position results in ICASS services being provided to two officers. For example, there may be two residential properties occupied for one position and guard services provided for both residences. If such a situation exists, this may require a change to workload counts as outlined below. For examples of applying this policy, see 6 FAH-5 Exhibit 333.2(2).

(a) Static workload counts: For double encumbered positions that overlap for three months or more, pro-rated static workload counts may be added to the sponsoring agency’s workload in the fiscal year when the services are provided.

(b) Cumulative workload counts: No adjustments are needed for cumulative workload counts since any additional workload will be captured as the services are used.

(c) When to make changes in workload: Changes to workload can be made in either the Initial or Final budget and are pro-rated based on the chart shown in 6 FAH-5 H-333.2, paragraph c.

(5) Service Recognition Package (SRP) for Special Incentive Posts (SIP): A long-term double encumbered situation exists when an officer is assigned TDY to a Special Incentive Post (SIP) and he/she is authorized to leave his/her family behind at the post of assignment during his/her long-term TDY. The State Department’s Service Recognition Package (SRP) provides several benefits to employees assigned to SIP on a one-year temporary duty (TDY) basis. Allowing the TDYer’s family to remain at the employee’s current post of assignment, despite the employee’s absence, is a significant benefit with substantial costs as the family will continue to receive ICASS services. Often the vacated position is filled with a new employee, resulting in a one-year double encumbered position. Workload for the TDYer’s family, as well as the new employee and family, is included in the budget. Addressing workload in this situation requires calculating workload counts for both the newly arrived employee and family and the family of the TDYer, assigning those counts to the appropriate State Department agency code, and assigning the workload to the correct fiscal year. Due to the complexity of this process, detailed instructions are provided in ICASS Hints 19 posted on the ICASS Service Center SharePoint site.

6 FAH-5 H-333.3 Changing Workload Counts

(CT:ICASS-108; 11-30-2021)

(Applies to participating ICASS agencies)

There are limited circumstances under which changes may be made to established workload counts as outlined below. Because any change to workload counts will impact all agency invoices, these limitations minimize the potential for significant increases in agency invoices. Any change in workload count that will result in a material change to customer agency invoices must be reported to the post budget committee:

(1) Abolishment of positions: If a customer agency is abolishing (downsizing) filled position(s), that agency must notify the service provider in writing as soon as possible, preferably giving six months’ notice of the planned reduction. The service provider will remove the agency’s workload count directly related to the abolished position in the next available budget using the pro-rata share formula outlined in 6 FAH-5 H-333.2;

NOTE: Agencies completely withdrawing from a service must give the service provider and ICASS council 6 months’ notice as outlined in 6 FAH-5 H-021, paragraph h. See paragraph (5) related to changing workload counts for withdrawal from services;

(2) Error corrections: The service provider may change workload counts in the final budget to correct errors made in the initial budget (e.g., forgetting to include a workload count for an agency, including a workload count for an agency that has left post, or including a workload count for a cost center to which an agency has not subscribed. Error corrections are communicated to the post budget committee as soon as discovered to ensure transparency;

(3) Changing circumstances: If an agency reverses its decision to leave a position unfilled or eliminate a position that it had informed the service provider would be abolished, an adjustment to the workload count for that agency is made in the next available budget using the pro rata formula outlined in 6 FAH-5 H-333.2. If a position was counted in the Data Call but an agency decides, prior to submission of the Initial Budget, not to fill it, the agency must inform the FMO in writing; the workload count is removed from the Initial Budget and the position is not counted. Similar adjustments may not be applied at the Final Budget;

(4) Addition of new or expanding agencies: The service provider will add the workload counts for agencies newly arriving at post, or existing agencies that are expanding, in the next available budget, pro-rating as appropriate (see 6 FAH-5 H-333.2, subparagraph b(2) and 6 FAH-5 H-392.1); and

(5) Withdrawal from service: The service provider adjusts workload for agencies completely withdrawing from a service or from post when 6 months' notice has been given (as outlined in 6 FAH-5 H-021, paragraph h). In general, this would be communicated the previous April 1 to be effective October 1 and the adjusted annual workload counts would be included in the initial budget submission. Apply the pro rata formula outlined in 6 FAH-5 H-333.2 when the termination is effective as of April 1. When the termination of services is effective as of October 1, the agency will receive no invoice in that year.

NOTE: Changes to cost center time allocations are not authorized in the final budget (see 6 FAH-5 H-315, subparagraph a(5)).

6 FAH-5 H-334 Collateral Workload Counts

(CT:ICASS-108; 11-30-2021)

(Applies to participating ICASS agencies)

a. The cost distribution methodology used in ICASS requires a consistent and transparent approach to tracking workload and distributing costs to customer agencies. The cost centers in ICASS represent a broad range of services that support an integrated management platform. In many situations, it is very difficult to isolate a service in order to avoid generating workload in another cost center. Consequently, there may be instances where an agency that does not subscribe to a specific cost center may generate workload in that cost center, requiring an adjustment in workload counts.

b. For example, an agency that does not subscribe to 6134-Procurement Services (because it uses its own purchase card) or 6139-Motor Pool Services (because it uses taxis only) has a high-level visit and wants an English-speaking driver and a dedicated vehicle. There are two alternatives in this situation:

(1) The agency is provided a motor pool vehicle and driver and collateral workload counts for all kilometers driven for this visit will be charged to the agency in the next fiscal year. The agency is also responsible for any direct charges incurred (e.g., tolls) and any driver overtime; or

(2) The agency is provided a rental vehicle with English-speaking driver and all costs are direct-charged to the agency. Collateral workload counts under Procurement and Financial Services will be charged to the agency in the next fiscal year.

6 FAH-5 H-335 ICASS Redistribution methodology

(CT:ICASS-82; 09-13-2018)

(Applies to participating ICASS agencies)

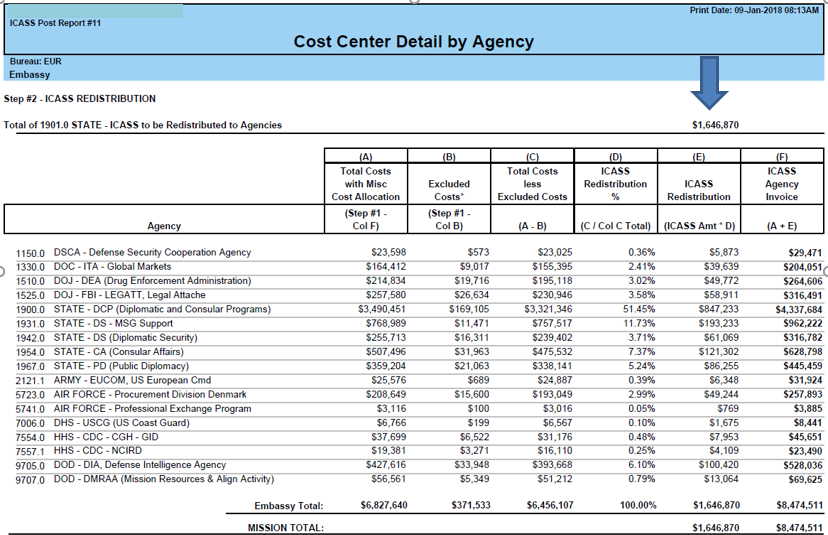

a. The ICASS service provider not only provides administrative services to participating agencies at post but is also a user of these same services. ICASS staff use space, supplies, equipment, and services and they are counted like any other agency at post. However, ICASS does not receive an appropriation so it cannot be billed; its costs are billed to customer agencies at post through the ICASS Redistribution process. These costs are distributed to the agencies based on their percentage share of the total cost of ICASS services at post. In the invoicing process, these costs are initially separated out so customer agencies can view the total service provider costs (shown on the top line of Exhibit H-335) before they are distributed.

b. At this stage of the invoicing process, the software totals each agency’s costs for each cost center (shown in Column A of Exhibit H-335). To determine each agency’s percentage share of the total costs, the software first removes certain “excluded costs” (i.e., residential and non-residential lease costs, utilities, and residential furniture pool costs) that are not considered service costs. The remaining amount (shown in Column C of Exhibit H-335) is what is used to calculate each agency’s percentage share of the total costs. This percentage for each agency is multiplied times the total amount of ICASS Redistribution.

c. In the final step, once each agency’s share of ICASS Redistribution is calculated (Column E in the Exhibit), the software adds the totals in columns B, C and E and the resulting sum is the total invoice for the agency (Column F).

6 FAH-5 H-336 THROUGH H-339 UNASSIGNED

6 FAH-5 Exhibit H-332.1

Modifications at Lite Posts

(CT:ICASS-108; 11-30-2021)

This is a sample approach to calculating modifications at a Lite post. It requires post to periodically determine the cost breakdown in “bundled” cost centers (e.g., 6196-Information Management, 6145-General Services, and 6445 HR Services) in order to calculate the estimated service cost (ESC). This approach ensures an equitable modification based on the cost of the services provided. This same approach can be used for a single Standard cost center to estimate the time and cost for each provided service.

|

6145-General Services |

ESC* $ |

ESC % |

Modification Policy |

|

|

1 |

Vehicle Maint. Services |

$70,000 |

2.9% |

Modification is based on total amount of the ESC for the services selected:

ESC%=up to 30% =.3 Mod

ESC% 31 – 60% =.6 Mod

ESC% > 60% = 1.0 |

|

2 |

Admin. Supply Services |

$250,000 |

10.3% |

|

|

3 |

Procurement Services |

$450,000 |

18.6% |

|

|

4 |

Reproduction Services |

$10,000 |

0.4% |

|

|

5 |

Shpg & Customs Services |

$75,000 |

3.1% |

|

|

6 |

Motor Pool Services |

$900,000 |

37.1% |

|

|

7 |

Warehouse and Property Management Services |

$600,000 |

24.7% |

|

|

8 |

Leasing Services |

$40,000 |

1.6% |

|

|

9 |

Travel Services |

$30,000 |

1.2% |

|

|

|

TOTAL |

$2,425,000 |

100.0% |

|

|

|

|

|

|

|

|

*ESC = Estimated Service Cost |

||||

6 FAH-5 Exhibit H-332.5

Standardized Sub-Cost Centers

(CT:ICASS-108; 11-30-2021)

This chart shows the standardized sub-cost centers (SCC) that must be used if the service is provided. For a detailed description of each SCC, see 6 FAH-5 H-341.15.

|

STANDARDIZED SUB-COST CENTER NAMES AND NUMBERS |

|||

|

Cost Center Number |

STD LITE BOTH |

Sub-Cost Center Name |

Distribution Factor* |

|

5821-X999 |

BOTH |

Local Guard Costs for Special Events |

Additional Guard Hours |

|

5823-X023 |

BOTH |

Res Sec Coord, Res Sec Equip Tech and CAMS |

# Residential Units |

|

6132-X001 |

STD |

LGP Vehicle Maintenance |

# LGP Vehicles Maintained |

|

6132-X132 |

STD |

Drive Cameras |

# Vehicles w/DriveCam |

|

6145-X132 |

LITE |

Drive Cameras |

# Vehicles w/DriveCam |

|

6133-X133 |

STD |

Admin Supplies Issued |

Value of Supplies Issued to Each Agency |

|

6145-X133 |

LITE |

Admin Supplies Issued |

Value of Supplies Issued to Each Agency* |

|

6144-X144 |

BOTH |

FAP Annual Assessment |

# FAP Subscribers |

|

6144-X244 |

BOTH |

Appliance Pool Annual Assessment |

# AP Subscribers |

|

6441-X001 |

STD |

PLP Host Language |

# Individuals Registered* |

|

6451-X002 |

STD |

PLP English |

# Individuals Registered* |

|

6445-X001 |

LITE |

PLP Host Language |

# Individuals Registered* |

|

6445-X002 |

LITE |

PLP English |

# Individuals Registered* |

|

7820-X099 |

BOTH |

Dedicated Storage |

# Net Sq Meters |

|

7820-X821 |

BOTH |

BO: GO/CL Parking Lot #1 |

# Parking Spaces* |

|

7820-X822 |

BOTH |

BO: GO/CL Parking Lot #2 |

# Parking Spaces* |

|

7850-X799 |

BOTH |

Make Ready |

# Net Sq Meters Made Ready* |

|

7850-X899 |

BOTH |

Commissioning/Decommissioning |

# Residences Comm/ Decomm.* |

|

7860-X099 |

BOTH |

Dedicated Storage |

# Net Sq Meters |

|

7860-X861 |

BOTH |

BO: OL Parking Lot #1 |

# Parking Spaces Assigned |

|

7860-X862 |

BOTH |

BO: OL Parking Lot #2 |

# Parking Spaces Assigned |

|

* = Distribution Factor is different from the parent cost center |

|||

·

6 FAH-5 Exhibit H-333.2(1)

Counting Temporarily Vacant Positions

(CT:ICASS-108; 11-30-2021)

The chart below explains how to count positions that are temporarily vacant as of May 1 but will be filled in the upcoming fiscal year for those cost centers that an agency subscribes to. This methodology applies to all static workload counts. Static counts related to an existing position which the agency informs the FMO in writing will be left vacant for the upcoming fiscal year are not counted.

|

Cost Center |

Workload Count |

|

6150-Basic Package Services |

The position is counted. |

|

6443-CLO Services |

The position is counted. If the family size for the new employee is unknown, follow the guidance in 6 FAH-5 H-333.2, paragraph a. |

|

5624-Health Services |

Same guidance as for CLO Services. |

|

5880-Security Services |

The position is counted. |

|

5458-IM Technical Support Services |

The OpenNet log -in ID is counted. Any additional devices to be serviced are counted. |

|

6194-Mail & Messenger Services |

The position is counted. |

|

6195-Telecomunications & Radio Services |

The number of supported devices from the previous incumbent. |

|

6143-Warehouse and Property Management Services |

The position is counted. |

|

6148-Leasing Services |

The lease is counted. |

|

6145-General Services (Lite) |

The position is counted. |

|

6144-FAP Services 6144-0144-FAP Annual Assessment |

The residence is counted. The subscription (position) is counted. |

|

6144-0244-AP Annual Assessment |

The subscription (position) is counted. |

|

6222-Payrolling Services |

The position is counted. |

|

6441-HR Services USDH Services |

The position is counted. |

|

6445-Human Resources Services (Lite) 5821-Residential LGP Services |

The position is counted. The estimated guard hours are included. |

|

5823-Mobile Patrol Services |

The residence is included. |

|

7810/7850-Residential Bldg. Ops. Services |

If no housing assignment has been made, use square meters of previous incumbent. |

|

7820/7860-Non-Residential Bldg. Ops. Services |

There should be no change due to a temporary vacant position. Existing office space assigned to the agency is already counted. |

6 FAH-5 Exhibit H-333.2(2)

Double Encumbered Positions

(CT:ICASS-108; 11-30-2021)

(Applies to participating ICASS Agencies)

The chart below includes examples of how to calculate static workload counts when there is a short-term double encumbered position as described in 6 FAH-5 H-333.2(4). No adjustments are made to cumulative workload counts. Prorating of workload counts follow the established policy in 6 FAH-5 H-333.2, subparagraph c(1). NOTE: This does not pertain to positions on a one-year TDY assignment to a Special Incentive Post (SIP).

FY = Fiscal Year IB = Initial Budget FB = Final Budget

|

New Employee Arrives |

Current Employee Departs |

Period of Overlap in Current FY |

How to Count |

|

April 1 |

July 15 |

3.5 months |

Services received for 3 months or more. In the FB, add pro-rated static workload counts for the new arrival in all relevant cost centers. |

|

June 1 |

Aug 15 |

2.5 months |

There is no impact on any workload counts. |

|

July 15 |

Nov 1 |

2.5 months (current FY) 1 month (upcoming FY) |

The overlap crosses fiscal years. Current FY: Services received for less than 3 months, no impact on workload counts. Upcoming FY: Services received for less than 3 months, there is no impact on workload counts. |

|

Sep 1 |

Jan 15 |

1 month (current FY) 3.5 months (upcoming FY) |

The overlap crosses fiscal years. Current FY: Services received for less than 3 months, no impact on workload counts. Upcoming FY: Services received for 3 months or more. In either the IB or FB, add pro-rated static workload counts for the new arrival in all relevant cost centers. |