14 FAH-1 H-700

DISPOSAL OF PERSONAL PROPERTY

14 FAH-1 H-710

DISPOSAL PROCEDURES AT POST

(CT:PPM-38; 01-29-2021)

(Office of Origin: A/LM)

14 FAH-1 H-711 DISPOSABLE PROPERTY

(CT:PPM-2; 07-27-2005)

(Uniform State/USAID)

Disposable property is property that is not required, or in such a condition that economical repairs cannot be made and should not be allowed to accumulate in offices or warehouses. Such property should be turned in by offices and either reused or disposed of. There are several methods used by the Department for disposing of property that is not required. Before any of these methods can be used, however, the proposed disposal must be documented and authorized.

14 FAH-1 H-712 REPORTING PROPERTY NO LONGER REQUIRED

(CT:PPM-2; 07-27-2005)

(Uniform State/USAID)

Expendable and nonexpendable property that is no longer required is reported to the general services office which will arrange for its removal. If the property is in good condition, the accountable property officer (APO) may wish to reassign it to satisfy another requirement, rather than return it to the warehouse. Before arranging for pick up, however, the general services office should make sure that a security inspection has been conducted on appropriate nonexpendable items, and that Form DS-586, Turn-In Property Inspection Certification, has been completed.

14 FAH-1 H-712.1 Screening Turned-In Expendable Property

(CT:PPM-1; 08-11-2004)

(Uniform State/USAID)

Warehouse personnel should screen returned expendable supplies to determine which items can be put back into stock. Form DS-127, Receiving and Inspection Report, should be prepared by the warehouse personnel, listing the description and quantity (by unit of issue), and sent to the accountable property officer (APO). Unusable expendable property should not be thrown away unless such action is approved by the APO.

14 FAH-1 H-712.2 Nonexpendable Property

14 FAH-1 H-712.2-1 Reporting Condition of Returned Property

(CT:PPM-1; 08-11-2004)

(Uniform State/USAID)

a. The post's internal requisitioning system should include provision for warehouse personnel to routinely report the condition of property turned in. When property has been picked up from an office, each item should be inspected, classified as to its condition, and a condition code annotated on the copy of the property turn-in form that is returned to the general services office, so that property record changes can be made. It is recommended that Form DS-584, Nonexpendable Property Transaction, be used to document property turn-in actions.

b. The condition codes listed in 14 FAH-1 Exhibit H-621.3 are used in classifying property condition.

c. Data on the copies of Form DS-584 returned to the general services office from the warehouse, should be posted to the property records to reflect location change and property condition.

14 FAH-1 H-712.2-2 Classification and Disposition of Returned Property

(CT:PPM-38; 01-29-2021)

(Uniform State/USAID)

a. A member of the warehouse staff should be designated to periodically (at least quarterly) evaluate and categorize turned-in property on hand so that appropriate disposition of the property can be made. A memorandum should be prepared and sent to the general services office, identifying condition of property and its availability to be rehabilitated, put back in stock, redistributed, transferred, or disposed of.

b. Upon receipt of the memorandum, the general services office should initiate appropriate action for disposition of the property. The accountable property officer (APO) should visit the warehouse to appraise any property recommended for rehabilitation or disposal.

c. At posts using the Integrated Logistics Management System (ILMS)or USAID’s automated property system, when property is sent out for rehabilitation, the property number label might be removed during the process. If this occurs, the APO should ensure that a new number is assigned to the property when it is returned and that a record change is made to reflect termination of the old property number.

14 FAH-1 H-713 METHODS OF DISPOSAL

(CT:PPM-27; 06-04-2018)

(Uniform State/USAID)

a. When disposing of property, the methods of disposal are followed in the order given:

(1) Redistribution to establishments within the parent agency;

(2) Transfer to another agency, or to a commissary/mess/recreational facility;

(3) Sale or exchange;

(4) USAID only: Grant-in-aid or project contribution;

(5) Donation; or

(6) Abandonment/destruction.

b. In determining the method of disposition most beneficial to the U.S. Government, consideration must be given to the following:

(1) Condition of the property;

(2) New and present value;

(3) Bona fide need by other posts abroad of the parent agency (taking into consideration the cost of storage, packing and shipping, and other related problems);

(4) Local sales interest and value;

(5) Other U.S. Government agency’s needs and willingness to purchase; and

(6) USAID only: Host-government and project needs.

14 FAH-1 H-713.1 Disposal Document Preparation

(CT:PPM-27; 06-04-2018)

(Uniform State/USAID)

a. With the exception of motor vehicles, the accountable property officer (APO) must get the approval of the property management officer (PMO) before property can be disposed of. This is done by completing Form DS-132, Property Disposal Authorization and Survey Report, for State or Form AID-534-1, Personal Property Disposal Authorization and Report, for USAID (see 14 FAM 418.3-2 for disposal of motor vehicles).

b. Separate reports are prepared for expendable property, nonexpendable property, replacement property, foreign excess property, salvage, and scrap (see 14 FAM 411.4 for property definitions). An original and one copy of Form DS-132 for State or Form AID-534-1 for USAID, should be prepared. The APO keeps the copy for his or her file and forwards the original to the PMO. If the PMO disapproves, Form DS-132 for State or Form AID-534-1 for USAID is returned to the APO, with appropriate comments. If the PMO approves, he or she forwards Form DS-132 or Form AID-534-1 to the property disposal officer (PDO).

c. State only: The instructions in 14 FAH-1 Exhibit H-713.1 will aid in the preparation of Form DS-132 for reporting unneeded personal property. The data field numbers on the instructions in this exhibit correspond to the circled numbers in each field of the form. Fields not addressed should be left blank.

14 FAH-1 H-713.2 Files

(CT:PPM-2; 07-27-2005)

(Uniform State/USAID)

The original of Form DS-132, Property Disposal Authorization and Survey Report, for State or Form AID-534-1, Personal Property Disposal Authorization and Report, for USAID along with any related disposal documents (e.g., invitations, bids, sales register, copies of sales receipt forms) should be kept on file in the property office to support the property records. They may be disposed of three years after final disposal action is taken (if sale was part of the disposal action, the file must be kept until three years after final settlement).

14 FAH-1 H-714 REDISTRIBUTION OF REPLACEMENT PROPERTY

14 FAH-1 H-714.1 Notification to Other Posts

(CT:PPM-2; 07-27-2005)

(Uniform State/USAID)

a. State only: When serviceable property is reported on Form DS-132, Property Disposal Authorization and Survey Report, the property disposal officer (PDO) should notify other posts within the geographic area of the availability of the property. Notification can be made either by airgram or telegram, depending on the urgency of the disposal. The notification should include the amount of property being offered, a complete description of the property, and the property's condition.

b. USAID only: To dispose of property by redistribution, it must be classified as replacement property and be in excellent or good condition. If the PDO believes that property meets these conditions, the PDO should advise the Bureau for Management, Overseas Management Support Division (M/OMS) at USAID Washington, DC headquarters (USAID/W). M/OMS will inform other USAID missions that the items are available.

c. Property is offered on a first-come, first-serve basis and the PDO should allow 30 days before taking any other disposal action.

14 FAH-1 H-714.2 Shipment to Other Posts

(CT:PPM-38; 01-29-2021)

(Uniform State/USAID)

a. A separate transfer document should be prepared for any property being redistributed to another post. Form DS-584, Nonexpendable Property Transaction, should be used for this purpose. The data field instructions in 14 FAH-1 Exhibit H-714.2 will aid in preparing Form DS-584. The data field numbers on the instructions correspond to the circled numbers in each field on the form. When serial-numbered items are involved, a line entry for each item should be made. Serial numbers, when applicable, should be part of the description.

b. Form DS-584, Nonexpendable Property Transaction, is a three-part form. The original and one copy should be included in the shipment to the receiving post, and that post is instructed to retain the copy for its records and sign and return the original. The second copy should be retained on file until the signed original is returned from the receiving post.

14 FAH-1 H-714.3 Property Disposal Officer (PDO) Final Action

(CT:PPM-2; 07-27-2005)

(Uniform State/USAID)

The property disposal officer (PDO) should keep all disposal action documents on file with Form DS-132, Property Disposal Authorization and Survey Report, for State or AID-534-1, Personal Property Disposal Authorization and Report, for USAID until all items listed on the form have been disposed of, and then should return all documents to the accountable property officer (APO) for property records adjustment and filing.

14 FAH-1 H-715 TRANSFER OF PROPERTY TO OTHER U.S. GOVERNMENT AGENCIES OR TO COMMISSARY/MESS/RECREATIONAL FACILITIES OR U.S.-SPONSORED SCHOOLS ABROAD

14 FAH-1 H-715.1 Property Transfer to Other U.S. Government Agencies

14 FAH-1 H-715.1-1 Notification to Other Agencies

(CT:PPM-1; 08-11-2004)

(Uniform State/USAID)

a. When responses to offers of property to other posts within the geographic area are not received, other U.S. Government agencies at the post location should be notified of the availability of the property. It is not necessary to circularize other U.S. Government agencies on a regional basis, as with redistribution to posts. However, if a request is received from another U.S. Government agency elsewhere in the geographic region, a transfer should be made.

b. When offering property to other U.S. Government agencies locally, the property disposal officer (PDO) should circulate a listing of the property stating the description and amount, and providing an explanation of its condition.

c. Property is offered on a first-come, first-serve basis and the PDO should allow 30 days before taking any other disposal action.

14 FAH-1 H-715.1-2 Shipment to Other Agencies

(CT:PPM-38; 01-29-2021)

(Uniform State/USAID)

a. A separate transfer document should be prepared for any property being transferred to another agency. Form DS-584, Nonexpendable Property Transaction, should be used for this purpose; 14 FAH-1 Exhibit H-715.1-2 is an example of a Form DS-584 prepared by State. The data field instructions in the exhibit will aid in the preparation of Form DS-584. The data field numbers in the instructions correspond to the circled numbers on each field of the form. When serial-numbered items are involved, a line entry for each item should be made. Serial numbers, when applicable, should be part of the description.

b. Form DS-584, Nonexpendable Property Transaction, is a three-part form. The original and one copy of Form DS-584 should be included in the shipment to the receiving agency, and the agency instructed to retain the copy for its records and sign and return the original. The second copy should be retained on file until the signed original is returned from the receiving agency.

14 FAH-1 H-715.1-3 Property Disposal Officer (PDO) Final Action

(CT:PPM-2; 07-27-2005)

(Uniform State/USAID)

The property disposal officer (PDO) should keep all disposal action documents on file with Form DS-132, Property Disposal Authorization and Survey Report, for State or Form AID-534-1, Personal Property Disposal Authorization and Report, for USAID until all items included on Form DS-132 or Form AID-534-1 have been disposed of, and then the PDO should return all documents to the accountable property officer (APO) for property records adjustment and filing.

14 FAH-1 H-715.2 State Property Transfer to Commissary/Mess/Recreational Facilities or U.S.-Sponsored Schools Abroad

14 FAH-1 H-715.2-1 Submission of Request

(CT:PPM-1; 08-11-2004)

(State Only)

Requests received from commissary/mess/recreational facilities or U.S.-sponsored schools abroad for unneeded property to satisfy bona fide needs should be submitted, via memorandum, to the property management officer (PMO). The request should include a listing of the property needed, the name of the requesting official, and an explanation of the need.

14 FAH-1 H-715.2-2 Approval

(CT:PPM-1; 08-11-2004)

(State Only)

Requests require the approval of the property management officer (PMO).

14 FAH-1 H-715.2-3 Transfer Document

(CT:PPM-1; 08-11-2004)

(State Only)

a. After the transfer is approved by the property management officer (PMO), Form DS-584, Nonexpendable Property Transaction, should be prepared to use as the action document.

b. The instructions in 14 FAH-1 Exhibit H-715.2-3 will assist in the preparation of Form DS-584. The data field numbers in the instructions correspond to the circled numbers in each field on the form.

c. Form DS-584, Nonexpendable Property Transaction, is a three-part form. The original and one copy should be included in the shipment to the receiving activity, and that activity instructed to retain the copy for its records and to sign and return the original. Retain the second copy on file until the signed original is returned from the receiving activity.

14 FAH-1 H-716 SALE OR EXCHANGE

14 FAH-1 H-716.1 General

(CT:PPM-27; 06-04-2018)

(Uniform State/USAID)

a. When property cannot be disposed of through redistribution to other Department of State establishments or through transfer to another U.S. Government agency, it is disposed of by sale or exchange.

b. The property disposal officer (PDO) must be a witness to key disposal activities on sale day (e.g., cash payments and issuing bills of sale) and must ensure that proper disposal-related entries are made on Form DS-132, Property Disposal Authorization and Survey Report, for State or Form AID-534-1, Personal Property Disposal Authorization and Report, for USAID (see 14 FAM 411.2-3 and 14 FAM 417.2).

c. Foreign excess property: If foreign excess property is not disposed of by transfer, it may be sold if this method is in the best interest of the U.S. Government (see 14 FAM 417.2-3).

d. Replacement property: Replacement property may be sold and the proceeds from the sale used for the acquisition of similar property.

14 FAH-1 H-716.2 Pre-Sale Action

14 FAH-1 H-716.2-1 Lotting

(CT:PPM-1; 08-11-2004)

(Uniform State/USAID)

a. Property assembled in lots is one of the most important considerations in sales preparation. Property lotting affords prospective bidders the opportunity to bid on only those types and quantities of property in which they have real buying interest.

b. The property should be separated into lots of type, similarity, condition, etc. and arranged in such a way that will create a greater buyer appeal, and, whenever possible, property should be lotted by make or manufacturer. Similar items should be lotted together when expected returns for individual items are too low to warrant an individual offering, or when it is determined that lotting together will enhance the sales value of the property. Lotting unrelated property downgrades the total value of the lot.

c. Residence property will probably have the interest of individuals and should be grouped accordingly. For example, a bed could be sold with frame, headboard, box spring, and mattress, or a kitchen table could be sold with the chairs. On the other hand, office furniture may have the interest of local merchants who may be more inclined to purchase larger lots by type. For example, a lot could include all desks or all chairs, etc.

d. Normally, scrap should not be offered on the same sale with usable property since prospective buyers of scrap are not normally buyers of usable property. Exceptions can be made when just a few items of scrap are involved and site clearance is imperative, or when the expense of a separate sale is not feasible. It is recommended that consideration be given to establishing a competitively awarded contract for scrap.

e. The lots should be numbered and signs made to identify the lot number.

f. Since the receipts of sale will be deposited to different accounts, care should be taken not to mix property belonging to more than one agency in the same lot.

g. Scrap and salvage property should be lotted separately from other disposal categories.

h. Trust-fund property and U.S.-owned property are never intermingled in one lot.

i. The integrity of the lots should be maintained in detail once they are established and open to the public inspection, and should continue through the time the property is removed by the successful bidder.

14 FAH-1 H-716.2-2 Advertising

(CT:PPM-1; 08-11-2004)

(Uniform State/USAID)

a. Except when local conditions prohibit, sales must be advertised. Advertisement should be made in sufficient time to permit prospective buyers to inspect the property prior to the date of sale.

b. As appropriate, advertising media such as radio, newspapers, trade journals, or posting in public places should be used to maximize competition and coverage. The extent of solicitation should be appropriate for the quantity and type of property to be sold, the logical market for disposal, the type of sale contemplated, and public interest. Advertisements, as applicable, should state:

(1) The method of sale (e.g., sealed bid, spot bid, auction, etc.);

(2) The location of the property and periods during which the property may be inspected;

(3) If it is a sealed bid sale, where the bid forms may be obtained and whether a deposit is required;

(4) Where the bids are to be submitted;

(5) Date and time that the bids must be received;

(6) The time and date that the bids will be opened;

(7) If applicable, notice that tax or customs duty must be paid by the purchaser before the property can be removed; and

(8) Notice that the sale is on an as-is, where-is, nonreturnable basis.

c. Small-lot, small-value, and isolated-location disposals which do not justify the expense of extensive advertising may be limited to public posting and letters of invitation to bid to a minimum of three potential buyers.

14 FAH-1 H-716.3 Administrative Detail

(CT:PPM-27; 06-04-2018)

(Uniform State/USAID)

A number of administrative details accompany each sale. Some of these details are as follows:

(1) During the inspection and the sale, when the public has access to the property, security coverage must be provided to prevent thefts, ensure the integrity of lots, and to avoid disputes. The property must be kept in an area where only authorized personnel have access;

(2) When the sale is a sealed-bid sale, a locked box shall be used for deposit of bids until the announced bid-opening time. The box shall be secured in a safe during nonworking hours and the box key secured separately;

(3) When the sale includes property that entered the country tax free, the property disposal officer (PDO) should notify local customs of the impending sale. Property cannot be released to the purchaser until local tax and/or customs duties are paid. The purchaser is required to show proof that the tax/customs duties have been paid before property is released;

(4) The PDO arranges, with the financial management officer (FMO) for a cashier to be at the sale location on sale day to accept payment from buyers and return deposits to unsuccessful bidders on sealed-bid sales. Only certified forms of payment (cash, certified checks, etc.) will be accepted;

(5) The sales documents must forbid the importation of such property into the United States unless the Secretary of Agriculture (in the case of any other commodity) determines that its importation will relieve domestic shortages or otherwise be beneficial to the U.S. economy;

(6) Sales documentation:

(a) Form OF-158, General Receipt, is used by the cashier to record payment by the buyer. The cashier will provide the buyer with a copy of the Form OF-158. If only a partial payment is made on sale day, the cashier will also provide instructions to the buyer on where to make the final payment;

(b) When final payment is made, the cashier will issue a second Form OF-158. The buyer will present Form OF-158 to the property disposal officer (PDO);

(7) Canceling sale bids: Bids which have been received are returned unopened to bidders and notice of cancellation is sent to all prospective bidders who were sent an invitation to bid, stating briefly the reasons for the cancellation;

(8) Amendment: When the sale is a sealed-bid sale and it becomes necessary to make changes to the invitation and to issue an amendment to the invitation, the amendment should be given to each person or firm that was furnished the original bid. Form SF-114-D, Sale of Government Property―Amendment of Invitation for Bids/Modification of Contract, is available from the General Services Administration (GSA). For spot-bid or auction sales, the amendment is issued at the time of bidder registration; and

(9) Sale expenses: Expenses incurred in connection with the sale may be paid from the proceeds, and only the net proceeds deposited. Expenses that may be deducted include advertising, auctioneer fees, customs fees, duties, taxes, commercial transportation, casual labor, and equipment rentals. Expenses that may not be deducted include regular salary and overtime payments to contract or direct-hire employees of the U.S. Government.

Property personnel shall monitor claims and the removal of sold property.

14 FAH-1 H-716.4 Methods of Sale

(CT:PPM-1; 08-11-2004)

(Uniform State/USAID)

The property disposal officer (PDO) determines the method of sale to be used. Competitive-bid sales must be used whenever possible. Negotiated sales are not competitive and are used only when competitive-bid sales are not appropriate. Some of the factors that will influence the PDO in determining the best method of sale are:

(1) Quantity, type, and condition of the property;

(2) Local demand; and

(3) Past sales experience.

14 FAH-1 H-716.4-1 Sealed-Bid Sale

(CT:PPM-27; 06-04-2018)

(Uniform State/USAID)

a. This type of sale must be advertised.

b. Sealed-bid sales are especially suitable for large quantities of property that can be sold by multiple lot arrangements using one master bid form. It is the fairest and most objective method of sale with the least risk of collusion. The post may request that a deposit of 10 percent of the total amount bid accompany the bid.

c. Bid form:

(1) It is recommended that Form SF-114, Sale of Government Property—Bid and Award, available from the General Services Administration (GSA), be used to conduct and execute the sealed-bid sale. A listing of various sale terms and conditions for use in conducting sales are included on other forms (Form SF-114C through Form SF-114C-2) available from GSA. The condition that applicable local taxes and customs duties are payable by the purchaser must be added to Form SF-114 (property is not released to the buyer until the buyer presents proof that the taxes/customs duties have been paid);

(2) Bid forms may be mailed to prospective buyers, or prospective buyers may pick up the forms at the location designated on the advertisement. Based on post’s experience, it may be desirable to maintain a list of prospective bidders to whom bid forms are mailed routinely;

(3) If Form SF-114 is not available at the time of the sale and a substitute format is prepared at post, the substitute format should include the following:

(a) Location, date, and times for inspection and for sale;

(b) Where to send the bid and what deposit is required;

(c) Description of the property, stating sizes, year of manufacture, and unique characteristics or conditions such as electrical features for appliances, etc.;

(d) The condition that the property is sold on an as-is, where-is, nonreturnable basis for cash payment without refund or warranty by the U.S. Government (unless these conditions are prohibited by the laws of the host country);

(e) Notice that the U.S. Government reserves the right to withdraw for its use any or all of the property prior to actual removal of the property from U.S. Government control;

(f) Notice that the U.S. Government reserves the right to reject any bid that is considered not to be commensurate with the value of the property, or to reject any bid where there is evidence of connivance, collusion, or bribery;

(g) Time period for making payment for the property (maximum of 24 hours after close of the sale is generally sufficient);

(h) The condition that applicable local taxes and customs duties are payable by the purchaser (property shall not be released to the buyer until the buyer presents proof that the taxes/customs duties have been paid). Normally, it is enough for the U.S. agency to inform the prospective buyer of the buyer's obligation to pay taxes and duties. However, it may be necessary for the post to notify customs officials of the facts regarding the sale, if local rules dictate;

(i) Time period for removal of the property after purchase is made (maximum of 72 hours should be enough time for purchaser to pay any tax/customs duties and make arrangements for removal);

(j) Notice that all arrangements and costs necessary to effect removal of the property are the purchaser's responsibility; and

(k) The condition that in the event the purchaser fails to remove property awarded and fully paid for from U.S. premises within the prescribed period of time, the U.S. Government, at its election and upon notice of default, shall be entitled to charge progressive storage rates up to the bid value, after which the awardee shall forfeit title to the property and all payments made;

(4) The bid forms should list all the property to be sold by lot number and should include space where the amounts of the bids may be entered. As the bid forms are issued, a record of the names to whom the forms are sent should be kept, and checked off as bids are returned; and

(5) As bids are received, they are to be time-and-date-stamped.

d. Sale day:

(1) Sealed bids are opened publicly at the declared time by the property disposal officer (PDO), and the names and bids announced and confirmed. Names and deposits received are recorded on a sales register. Form OF-158, General Receipt, is given to the buyer by the cashier. The following statement, together with the signature of the property disposal officer and the date of signature, must appear on all sales register sheets: "I certify that I have personally opened and read all bids received and verified all entries on this sales register from those bids, and find it correct";

(2) Bids received after the announced closing time or bids not accompanied by deposits (if deposit was required), should be rejected;

(3) Before making the award, bids should be examined to determine that there are no disqualifying factors affecting the sale, and that the bid is commensurate with the market value of the property offered. If the bid is not commensurate with the market value, the PDO may wish to withhold sale and re-offer the property at another time. Local market conditions and sales participation are two of the factors to be considered in making the determination;

(4) After assuring that all bids are in order, the highest bidder for each lot receives that lot and deposits are returned to the unsuccessful bidders. As deposits are returned to unsuccessful bidders, those bidders present are asked to initial the sales register opposite their names, confirming the return. Notification and return of deposits to unsuccessful bidders not present may be made by letter;

(5) In the event of a tie, a time and place should be established for a drawing by lot and, if time permits, the bidders whose bids are tied should be given an opportunity to be present at the drawing. Such drawing shall be witnessed by at least two employees. The names of the two witnesses must be retained in the disposal file; and

(6) Successful bidders may be notified of their award by telephone, but the award must be confirmed by a written notice of award.

14 FAH-1 H-716.4-2 Spot-Bid Sale

(CT:PPM-27; 06-04-2018)

(Uniform State/USAID)

a. This type of sale must be advertised.

b. Spot-bid sale is appropriate when time is important (waiting periods and prolonged inspections are minimized), or individual lots are small and identical, or for similar types of property.

c. Pre-sale action:

(1) Each item should be numbered. If necessary, a minimum acceptable bid may be posted on the item;

(2) A list of sale conditions and a list of the property to be sold should be prepared, and several copies made, to distribute to prospective bidders on sale day. The line items on the list should be in numerical sequence corresponding to numbers on the property. Some of the conditions to include on the list of sale conditions are as follows:

(a) The property is sold on an as-is basis for cash payment without refund or warranty by the U.S. Government (unless these conditions are prohibited by the laws of the host country);

(b) The U.S. Government reserves the right to reject any bid that is considered to not be commensurate with the value of the property;

(c) Conditions for making payment for the property (total payment on sale day preferred but suggest allowing for 10 percent down payment on sale day with a maximum of 24 hours granted for payment of the balance);

(d) Applicable local taxes and customs duties are payable by the purchaser before the property can be removed;

(e) Time period for removal of the property after purchase is made (maximum of 72 hours should be enough time for purchaser to pay any tax/customs duties and make arrangements for removal); and

(f) The purchaser must make all arrangements and perform all work necessary to effect removal of the property at his or her expense.

d. Sale day:

(1) A sales register should be set up for prospective bidders to sign as they arrive on sale day. The lines in the register should be numbered and, as a prospective bidder registers, the bidder should be assigned the bid number corresponding to that line entry (see 14 FAH-1 Exhibit H-716.4-2A for a sales-register format);

(2) Prospective bidders are given prepared bid cards, a copy of the property listing, and a copy of the sale terms/conditions (see 14 FAH-1 Exhibit H-716.4-2B for a bid-card format);

(3) In requesting bids, the property disposal officer (PDO) announces the item or lot, its identification number, and a brief description;

(4) Each item or lot is offered separately and a bid is made by submitting a bid card. The card should show the item number, bid price, registration number of the bidder, and the signature of the bidder. After announcement is made that bidding for an item is closed, no further bids should be accepted for that item;

(5) Award of each item offered should be made to the highest bidder, item by item, as the sale progresses. Bids shall not be disclosed prior to the announcement of award for any item or lot. The amount of the high acceptable bid and the name or registration number of the successful bidder should be publicly announced. In the event that all bids are rejected, the amount of the high bid received should be publicly announced. Items for which all bids have been rejected may be re-offered later during the sale, or at a future date;

(6) Successful bidders should make total payment, or at least a 10 percent deposit, with a maximum of 24 hours allowed for payment of the balance. Form OF-158, General Receipt, is given to the buyer by the cashier; and

(7) In case of a tie, a coin toss should be used to determine the successful bidder. The successful bidders on the tie bid item must be determined prior to requesting bids for the next item.

14 FAH-1 H-716.4-3 Auction Sale

(CT:PPM-27; 06-04-2018)

(Uniform State/USAID)

a. This type of sale must be advertised.

b. An auction sale is used when there is a sizeable accumulation of property which has comparatively good commercial market appeal (sufficient quantity and demand), or when there is a sufficient quantity of specific groups. Basic factors to be considered in determining whether an auction sale should be conducted include:

(1) The nature and extent of the demand in the local market for the type of property to be sold; and

(2) The adequacy of facilities for conducting an auction.

c. Pre-sale action:

(1) A list of sale conditions and a list of the property to be sold should be prepared, and several copies made to distribute to prospective bidders on sale day. The line items on the list should be in numerical sequence and corresponding numbers should be attached to the property items. Some of the conditions to be included on the list of sale conditions are as follows:

(a) Property is sold on an as-is basis for cash payment without refund or warranty (unless these conditions are prohibited by the laws of the host country);

(b) Applicable local taxes and customs duties are payable by the purchaser before the property can be removed;

(c) The U.S. Government reserves the right to reject any bid that is considered not to be commensurate with the value of the property;

(d) In the event of a dispute as to the amount of the bid, the item, or item number, the U.S. Government reserves the right to re-offer the property;

(e) Conditions for making payment for the property (total payment on sale day preferred but suggest allowing for 10 percent down payment on sale day with a maximum of 24 hours granted for payment of the balance);

(f) Time period for removal of the property after purchase is made (maximum of 72 hours should be enough time for purchaser to pay any tax/customs duties and make arrangements for removal);

(g) Notice that all arrangements and cost necessary to effect removal of the property are the responsibility of the purchaser; and

(2) Arrange for the services of a qualified auctioneer. The auctioneer should be paid from the receipts of the sale.

d. Sale day:

(1) Prospective bidders should be provided with a list of property to be sold, and with the list of sale conditions;

(2) A sales register should be set up to identify each bidder who intends to participate in the auction (see 14 FAH-1 Exhibit H-716.4-2A for an example of a sales register) and offers should not be recognized from any person not properly registered. The sales register should also include a statement of agreement and bidders should be asked to sign the register after they have read the list of sale conditions that were provided;

(3) Usually, bidders communicate the amount of their bids either orally or by some other means that will be recognized by, and acceptable to, the auctioneer. Numbered cards or paddles are sometimes used for this purpose. The lines in the sales register are numbered and, when a prospective bidder registers, the bidder is given a card or a paddle with a number corresponding to that line entry. The numbers on the cards or paddles should be large enough for easy identification by the auctioneer;

(4) The sale should commence with an announcement concerning the conduct of the sale, and should include any corrections or changes to the property listing or any other information pertinent to the sale that may not be on the list of conditions provided to the bidders;

(5) The auctioneer should offer each item separately in the sequence appearing on the listing, and the award is given to the highest bidder who should be asked to show the registration number on his or her card or paddle; and

(6) Successful bidders should make total payment, or at least a 10 percent deposit, with a maximum of 24 hours granted for payment of the balance. The buyer makes payment to the cashier and receives a copy of Form OF-158, General Receipt.

14 FAH-1 H-716.4-4 Negotiated Sale

(CT:PPM-27; 06-04-2018)

(Uniform State/USAID)

a. Property may be sold on a negotiated basis if the estimated fair-market value of the property is $1,000 or less, and if at least two attempts to sell the property competitively were unsuccessful either because there were no bidders or because the bids were unreasonable (prior bidders must have the opportunity to submit offers on the negotiated sale). In certain circumstances, the $1,000 fair-market value limitation may be waived. Requests for waivers may be submitted to the Logistics Management office (A/LM/PMP) for State or to the Bureau for Management, Overseas Management Support Division (M/OMS), for USAID. Large quantities may not be divided to meet the $1,000 limit. Negotiated sales are also permitted when an emergency exists which does not allow sufficient time to advertise a competitive sale. This method of sale is used only in special circumstances and requires written justification from the property disposal officer (PDO) and approval by the property management officer (PMO).

b. Property shall not be sold to U.S. Government employees or their relatives, or to U.S. Government contractors or their relatives on a negotiated basis.

c. Economic factors, or the need for immediate disposal action, would be the principal considerations for using this method and would include but not necessarily be limited to:

(1) Sales involving perishables or other property that would spoil or deteriorate rapidly;

(2) Property that is a health hazard;

(3) Property that is a storage problem or is accruing rental charges beyond its value; and

(4) Property which has little value or relation to the costs of advertising.

d. Complete records must be kept of all negotiated-sale transactions.

14 FAH-1 H-716.4-5 Exchange

(CT:PPM-1; 08-11-2004)

(Uniform State/USAID)

Replacement property may be exchanged in whole or in partial payment for similar items. For example, when purchasing a new printer, an agreement could be reached with the vendor for a trade-in allowance on an old computer.

14 FAH-1 H-716.4-6 Files

(CT:PPM-2; 07-27-2005)

(Uniform State/USAID)

Copies of all documents related to sales (e.g., invitations, bids, sales register, copies of sales slips) must be kept in the disposal file with Form DS-132, Property Disposal Authorization and Survey Report, for State or Form AID-534-1, Personal Property Disposal Authorization and Report, for USAID. They may be disposed of three years after final settlement.

14 FAH-1 H-716.5 USAID Only: Project Contribution or Grant-in-Aid

(CT:PPM-27; 06-04-2018)

(USAID Only)

See 14 FAM 417.2-4. For suggested project contribution format, see 14 FAH-1 Exhibit H-716.5A. For suggested grant-in-aid format, see 14 FAH-1 Exhibit H-716.5B.

14 FAH-1 H-716.6 Abandonment or Destruction

(CT:PPM-27; 06-04-2018)

(Uniform State/USAID)

a. Normally, property reaches the abandonment or destruction phase only after redistribution, transfer, donation, and sale efforts have produced no results. It has been then demonstrated and documented that the property has no utilization or sales value and is eligible for disposition through abandonment or destruction.

b. Procedure:

(1) Justification: The first requirement when preparing to dispose of property through abandonment or destruction is to determine the proper justification for using this type of disposal. Generally, justifications used at posts abroad are:

(a) The property has no commercial value. No commercial value means that it has been determined that the property has neither utility nor monetary value (either as an item or as scrap); or

(b) The cost of care, handling, and preparation of the property for sale would be greater than the expected sale proceeds (estimated fair-market value);

(2) Written finding: Upon selection of the appropriate justification, the property disposal officer (PDO) should prepare a written finding justifying the abandonment or destruction action. The written finding should include:

(a) A detailed description of the property, condition, and total acquisition cost;

(b) A full account of efforts to dispose of the property through all other disposal options;

(c) The authority for the abandonment or destruction action along with any pertinent supporting documentation;

(d) A statement describing the proposed method of destruction (e.g., burning, burying, etc.) or the abandonment location;

(e) A statement that the proposed abandonment or destruction action will not be detrimental or dangerous to public health or safety, and will not infringe on the rights of other persons; and

(f) The signature of the property disposal officer (PDO). The written finding for property having an acquisition cost in excess of $500 should also be signed by the property management officer (PMO);

(3) Certification:

(a) An employee, other than the accountable property officer (APO) or the property disposal officer (PDO), must serve as witness to the destruction or abandonment. To document the action and provide an audit trail following destruction or abandonment, a certificate of destruction or abandonment must be prepared by the PDO and must be signed and dated by the PDO and the employee who witnessed the abandonment or destruction action. The certificate should then be made part of the disposal file;

(b) The certificate should read as follows:

I certify that (identify items) were (abandoned/ destroyed) in a manner authorized by 14 FAM 412.4-1.

_____________________ ________

Property Disposal Officer Date

I certify that I have witnessed the (abandonment/ destruction) of the described property in the manner and on the date stated herein.

_____________________ ________

Witness Date

14 FAH-1 H-716.7 Property Disposal Officer Final Action

(CT:PPM-2; 07-27-2005)

(Uniform State/USAID)

a. Any given disposal document may result in a variety of disposal actions (i.e., redistribution, transfer, sale, etc.). The property disposal officer (PDO) must retain copies of all documents relating to disposal actions until total disposal action on Form DS-132, Property Disposal Authorization and Survey Report, for State or Form AID-534-1, Personal Property Disposal Authorization and Report, for USAID has been made. The PDO must complete the Property Disposal Officer field on Form DS-132 (field [17] on 14 FAH-1 Exhibit H-713.1), or Form AID-534-1 including any shipping information (e.g., carrier, bill of lading number, etc.), and forward the original of the form and copies of related disposal documents to the accountable property officer (APO) for records adjustment and filing.

b. State only: If reimbursement has been received through sale or transfer, the PDO must send a copy of Form DS-132 to the budget and fiscal (B&F) office with instructions for depositing the receipts. The B&F office must complete the budget and fiscal officer (BFO) field on the backside of Form DS-132 and return the copy to the APO.

c. USAID only: Payments received through the sale or transfer of property are submitted to the USAID mission controller’s office along with a copy of Form AID-534-1. The controller’s office will document Form AID-534-1 noting final action and will return the copy to the USAID APO.

14 FAH-1 H-716.8 Accountable Property Officer (APO) Final Action

(CT:PPM-2; 07-27-2005)

(Uniform State/USAID)

a. When the original of Form DS-132, Property Disposal Authorization and Survey Report, for State or Form AID-534-1, Personal Property Disposal Authorization and Report, for USAID and related disposal documents are received back from the property disposal officer (PDO), the accountable property officer (APO) must ensure that the property is removed from the property records, and then must complete the Accountable Property Officer field on the back side of Form DS-132 or Form AID-534-1.

b. All documents are retained on file in support of property records. They may be disposed of three years after final disposal action is taken (if sale was part of the disposal action, the file must be kept until three years after final settlement).

14 FAH-1 H-717 THROUGH H-719 UNASSIGNED

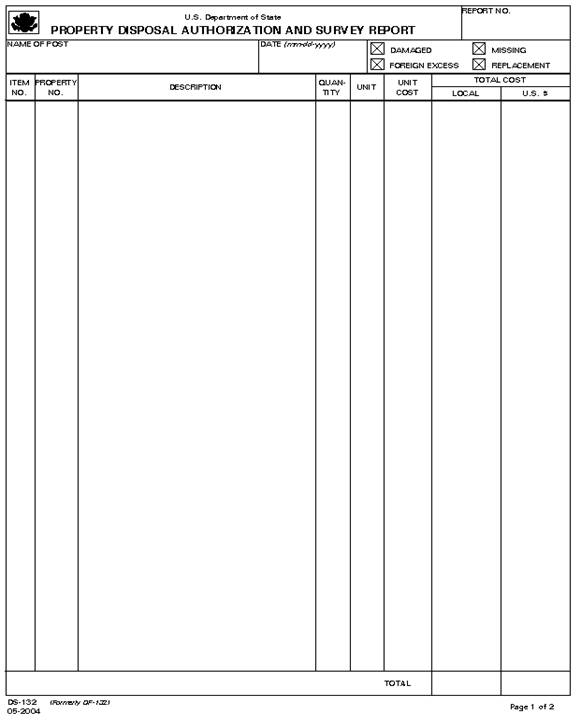

14 FAH-1 Exhibit H-713.1

Form DS-132

State Only: Property Disposal Authorization and Survey Report

(CT:PPM-38; 01-29-2021)

Data Field Preparation Instructions for Form DS-132

State only: These instructions will aid in the preparation of Form DS-132 for reporting unneeded personal property. The data field numbers on the instructions below correspond to the circled numbers in each field on the form. Fields not addressed should be left blank.

Data Field

[1] Post

Enter the name of the post. If post is preparing the disposal document for another agency, the name of the agency may also be entered here.

[2] Date

Enter the date that the report is prepared.

[3] Report Number

Report numbers should be in numerical order and should include the current calendar year; for example, the first report in calendar year 2002 could be D/2002-1.

[4] Property Classification

Place an "X" in the appropriate box. For property being disposed of, the classification will generally be either replacement property or foreign excess property.

[5] Item Number

Each line item on the report should be listed in numeric sequence.

[6] Property Number

Enter the property number, if applicable.

[7] Description

Enter the property descriptions in alphabetical order using the description as recorded on the property records. Include model or serial numbers, if appropriate. When any of the property is disposed of by sale, the sales receipt should be annotated in this field with the appropriate line item. As an alternative to entering all of the descriptive information, posts may enter only the property number in Block 6, and then attach a printout of items to be disposed of to Form DS-132. To get a printout, use the location control screen to establish a unique location in the warehouse; for example, establish an "EXCESS" location. Then transfer everything to be disposed of to this unique location and print an inventory listing by location limited to that location. For USAID: Enter the correct Object Class, Control Number, and standard description assigned to each item in the AID Nonexpendable Property Guide.

[8] Quantity

Enter quantity.

[9] Unit

Enter the item unit (e.g., each, box, dozen).

[10] Unit Cost

Enter the unit cost recorded on property accountable records. If the item cost less than $500, and is not recorded on accountable property records, an estimated cost can be determined from stock control records.

[11] Total Cost

Enter the total line-item cost in the U.S. currency field. For USAID: Enter the cost in local currency for AID Trust-Fund property.

[12] Total

Enter the complete total of field [10].

[13] Circumstances Causing Reported Status of Property

Use this field when this form reports missing or damaged property (see 14 FAH-1 H-226.5).

[14] Accountable Property Officer

The accountable property officer (APO) should make an entry in this field recommending that the property be disposed of, and stating his or her reasons for the recommendation; for example, "Property listed on this report is in poor condition and uneconomical to repair. I recommend disposal action.”

[15] Property Management Officer

The property management officer (PMO) either approves or disapproves the request. If the request is disapproved, the PMO states reasons for the disapproval and returns Form DS-132, Property Disposal Authorization and Survey Report, for State or Form AID-534-1, Personal Property Disposal Authorization and Report, for USAID to the accountable property officer (APO). If the request is approved, the PMO completes this field and forwards Form DS-132 or Form AID-534-1 to the property disposal officer (PDO).

[16] Board of Survey Findings and Decision

This field is used when the property survey board is involved with a report of missing or damaged property.

[17] Property Disposal Officer

After all of the property listed on Form DS-132 has been disposed of, the property disposal officer indicates disposal action(s) taken and forwards the original to the accountable property officer along with copies of any other documents relating to the disposal action(s). If reimbursement has been received through sale or transfer, a copy of Form DS-132 should also be forwarded to the budget and fiscal (B&F) office.

[18] Budget and Fiscal Officer

When the post receives payment for property, the property disposal officer forwards Form DS-132 to the budget and fiscal officer for State who completes this field by indicating action taken (for example, "payment received and deposited") and forwards Form DS-132 to the accountable property officer (APO).

[19] Property Management Officer

Final comments by the property management officer, if appropriate.

[20] Accountable Property Officer

When all actions are complete, the original is returned to the accountable property officer who sees that property records are adjusted to show the disposition of the property. After adjustment, the accountable property officer records the action taken (for example, "property has been removed from the property records").

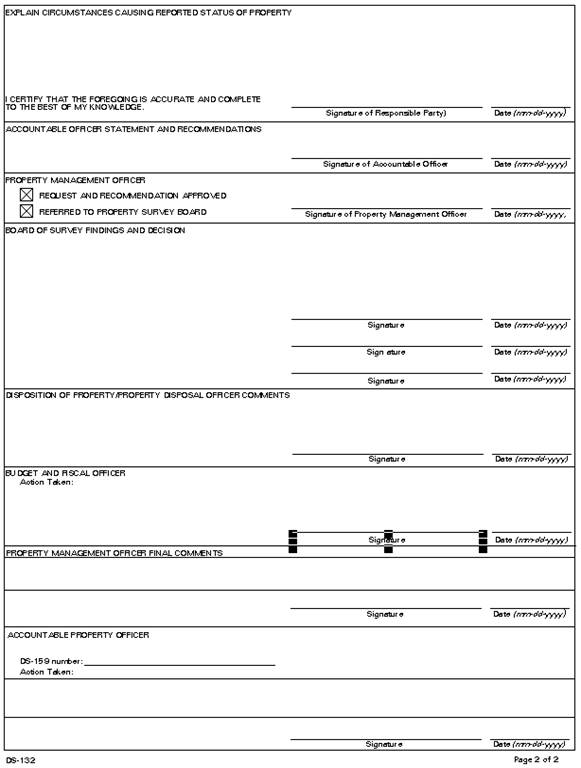

14 FAH-1 Exhibit H-714.2

Form DS-584

Nonexpendable Property Transaction (Redistribution)

(CT:PPM-38; 01-29-2021)

Data Field Preparation Instructions for Form DS-584

A separate transfer document should be prepared for any property being redistributed to another post. Form DS-584, Nonexpendable Property Transaction, should be used for this purpose. The data field numbers on the instructions below correspond to the circled numbers in each field on the form. When serial-numbered items are involved, a line entry for each item should be made. Serial numbers, when applicable, should be part of the description.

Data Field

[1] Date

Date the Form DS-584 is prepared.

[3] Action

Enter an "X" in the Redistribution field, to indicate that this is a property redistribution action.

[4] Control/Auth No.

Enter the number of the Form DS-132, Property Disposal Authorization and Survey Report, on which the property was declared excess.

[6] Requestor's Name

The name of the receiving post contact.

[7] Post/Agency

The name of the receiving post.

[10] Telephone Number

The telephone number of the receiving post contact.

[13] Approving Officer Signature

The property disposal officer signs as approving officer.

[14] Deliver/Ship To

The delivery address of the post to which the property is being redistributed.

[15] Property Number

Enter the property number, if applicable.

[16] Serial Number

Enter any serial number.

[17] Description

Use the same descriptions that appear on Form DS-132, including any model numbers.

[18] Quantity

When entering serial-numbered items, this field may be left blank since items are listed individually. Otherwise, the line-item quantity being redistributed should be entered.

[19] Condition

Indicate the condition of the property.

[20] Unit Cost

Enter the unit cost indicated on Form DS-132.

[21] Total Cost

The total line-item cost.

[22] Property Records

Leave blank; property records will be adjusted using Form DS-132 after all of the property listed on the form has been disposed of.

[23] Receipt

The receiving post's receiving clerk signs and dates.

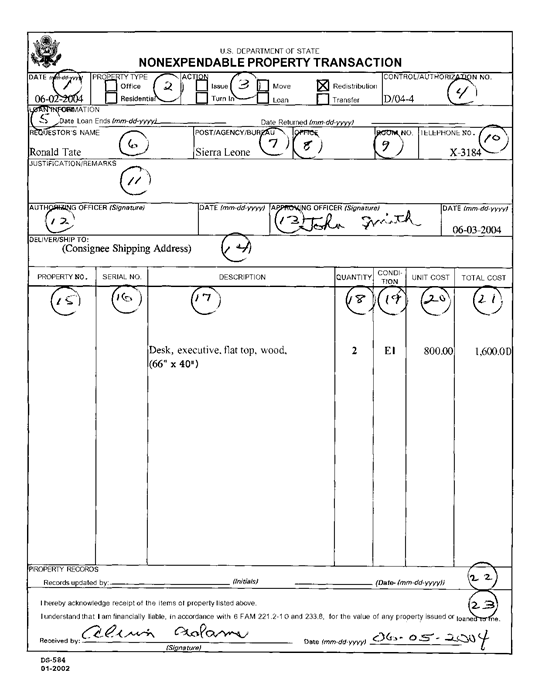

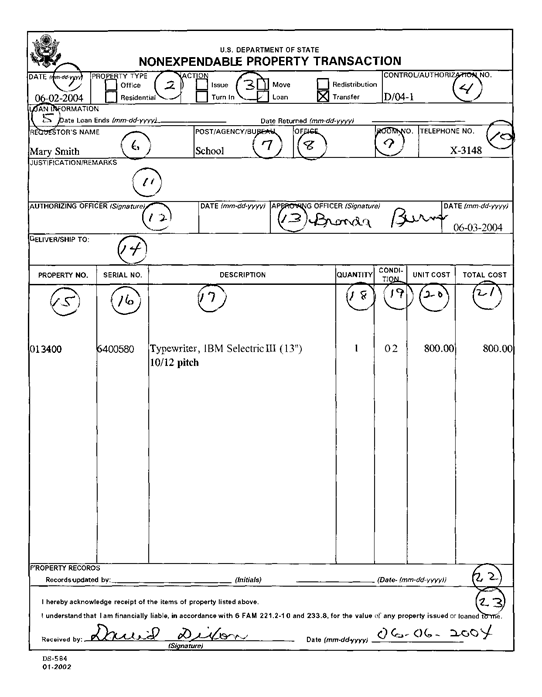

14 FAH-1 Exhibit H-715.1-2

Form DS-584

Nonexpendable Property Transaction (Agency-to-Agency Transfer)

(CT:PPM-38; 01-29-2021)

Data Field Preparation Instructions for Form DS-584

A separate transfer document should be prepared for any property being transferred to another agency. Form DS-584, Nonexpendable Property Transaction, should be used for this purpose. This exhibit is an example of a Form DS-584 prepared by State. The data field instructions in the exhibit will aid in the preparation of Form DS-584. The data field numbers in the instructions below correspond to the circled numbers in each field on the form. When serial-numbered items are involved, a line entry for each item should be made. Serial numbers, when applicable, should be part of the description.

Data Field

[1] Date

Date the Form DS-584 is prepared.

[3] Action

Enter an "X" in the Transfer field to indicate that this is a property transfer action.

[4] Control/Authorization No.

Enter the number of the Form DS-132, Property Disposal Authorization and Survey Report, on which the property was declared excess.

[6] Requestor's Name

The name of the receiving agency contact.

[7] Post/Agency

The name of the receiving agency.

[10] Telephone Number

The telephone number of the receiving agency contact.

[13] Approving Officer Signature

The property disposal officer signs as approving officer.

[14] Deliver/Ship To

The delivery address of the agency to which the property is being transferred.

[15] Property Number

Enter the property number.

[16] Serial Number

Enter any serial number.

[17] Description

Use the same descriptions that appear on Form DS-132, including any model numbers.

[18] Quantity

The line-item quantity being transferred should be entered.

[19] Condition

Indicate the condition of the property.

[20] Unit Cost

Enter the unit cost indicated on Form DS-132.

[21] Total Cost

The total line-item cost.

[22] Property Records

Leave blank; property records will be adjusted using Form DS-132, Property Disposal Authorization and Survey Report, after all of the property on the form has been disposed of.

[23] Receipt

The receiving agency's receiving clerk signs and dates.

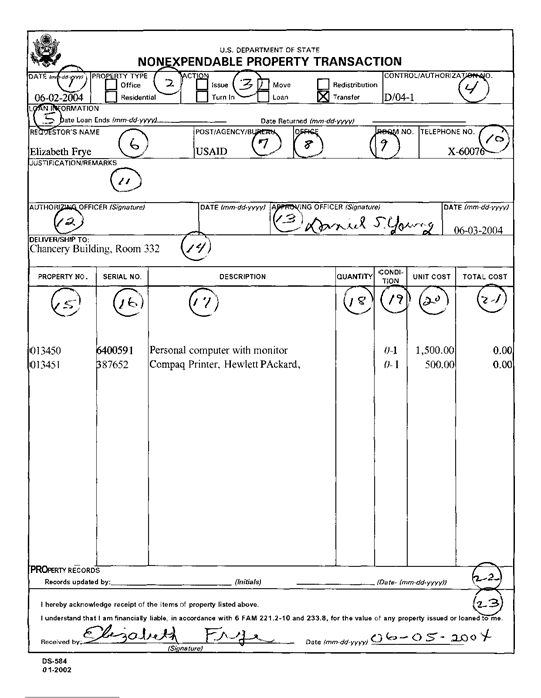

14 FAH-1 Exhibit H-715.2-3

Form DS-584

State Only: Nonexpendable Property Transaction (Transfer to an Entity Such as

a Commissary Abroad)

(CT:PPM-38; 01-29-2021)

Data Field Preparation Instructions for Form DS-584

The data field preparation instructions below will assist in the preparation of Form DS-584. The data field numbers in the instructions correspond to the circled numbers in each field on the form.

Data Field

[1] Date

Date the Form DS-584 is prepared.

[3] Action

Enter an "X" in the Transfer field to indicate that this is a property transfer action.

[4] Control/Authorization No.

Enter the number of the Form DS-132, Property Disposal Authorization and Survey Report, on which the property was declared excess.

[6] Requestor's Name

The name of the contact at the receiving activity.

[7] Post/Agency

The name of the receiving activity.

[10] Telephone Number

The telephone number of the contact at the receiving activity.

[13] Approving Officer Signature

Generally, the property management officer will be the only approving officer. In some cases, approval from the appropriate regional bureau or the Bureau of International Organization Affairs (IO) is required (see 14 FAM 417.2-4(A), paragraph d).

[14] Deliver/Ship To

The delivery address of the activity to which the property is being transferred.

[15] Property Number

Enter the property number.

[16] Serial Number

Enter any serial number.

[17] Description

Use the same description that appears on Form DS-132 including any model numbers.

[18] Quantity

Enter the line-item quantity being transferred.

[19] Condition

Indicate the condition of the property.

[20] Unit Cost

Enter the unit cost indicated on Form DS-132.

[21] Total Cost

The total line-item cost.

[22] Property Records

Leave blank; property records will be adjusted using Form DS-132 after all of the property on the form has been disposed of.

[23] Receipt

The receiving activity's property officer signs and dates.

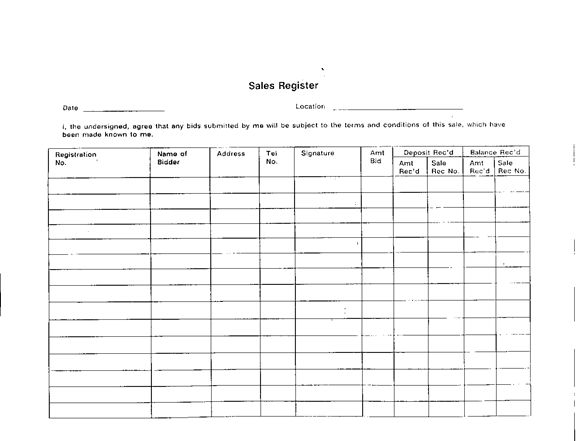

14 FAH-1 Exhibit H-716.4-2A

Sales Register Format

(CT:PPM-1; 08-11-2004)

14 FAH-1 Exhibit H-716.4-2B

Bid Card Format

(CT:PPM-1; 08-11-2004)

BID CARD

Item No. ______________________ Amount Bid ________________

Bidder’s Registration No. ______________________

Subject to the general sales terms and conditions that have been made known to me, I, the undersigned, offer and agree to purchase the item designated above at the price indicated above.

Name of Bidder __________________________________________

(Print Name)

Address ________________________________________________

________________________________________________

Signature _______________________________________________

Telephone No. _________

14 FAH-1 Exhibit H-716.5A

Suggested Project Contribution Format

(CT:PPM-1; 08-11-2004)

(USAID Only)

In addition to the USAID dollar-financed commodities shown in the project agreement [title and number]___________________________

dated ____________________________, between the Government of [country]__________________________________________________ and the Agency represented by the Director of USAID to [country]______________________________________________, the title to the property listed below is hereby transferred to the Ministry (Agency) of _______________________________________ for the express purpose of advancing objectives set forth in the Project Agreement.

Unit

Total

Item Number Description Quantity Cost Unit Cost

Accepted by:

(signed) Director

Ministry of ___________

(date)

USAID Property Management Officer

USAID Accountable Property Officer

USAID Program Officer

USAID Controller

14 FAH-1 Exhibit H-716.5B

Suggested Grant-in-Aid Format

(CT:PPM-1; 08-11-2004)

(USAID Only)

Grant In Aid

For purposes of implementing the cooperative program and to improve the capability or capacity of [office-field words]___________________.

In the [Ministry of]_________________________________________. The Agency for International Development, represented by the Director of USAID to _____________________________, hereby makes a grant in aid and transfers title for the property listed below to the Ministry of ________________________________________________________.

Unit

Total

Item Number Description Quantity Cost Unit Cost

Accepted by:

(signed) Director

Ministry of ___________

(date)

USAID Property Management Officer

USAID Accountable Property Officer

USAID Program Officer

USAID Controller