14 FAM 600

employee logistics - household effects

TRANSPORTING EFFECTS

(CT:LOG-418; 06-05-2025)

(Office of Origin: A/GO)

14 FAM 611 POLICY AND AUTHORITY

14 FAM 611.1 Applicability

(CT:LOG-257; 03-29-2019)

(State/USAGM/USAID/Commerce/Agriculture)

(Foreign Service)

These policies and procedures apply to Foreign Service employees of the participating agencies.

14 FAM 611.2 Authorities

(CT:LOG-418; 06-05-2025)

(State/USAGM/USAID/Commerce/Agriculture)

(Foreign Service)

Authorities include:

(1) Section 901 of the Foreign Service Act of 1980, as amended (22 U.S. Code 4081), authorizes the Secretary to pay the official transportation and related expenses of members of the Service and their families, including certain costs or expenses incurred for:

(a) Transporting the furniture and household and personal effects of a member of the Service (and their family) to successive posts of duty;

(b) Packing and unpacking, transporting to and from a place of storage, and storing the furniture and household effects (HHE) of a member of the Service (and of their family); and

(c) Transporting for or on behalf of a member of the Service a privately owned motor vehicle (POV);

(2) 22 U.S.C. 3927 - Duties and responsibilities of the chief of mission to a foreign country;

(3) Use of U.S.-flag vessels for transporting household goods and/or personal effects of U.S. Government employees:

(a) 46 U.S.C. 55302 and 46 U.S.C. 55303 - Section 901(a) of the Merchant Marine Act of 1936, as amended - Transportation in American Vessels of Government Personnel and Certain Cargoes; and

(b) 41 Code of Federal Regulations (CFR) 102-118.95 – What forms can my agency use to pay transportation bills?

(4) 49 U.S.C. 40118 - The Fly America Act;

(5) 19 CFR Part 142 – Customs Duty/Entry Process;

(6) 31 U.S.C. 3721 and implementing regulations 20 CFR 429.201 et seq. - Military Personnel and Civilian Employees Claims Act of 1964, as amended;

(7) 18 U.S.C. 921 - Gun Control Act of 1968, Chapter II sections B (Ownership Prohibitions) and C (Limitation of Imports);

(8) 27 CFR Part 478 - Commerce in Firearms and Ammunition;

(9) 41 CFR 302 – Federal Travel Regulation – Relocation Allowances;

(10) 7 CFR Part 319 – Foreign Quarantine Notices;

(11) Federal Acquisition Regulation (FAR) 48 CFR;

(12) The Bioterrorism Act of 2002, Public Law 107-188; and

(13)49 U.S.C. 10721 and 13712 - Negotiate a rate tender under a federal transportation procurement statute.

14 FAM 611.3 Definitions

(CT:LOG-418; 06-05-2025)

(State/USAGM/USAID/Commerce/Agriculture)

(Foreign Service)

Actual expense method: The shipping method where the agency is responsible for arranging and paying for all aspects (e.g., packing/unpacking, pickup/delivery, weighing, line-haul, drayage, temporary storage, etc.) of transporting personal effects with commercial service providers.

Construction materials: Items of a nature and in volumes typically used to construct or renovate a portion of a dwelling, or to construct a product larger than an ordinary item of furniture for personal use. Examples of construction materials include wooden planks, boards, ceiling tiles, floor tiles or flooring, roofing materials, windows, doors, or framing thereof, masonry, bricks, blocks, cement, sand, paneling, drywall boards, or hardware (e.g., nails) in volumes greater than would normally be used in an ordinary household workshop. Those materials that are part of artwork or crafts in total weight of less than 200 pounds may be regarded as HHE as determined by inspection as required. The U.S. Government does not ship or store employee-owned construction material (14 FAM 611.6).

Cost-Construct Shipping: The transport of personal effects or privately owned vehicle to and from points not listed on the employee's travel authorization, from non-authorized points of storage onward to post, and from post to a non-authorized point of storage.

Consumables (CNS): Limited to foodstuffs for human consumption (with the exception of pet food or cat litter) or items used for personal or household maintenance such as toiletries and nonhazardous cleaning supplies. Consumables shipments do not include household (HHE) or items used for the care and maintenance of a vehicle. HHE shipments may include consumable items.

Continuous storage: See definition of non-temporary storage.

Duty station: See definition of duty station in 14 FAM 511.3.

Eligible family members (EFM): See definition of eligible family member in 14 FAM 511.3.

European Logistical Support Office (ELSO): Located at the port of Antwerp, Belgium (see 14 FAM 614.7).

Foreign-flag vessel: See definition of foreign-flag vessel in 14 FAM 511.3.

Gross weight: The net weight of a shipment plus the weight of any outside shipping containers, and any blocking and bracing required by the packer to secure items in the containers.

Household effects (HHE): Property, unless specifically excluded, associated with the home and all personal effects belonging to an employee and immediate family members that legally may be accepted and transported by a commercial carrier (see 14 FAM 611.6 for a representative list of included and excluded HHE).

Inherited personal effects: Personal effects that come into an employee’s possession upon the death of an immediate family member of the employee or the employee’s spouse or when the immediate family member is placed into an assisted living facility.

Layette: A separate and distinct airfreight weight allowance authorized for a newborn infant or adopted child less than five years of age who is an eligible family member of an employee assigned to an overseas post where suitable layettes are unavailable locally. A layette shipment consists of items related to the direct care and feeding of the infant or adopted child and may include clothing, blankets, equipment, and furnishings. Equipment and furnishings may include baby crib, baby chair, and car seat. A rocking chair and glider can be shipped if they fit within the dimensions of a standard tri-wall carton. Besides milk, formula, and commercial baby food, foodstuffs are not allowed (14 FAM 613.4).

Local move: The transport of an employee's personal effects within a 50-mile radius from the origin of the shipment. The 50-mile radius is always calculated in a straight line. The U.S. Government (USG) does not fund the transport of personal effects in connection with a local move unless the local move is originating from USG-funded permanent housing (14 FAM 612.3-2, 14 FAM 611.7 and 14 FAM 618.4) and the move is in the best interest of the USG.

Merchant Marine Act of 1936: A legal requirement under 46 U.S.C. 55302 and 55303 which establishes that all U.S. Government-financed transportation of vessel cargo be performed on U.S.-flag vessels unless such service by foreign carriers is a matter of necessity for the mission (14 FAM 611.4 and 14 FAM 616.1).

Net weight: The weight of the actual effects plus inside packing material to include cartons, barrels, fiber drums, crates, boxes, and wrapping and cushioning material used to pack small or fragile articles for shipment or storage. Such articles include clothing, linens, books, pictures, mirrors, lampshades and bases, bric-a-brac, glassware, chinaware, and other small articles that normally require wrapping and cushioning before removal from the residence.

Non-temporary storage: The storage of HHE while an employee is assigned to a duty station where the employee is not authorized a portion or all of the regulatory HHE weight entitlement due to post specific weight or other post-specific restrictions, or when authorized in the public interest. Continuous storage and permanent storage terms are interchangeable with non-temporary storage.

Official station: See definition of official station in 14 FAM 511.3.

Permanent housing: Either the employees’ residence or a residence funded under post housing allowance for employee occupation during a tour of duty while permanently assigned to post. Temporary housing covered by the HSTA or TQSE or occupied during make-ready periods for post housing is not considered permanent housing.

Permanent storage: See definition of non-temporary storage.

Post of duty: See definition of post of duty in 14 FAM 511.3.

Privately owned vehicle (POV): Motor vehicle (to include Motorcycles) owned by the employee or an eligible family member (14 FAM 611.5 and 14 FAM 615).

Soil: Loose material of the earth's surface in which plants, trees, and shrubs grow. Soil consists of disintegrated rock, organic matter, minerals, and soluble salts. Customs and Border Protection (CBP) prohibits entry of soil unless accompanied by an import permit.

Tare weight: The gross weight minus the net weight. The weight of any outside shipping container and any blocking and bracing required by the packer to secure items in the container.

Unaccompanied air baggage (UAB): Personal belongings needed immediately by the traveler upon arrival at his or her destination (see 14 FAM 613.3-2 for items that qualify as UAB).

U.S.-Flag vessel: Vessel registered under the laws of the United States of America.

14 FAM 611.4 Use of U.S.-Flag Vessels

(CT:LOG-363; 10-05-2022)

(State/USAGM/USAID/Commerce/Agriculture)

(Foreign Service)

a. In accordance with Section 901(a) of the Merchant Marine Act of 1936, as amended (46 U.S.C. 55302 and 55303), any officer or employee of the United States Government traveling on official business abroad or to or from any of the territories or possessions of the United States must travel and transport his or her personal effects and POV on vessels registered under the laws of the United States where such vessels are available unless the necessity of the employee’s mission requires the use of a vessel under a foreign flag. Agencies may not pay for or reimburse transportation expenses incurred on a foreign vessel without demonstrating a need to use a foreign vessel.

b. USAID only: Executive Order 11223 exempts USAID from the requirements of Section 901(a) of the Merchant Marine Act of 1936, as amended (46 U.S.C. 55302 and 55303). USAID's policy is to transport employee personal effects and POVs on U.S.-flag vessels where such vessels are available and their use is feasible (14 FAM 616.3).

14 FAM 611.5 Privately Owned Vehicles (POVs)

(CT:LOG-418; 06-05-2025)

(State/USAGM/USAID/Commerce/Agriculture)

(Foreign Service)

a. A travel authorization which includes authority for the transportation of effects constitutes authority for the transportation (i.e., water, rail, air, or driven) of one motor vehicle owned by the employee or an eligible family member when such transportation has been determined to be necessary or expedient, unless prohibited by regulation or administrative action. Not more than one motor vehicle may be transported to a post of assignment, except as provided by 14 FAM 615.3, 14 FAM 615.4, and 14 FAM 615.5.

b. With limited exceptions, employees are expected to drive their POVs to countries sharing a land border with the United States. If an employee is unable to drive due to one of the exceptions below, the POV may be shipped by the most expeditious and cost-effective mode of transport. Exceptions:

(1) Neither the authorized nor the actual points of origin and destination are connected by a hard-surface, all-weather highway and/or vehicular ferry. Employees posted to the following Mexican posts, however, may be authorized POV shipment at U.S. Government expense (interior posts only):

(a) Guadalajara;

(b) Hermosillo;

(c) Merida;

(d) Mexico City; and

(e) Monterrey;

(2) An employee is absent from post under orders (including combined home leave and transfer orders) and is therefore unable to drive the vehicle from the old post to the new post; and

(3) In cases other than those specified above in this section, an authorizing officer may determine that transportation of a POV is necessary or expedient. Such cases frequently occur when danger or undue hardship would be involved if the employee or an eligible family member drove the vehicle between the authorized points of origin and destination. A copy of this determination must be furnished by the traveler for submission with the travel voucher.

c. Degradation of mechanical condition while in storage or shipping is the employee's responsibility (i.e., dead battery, oil leaks, etc.).

14 FAM 611.6 Household Effects (HHE)

(CT:LOG-418; 06-05-2025)

(State/USAGM/USAID/Commerce/Agriculture)

(Foreign Service)

a. HHE as defined above may also include:

(1) Professional books, papers, and equipment (see 14 FAM 514.4, subparagraph a (8), regarding request for approval of shipment of professional materials and the NOTE regarding professional materials for medical specialists);

(2) Replacement parts or maintenance items for a POV such as tires, motor oil, windshield wipers, windshield wiper fluid, spark plugs, belts, filters, and any other similar items. Non-spillable (UN 2800) automotive batteries may be shipped if allowed by host-country import rules and they are properly marked and documented;

(3) Integral or attached POV parts that must be removed in preparation for shipping due to high vulnerability to pilferage or damage, such as hubcaps or wheel covers, pickup truck tailgate, side mirrors, cigarette lighters, antennas, sound systems, GPS units, and other removable electronic items;

(4) Consumable items (may be included in an HHE shipment utilizing a portion of the HHE shipping weight entitlement or shipped under the separate consumables allowance, if the employee is assigned to a consumables post-see the A/OPR/ALS website for the list of consumables posts);

(5) Snowmobiles, ATVs, motorcycles, mopeds, and trailers manufactured for the specific purpose of transporting these types of equipment, provided they do not exceed the interior dimensions of a 20’ sea container (L232” x W92”x H94”);

(6) Inherited personal effects that come into an employee’s possession upon the death of an immediate family member of the employee or the employee’s spouse, or when the immediate family member is placed into an assisted living facility. Request for shipment and storage of inherited personal effects must be made to the Executive Director, GTM/EX, in conjunction with a current set of PCS orders (see 14 FAM 611.3 for a definition of inherited personal effects). Employees may submit a TMTWO immediately after issuance of a TMONE, if needed. Shipment of inherited effects are authorized only from within the United States or U.S. territory. Inherited personal effects are not authorized for shipment to the employee’s post or any other location outside of the United States. If approved, the GTM technician will authorize placement of the inherited personal effects into a U.S. Government storage facility. Domestically assigned employees are not eligible for shipment of inherited effects; and

(7) Taxidermy or stuffed animals: The employee is responsible for reviewing and understanding all requirements before initiating a request to transport taxidermy or stuffed animal trophies (50 CFR Part 13). Prior to shipping, the employee must confirm that the transit points, the storage location, and the destination location will accept animal trophies. The employee is responsible for all certificates for clearance and customs and duty fees incurred even if the animal trophies are rejected at any transit, storage, or destination point after shipment commences.

b. HHE does not include:

(1) Personal luggage in connection with travel by common carrier transportation (14 FAM 568);

(2) Automobiles or major automotive parts (e.g., engines, engine blocks, transmissions, doors, etc.), trucks, vans, tuk tuks and similar motor vehicles, mobile homes, camper trailers, utility trailers, golf carts, boats and personal watercraft (including canoes, kayaks, rowboats, jet skis, or any small open watercraft), aircraft, and farming vehicles;

(3) Live animals and live plants;

(4) Soil (see 14 FAM 611.3 for definition of soil);

(5) Cordwood, untreated or unworked raw lumber and building or construction materials including plywood or wood pallets (see 14 FAM 611.3 for definition of construction materials);

(6) Items for resale, disposal, or commercial use rather than for use by employee and immediate family members, or any items in commercial quantities;

(7) Privately owned live ammunition (see 14 FAM 611.7-2 regarding shipment of a personally owned firearm and ammunition); or

(8) Propane gas tanks.

c. Federal, state, and local laws or carrier regulations may prohibit commercial shipment of certain articles not included in subparagraph (2) of this section. These articles may include:

(1) Property that may damage equipment or other property (e.g., hazardous articles including explosives, flammable and corrosive material, poisons);

(2) Articles that cannot be taken from the premises without damage to the article or premises; and

(3) Perishable articles (including frozen foods) requiring refrigeration, or perishable plants.

14 FAM 611.7 Limitations

(CT:LOG-418; 06-05-2025)

(State/USAGM/USAID/Commerce/Agriculture)

(Foreign Service)

a. The director, Office of Transportation Management (A/GO/OPS/TM), and/or GTM/EX as the Department’s authority for appeal, are authorized to deny the use of U.S. Government services and facilities in circumstances involving unusual boxing, crating, shipping, storage, and handling costs associated with personal effects and requested by the employee; or in cases when an item cannot be shipped in any normal way, such as when it does not fit in standard approved shipping containers.

b. This provision includes, but is not limited to, requests to ship items of unusual size, or with special characteristics or qualities, or which are perishable, fragile, or contain hazardous material as established by international agreement; requests for more than two supplemental shipments; taxidermy or stuffed animal trophies prohibited by destination; any access and removal of effects from permanent storage or any HHE surface shipment weighing less than 200 net pounds; or multiple requests for pick-ups of personal effects from locations other than the primary residence.

c. Special crating should be used only when it is deemed absolutely necessary by the packing company as the only way to safely transport an item. This requirement must be documented (14 FAM Exhibit 611.9); and approved by the U.S. Government bill-of-lading- (GBL) issuing officer. Any and all requests for special crating that are not approved for payment by the U.S. Government must be paid by the employee, or the crating request will be cancelled. Any request for special crating that exceeds a total of $500.00 must be approved by GTM/EX or the designated representative (see 14 FAM Exhibit 611.6 for a list of items that may be crated).

d. The Transportation Service Provider (TSP) will disassemble employee personal property items at point of origin to ensure safe transport and delivery except for exercise equipment, baby cribs and similar articles, and outdoor items such as swing sets, trampolines, and other playground equipment which is the employee’s responsibility to disassemble. Items that are disassembled at origin are the responsibility of a TSP to be reassembled at the destination. The employee, not the TSP, is responsible for draining waterbeds and for detaching and reattaching appliances to water and gas lines. Disassembly by either the TSP or employee will be noted on the inventory

e. The U.S. Government does not pay to transport personal effects in connection with a local move unless the local move is originating from U.S. Government-funded permanent housing (see 14 FAM 611.3 for definition of local move and permanent housing).

f. Lithium-ion and lithium-metal batteries meeting the following size, quantity, and energy levels are allowed in an employee's HHE, UAB, and LAY shipment between duty stations when the batteries are installed in the equipment needed to power the device. Air and ocean carriers could further restrict this policy:

(1) Lithium-ion batteries rated at 100 watt-hours (Wh) or less (20 Wh or less for single cell). Each personal effects shipment, regardless of type (HHE, UAB, or LAY) or transport mode (air or surface), is limited to two pieces of equipment per shipment with an installed lithium-ion battery that meets the above size/rating limitation;

(2) Lithium metal batteries containing two (2) grams or less of lithium content (one (1) gram or less for single cell). There is no "per shipment" limit on the number of lithium metal batteries installed in equipment that can be shipped in personal effects shipments providing they meet the above size/content limitation; and

(3) Lithium batteries of all types, sizes, and energy levels are prohibited in personal effects shipments destined to long-term/permanent storage.

g. Locked or combination safes, boxes, containers, etc., cannot be accepted into permanent storage unless the employee provides the lock combination or key to the transportation service provider at the time of packing. For firearms, see 14 FAM 611.7-2(d).

h. The director, Office of Transportation Management (A/GO/OPS/TM) for State; Human Resources Manager, USFCS/OIO/OFHR for Commerce; or Chief, FA/AS/TT for USAID, will determine the extent to which these services can be denied. In such cases, employees retain the right to normal legal and administrative appeals.

14 FAM 611.7-1 Weight Allowance for Shipment and Storage

(CT:LOG-363; 10-05-2022)

(State/USAGM/USAID/Commerce/Agriculture)

(Foreign Service)

a. The combined shipment and storage of effects allowance has been established at the statutory limit of 8,165 kilograms or 18,000 pounds, net weight, for each employee, regardless of family status.

b. A limited shipment allowance is set at 3,265 kilograms or 7,200 pounds, net weight, for each employee, regardless of family status, and will be authorized in lieu of full shipment when post provides adequate furnishings. (For further information, see 14 FAM 613.1.)

c. A special shipment allowance of less than 7,200 pounds, net weight, applies for certain posts with limited facilities, one-year tours, unaccompanied status, or other special circumstances. See the periodic memorandum entitled "Posts with Special Shipment Allowances for Post Assignment Travel" maintained by the Department of State’s GTM Assignments Division.

d. Should the actual weight in continuous storage and the estimated weight of all shipments exceed the 18,000-pound statutory limit (14 FAM 611.7-1), the weight already in continuous storage prior to the new travel authorization is the first weight credited the 18,000 pounds.

e. Employees are encouraged to review their Travel Message Three (TMTHREE) for any specific recommendations or cautions on what furniture to ship to their onward post. Employees assigned to a furnished post are provided basic furniture items by the government under the Furniture and Appliance Pool (FAP) program. Given limited warehouse space, post policies may prohibit assigned FAP furniture removal and storage at U.S. Government expense. Employees should review the post housing policy and communicate with the general services and community liaison offices regarding shipping personal furniture to post (see 6 FAH-5 H-512.3-1 for further information).

f. Storage is covered under 14 FAM 620.

14 FAM 611.7-2 Personally Owned Firearms and Ammunition

(CT:LOG-363; 10-05-2022)

(State/USAGM/USAID/Commerce/Agriculture)

(Foreign Service and Civil Service)

a. It is the responsibility of each employee to consult the post report and/or with the post management officer to learn the restrictions and limitations, if any, that are placed on the shipment of personally owned firearms or ammunition into the country of assignment. The post report will include the required procedures under host-country regulations when firearms and ammunition may be imported (2 FAM 170). When post reports are not available, the employee, before initiating shipment of firearms or ammunition, must secure written authorization and approval from the chief of mission or designated representative.

b. The Department of State will not ship ammunition as part of an employee’s effects. Ammunition, a hazardous cargo, requires special handling and labeling. The employee should directly ship ammunition separately and consign it to an import handler.

c. When an employee transfers directly without a Washington, DC assignment from one post to another where fewer, or no, firearms are authorized, the employee must send the excess, or all, firearms back to the United States in accordance with regulations governing the importation of firearms and ammunition. See 14 FAM 618.5 for more information on shipping firearms and ammunition.

d. Employees are responsible for ensuring their firearms are clear of ammunition and installing a trigger or cable lock prior to handing them over to the contracted service provider for shipping or storing. Should an employee elect to store a firearm in a case, the case must remain unlocked. Firearms are not allowed in safes or lockboxes while in controlled storage.

14 FAM 612 AUTHORIZED EXPENSES

(CT:LOG-363; 10-05-2022)

(State/USAGM/USAID/Commerce/Agriculture)

(Foreign Service)

Authorized expenses in connection with shipment of effects include the following (14 FAM 618):

(1) Packing, crating, unpacking, and necessary incidental cartage, including construction or purchase of necessary wooden containers;

(2) Hire of lift vans (but not transportation of, or import or export duties on, empty lift vans);

(3) Transportation of empty lift vans or shipping containers to or from the facilities of the owner or owner's agent, when such lift vans or containers are furnished without charge by vessel lines, railroads, airlines, military installations, etc., for the movement of effects;

(4) Freight by any type of carrier, including air if specifically authorized or more economical or advantageous to the U.S. Government;

(5) Transshipment and handling charges, tonnage fees, cartage and storage en route, unavoidable demurrage charges (compensation paid for detention of freight or other cargo during loading and unloading beyond the scheduled time of departure), and all similar expenses incidental to direct shipment, but not import or export duties;

(6) Services of customs brokers when the foreign establishment or U.S. despatch agency cannot make the customs entry;

(7) Cartage at destination from the shipping terminal to the residence or place of unpacking and thence to the residence; or, when the effects are stored at U.S. Government expense, from the shipping terminal to the place of storage and thence to the residence;

(8) General average contributions in connection with losses at sea (5 U.S.C. 5732); and

(9) Other miscellaneous expenses when necessarily incurred in connection with the shipment of effects.

14 FAM 612.1 Unpacking and Hauling Services

(CT:LOG-393; 03-26-2024)

(State/USAGM/USAID/Commerce/Agriculture)

(Foreign Service)

Receiving posts pay for local costs incurred for receiving, handling, and unpacking pack-and-crate shipments. Through bill-of-lading shipments specify that all arrangements and payments with respect to customs documentation, packing, unpacking, local drayage (transport), and other related services will be handled by the carrier. Therefore, posts should merely inspect such shipments closely to determine that the carrier provided the services agreed upon. Posts should exercise particular care to make certain that when receiving through bill-of-lading shipments they make no payments for services rendered in connection with these shipments. (For packing and unpacking excused absence see 3 FAH-1 H-346.)

14 FAM 612.2 Shipment Terminating Abroad

14 FAM 612.2-1 Shipment Arrangement and Payment

(CT:LOG-363; 10-05-2022)

(State/USAGM/USAID/Commerce/Agriculture)

(Foreign Service)

Normally the post will arrange the unpacking and hauling of effects for delivery to the employee's residence and will arrange for the payment of costs by the fiscal office for the post. Contact a despatch agent for more information about arranging deliveries with post-issued GBLs and tenders paid by a Financial Management Center.

14 FAM 612.2-2 Reweighing Inbound Shipments

(CT:LOG-363; 10-05-2022)

(State/USAGM/USAID/Commerce/Agriculture)

(Foreign Service)

a. If the post has reason to believe that the stated weight of an inbound shipment of HHE or UAB is too high, a contractor should reweigh the shipment upon its arrival at the post. In such cases, reweighing provides an excellent opportunity to protect the Department or agency from paying overcharges for packing and transportation services based on net and gross weights that prove to be incorrect. When the shipment exceeds the employee's allowance, correct reweighing procedures are especially beneficial to the employee, who would otherwise be required to pay excess charges.

b. At the time of receipt, each lift van must be weighed separately on a certified scale to establish its gross weight. Following delivery and unpacking of the HHE, the lift van and any blocking and bracing material must be reweighed on the same scale to obtain the tare (empty) weight of the lift van. The gross weight less the tare weight will establish the actual net weight of the HHE as defined in 14 FAM 611.3. Cartons and wrapping or padding material must not be included as part of the tare weight of the lift van. As stated in 14 FAM 611.3, the weight of these items is part of the net weight of the HHE shipment. A weight ticket must be stamped by the weighing machine or completed by the contractor showing the gross, tare, and net weights.

c. When inbound HHE or UAB shipments are reweighed and the ticketed vice actual gross or net weight is found to be significantly higher, the shipping post must be notified of all details (including the reweighing tickets) in order to undertake corrective measures with the contractor or carrier. If the shipment originated in the United States, the receiving post must notify the particular department or agency transportation office.

d. When a UAB shipment exceeds the employee's allowance arrives at post, the contractor should reweigh it at the air carrier's terminal at time of pick-up. The air carrier's scale will probably be the most accurate and accessible for reweighing the baggage shipment. If the weight of the UAB shipment differs from the weight shown on the air waybill, the delivering airline should note the correct weight before the receiving post takes possession of the baggage. The receiving post can then notify the origin transportation office regarding the discrepancy for follow-up.

14 FAM 612.3 Employee Responsibilities for Excess Transportation Costs

(CT:LOG-363; 10-05-2022)

(State/USAGM/USAID/Commerce/Agriculture)

(Foreign Service)

a. Employees relocating under official travel authorizations are responsible for any transportation, demurrage, storage, customs cartage, or other costs incurred by them, their eligible family members, or agents which are not authorized by laws and regulations governing the shipment and/or storage at U.S. Government expense of personal effects (HHE, UAB, POV, and CNS).

b. When transferring between posts (post-to-post; post to U.S.; U.S. to U.S.), employees are responsible for:

(1) Ensuring that personal effects do not exceed the shipping and/or storage entitlements prescribed in the FAM and stated within their applicable official travel authorization; and

(2) Accepting their personal and sole responsibility to pay the excess costs from personal funds of any excess charges incurred for overweight or cost-construct shipments (14 FAM 612.3-2).

14 FAM 612.3-1 Estimating Weights

(CT:LOG-418; 06-05-2025)

(State/USAGM/USAID/Commerce/Agriculture)

(Foreign Service)

a. Employees must know their personal effects shipping weight entitlements and limitations. As a guide for estimating weight in future shipments, they should maintain personal records of each shipment's previous weight, including the weight(s) of any shipments in storage. Historical shipment weights and the weight(s) of any shipments currently in permanent storage may be obtained from the general services office at post, by accessing Transportation Lite/Plan My Move, or from the Washington transportation office.

b. 14 FAM Exhibit 612.3-1 is a guide to assist employees in estimating the net weight of their effects prior to packing. This exhibit lists the HHE that generally comprises most articles used to furnish a residence. An estimated net weight for fragile articles, which normally require preliminary packing before removal from the residence, includes packing and crating materials (14 FAM 611.3).

c. Employees should exercise care in utilizing the list in 14 FAM Exhibit 612.3-1 to estimate the net weight of their effects. The figures furnished represent average weights and serve as a guide. Regardless of the estimated net weight arrived at by the use of this list, the actual net weight of the effects shipped or stored will be charged against an employee's authorized weight allowance.

d. The average cubic feet per piece is furnished as an indication of the size of the article for which the weight is shown. As a general rule, 112 kilograms per cubic meter or seven pounds per cubic foot may be used to estimate the net weight of the articles not listed. The net weight of effects shipped or stored is determined by weighing the effects on scales at the point of origin or destination, if possible.

e. An additional tool available to estimate personal effects weights is the pre-move survey weight estimate performed by the transportation service provider (TSP) prior to shipment pack-out. While the primary purpose of the pre-move survey is for the TSP to determine the TSP's packing and servicing requirements, the TSP representative will also provide a pre-move survey estimated weight of each shipment to the employee. Employees must note, however, that this is an estimate only, and must not assume that the estimate will be the actual, or final, packed shipment weight. The employee should utilize a combination of the TSP survey weight estimate, historical shipment weights, and knowledge of what items have been added or removed to the household since the last pack-out. In any case when a combination of these tools indicates the possibility of meeting or exceeding the authorized shipping and storage weight entitlements, employees should take action prior to pack-out to reduce the weight of their personal effects or be prepared to pay for all excess costs due to excess shipment weight.

f. Official weights for HHE, CNS, and non-temporary storage shipments are recorded at the warehouse on a certified scale and are not weighed at pack-out or delivery residence. The TSP is not authorized to provide weighing services for these types of shipments at the pack-out residence or at the delivery address and has the right to deny such request.

g. The TSP must weigh UAB shipments using a portable scale at the pack-out location to determine an unofficial gross weight. The TSP must inform the employee that this weight is an estimate, and the shipment will be re-weighed on a certified scale at the TSP’s facility for the official weight. The official weight, obtained from the certified scale, will be used to calculate the employee’s weight allowance.

14 FAM 612.3-2 Overweight and Cost-Constructive Household Effects (HHE), Consumables (CNS), and Unaccompanied Air Baggage (UAB) Shipments

(CT:LOG-418; 06-05-2025)

(State/USAGM/USAID/Commerce/Agriculture)

(Foreign Service)

a. Cost-construct shipments:

(1) HHE may be shipped at U.S. Government expense to and from points listed on the employee's travel authorization, from authorized points of storage to onward post, and from post to authorized point of storage. CNS may be shipped at U.S. Government expense from the employee's losing post, authorized home leave location, the Washington, DC area, and/or from ELSO when transferring Post-to-Post. UAB may be shipped at U.S. Government expense following the official routing of the travel itinerary contained in the applicable travel authorization. Shipments from alternate origins or to alternate destinations are made on a cost-constructive basis based on the actual weight shipped, but not exceeding actual cost which would have been incurred had the shipment been made between the authorized points of origin and destination, with the employee paying any excess cost. An employee is not permitted to cost-construct a local move. The general services/transportation office should advise the employee of excess transportation charges due to cost-constructing before effects are shipped. The employee should pay any such excess transportation charges to the post cashier or, in the United States, the Comptroller and Global Financial Services (CGFS) through Pay.gov, Online Bill Payment, or Automated Clearing House, prior to shipment of effects. In any case, the employee remains responsible for payment of excess costs even if excess cost information is not provided until after shipment of effects;

(2) Shipments to/from/between alternate international destinations not on the travel authorization may be subject to customs and duty fees to be paid directly to the broker or clearing firm. The employee is responsible for verifying clearance requirements in advance, processing all necessary clearance documentation, and paying all associated fees for shipments to alternate destinations not on the travel authorization; and

(3) State and Commerce only: The cost of shipping HHE for storage to an authorized storage point (14 FAM 624) may not be used as the basis for a cost-construct shipment of the effects to an alternate destination. In certain circumstances, exceptions to this regulation may be granted in accordance with 14 FAM 514.

b. Overweight shipments:

(1) All HHE, CNS, and UAB shipments are accomplished based on authorized weight allowance for each employee. If a shipment is known to exceed the authorized shipping weight entitlement, the originating post or the Washington Transportation Office will make all possible effort not to forward the shipment until the employee is notified of the excess weight situation, is informed of the excess cost due and payable for the excess weight and is advised of the options available to correct the excess weight situation. Employees are encouraged to be proactive during the relocation process and validate their shipments' weights by contacting the general services office at post or the Washington Transportation Office as soon as possible after pack-out, and prior to their departure from their duty station. If a shipment is overweight, it may be forwarded once the employee has either:

(a) Paid the excess cost for the excess weight to the post cashier or, in the United States, the CGFS Cashier (via Pay.gov, Online Bill Payment, or Automated Clearing House), and provided a receipt for payment to the GSO office at post or Washington transportation counselor; or

(b) Elected to identify items by inventory number and description for removal from the shipment and disposal in order to reduce the weight to the authorized entitlement weight; or

(c) Elected to identify items by inventory number for removal from the shipment and placement into permanent storage, provided there is sufficient weight entitlement remaining, and provided the employee pays for shipment of the excess weight when the authorized storage location is not the same as the overweight shipment’s origin location. This does not apply if the employee is being transferred to Washington, DC where permanent storage is not authorized;

(2) HHE shipment excess transportation costs are computed on the basis of the ratio of the excess net weight to the total net weight allowed for the specific post. Appropriate excess cost to be paid by the employee will include excess packing/trucking charges at origin, excess delivery/unpacking charges at destination, and ocean/port charges as applicable. (See 14 FAM Exhibit 614.5 for a cost example.) Contact your general services office or Washington transportation counselor for specific costs;

(3) The net weight of any effects which become a total loss in transit due to military action, theft, fire, shipwreck, or other causes is not charged against the employee's weight allowance. Subsequent shipment may be made, equal to the weight of the lost or totally damaged effects, without excess transportation costs being charged to the employee;

(4) Excess weight cannot be placed into another employee's HHE or UAB shipment to avoid overweight charges; and

(5) HHE and UAB, either within or over the employee’s weight allowance, may not be sent through the diplomatic pouch (classified or unclassified), military postal service (APO/FPO), or diplomatic post office (DPO); see 14 FAM 742.4-1; and

(6) For domestic van line shipments, any shipments that exceed the 18,000 pounds net weight limitation must be paid by the employee with no exception. Due to the nature of this transportation service, once the shipment has departed the residence, there will be no opportunity to remove items as the shipment is en route directly to the next destination.

14 FAM 613 SHIPMENT AND STORAGE WEIGHT ALLOWANCE

14 FAM 613.1 Shipment and Storage Weight Allowance

(CT:LOG-393; 03-26-2024)

(State/USAGM/USAID/Commerce/Agriculture)

(Foreign Service)

a. Initial allowance:

(1) The combined shipment and storage of effects allowance is established at the statutory limit of 8,156 kilograms or 18,000 pounds, net weight, for each employee, regardless of family status;

(2) The limited shipment allowance is set at 3,265 kilograms or 7,200 pounds net weight, for each employee, regardless of family status, and will be authorized in lieu of full shipment (8,156 kilograms or 18,000 pounds) when post provides adequate furnishings. An employee assigned from one limited shipment post to another limited shipment post may ship up to 7,200 pounds in any combination that does not exceed the 7,200 net pounds from the old post to the new post, from the old post to the authorized storage location, or from the authorized storage location to the new post;

(3) A special shipment weight allowance of less than 7,200 pounds, net weight, applies for certain posts with limited facilities, limited tour length, unaccompanied status, or other special circumstances. NOTE: Permitted shipments of 750 pounds net weight of HHE via air associated with Special Incentive Posts may not be divided into supplemental shipments. Employees are authorized one shipment of HHE via air not to exceed the special allowance and it may be done on cost-construct basis. See the “Special Shipment Allowance Posts” sheet on the Bureau of Global Talent Management's Bidding Research Tools SharePoint site;

(4) The limited shipment allowance for a chief of mission (COM) is set at 5443 kilograms or 12,000 pounds, net weight. Only one shipment of up to 1,000 pounds of the 12,000-pound HHE allowance may be sent to post via air to accommodate representational items required immediately upon arrival at post and any unused weight cannot be moved as a supplemental shipment of HHE via air; the remaining 11,000 pounds of HHE will be shipped via the normal transportation method for the post. Upon departure from post, the entire 12,000-pound entitlement will be shipped via the normal shipping method. If the COM’s HHE shipping weight entitlement to the onward assignment is less than 12,000 net pounds, the HHE weight balance (not exceeding the regulatory 18,000-pound limitation) may be placed into permanent storage (14 FAM Exhibit 621); and

(5) These weight allowances are not reduced when an employee ships excess luggage, UAB, and/or a motor vehicle pursuant to 14 FAM 613.3 and 14 FAM 615. However, the weight of automotive replacement spare parts or supplies such as tires, motor oil, windshield wiper fluid, batteries, and any other accessories is chargeable against the total weight allowance (see 14 FAM 612.3-2, subparagraph b(3), regarding loss of effects).

b. Change in allowance:

(1) If an employee's HHE weight allowance is reduced through revision of shipping weight allowances while the employee is abroad, the employee's next authorization for shipment of effects will provide for shipment of the difference between the previously authorized and present weight allowance to the authorized storage point as designated in 14 FAM 622. When a U.S. assignment immediately follows an assignment to a limited shipment post, the weight of effects that were authorized to be shipped to that post may be returned to the United States;

(2) If the employee wishes to ship the former higher weight allowance to the next post, prompt application should be made to the appropriate agency's committee on exceptions. Such requests will be reviewed on an expeditious basis;

(3) The weight that may be shipped from the current post to the next foreign assignment is determined by the weight entitlement at the gaining post:

(a) If an employee is assigned from a limited post or special weight allowance post to an unlimited post, the weight entitlement at the gaining post, including amounts held in storage, is 18,000 pounds to the new post; or

(b) If an employee is assigned from an unlimited post to a limited post, the shipping weight entitlement post-to-post is 7,200 pounds; and remaining allowances from post to storage; the combined shipping and storage from the unlimited post cannot exceed 18,000 pounds; or

(c) If an employee is assigned from an unlimited post or a limited post to a special weight allowance post (e.g., special incentive post), the authorized shipping weight to the special post is the special post weight allowance. See the "Special Shipment Allowance Post" sheet on the Bureau of Global Talent Management's Bidding Research Tools SharePoint site. EXCEPTIONS: When the next assignment is to the United States either for retirement or a tour of duty, the weight entitlement is always determined by the weight entitlement at the current post, as of the date of the employee's transfer orders; and if an employee transfers from a special weight allowance post to a limited or unlimited post, the UAB and HHE weight entitlement from the special post is the special post weight allowance;

(4) An employee retiring or separating from the Foreign Service is authorized to ship from their current assignment and from storage locations where they possess property stored at U.S. Government expense. However, the employee may cost-construct any remaining weight not shipped from post up to the authorized weight amount from post, e.g., 7,200 pounds from a limited shipment post. The employee is not authorized to ship personal effects from other locations, even if the employee has unused weight allowances under the 18,000-pound statutory limit.

14 FAM 613.2 Change in Family Status

(CT:LOG-393; 03-26-2024)

(State/USAGM/USAID/Commerce/Agriculture)

(Foreign Service)

a. When a change in family status occurs from overseas, which would authorize the shipment of household effects (HHE), the effects may be shipped either from the place of acquisition or residence of the newly acquired family member to employee's current foreign duty station on a cost-constructive basis against the employee's shipment allowances, with the employee paying any excess cost.

b. When a family member relocates to post from the United States as an eligible family member (EFM), through a relocation in which a HHE shipment is authorized, the effects may be shipped either from the place of where the individual joined the family or residence in the United States of the new family member to employee's current foreign duty station at the government expense.

c. State and Commerce only: Officers assigned to domestic tours do not qualify for shipment of effects for an EFM welcomed during the domestic tours.

d. Employees assigned to a duty station in a foreign area who acquire a family member (see 14 FAM 611.3 for the definition of "eligible family member") after the issuance of assignment travel orders may be authorized travel expenses for the family member notwithstanding the time limitation specified in 14 FAM 584.2. UAB shipment of the new family member will be authorized from either the place where the individual joined the family or the individual's residence.

14 FAM 613.3 Unaccompanied Air Baggage (UAB)

14 FAM 613.3-1 Unaccompanied Air Baggage (UAB) Authorization and Weight Allowance

(CT:LOG-418; 06-05-2025)

(State/USAGM/USAID/Commerce/Agriculture)

(Foreign Service)

a. A UAB weight allowance for employees and their eligible family members authorized to travel is granted according to the following schedule unless otherwise prohibited by regulations:

|

Gross Weight |

Kilograms |

Pounds |

|

First person traveling |

113 |

250 |

|

Second person traveling |

91 |

200 |

|

Third person traveling |

68 |

150 |

|

Fourth or more persons traveling |

45 |

100 |

b. The UAB weight allowance is in addition to the HHE weight allowance shown in 14 FAM 613.1. UAB is shipped as airfreight by the most direct route between authorized points of origin and destination, regardless of the modes of travel of the employee and EFMs.

c. Because UAB is needed immediately upon arrival, the transport of UAB should be initiated promptly, preferably in advance of the traveler's departure. Shipment of UAB must be requested for the first available pack date within 30 days of the last traveler's arrival at the destination. If subsequent travelers depart after the first traveler, the 30-day time limitation for their allowance will be based on the subsequent traveler's arrival at the destination. Any unused airfreight weight from the initial traveler cannot be used by subsequent travelers unless the shipment is made within the initial 30 days after the first traveler's arrival at destination. UAB shipped from the losing post is limited to the traveler's unaccompanied baggage weight authorization. UAB shipped to the gaining post is limited to the traveler's UAB weight authorization.

NOTE: The transfer order normally authorizes the employee to ship the full UAB weight authorization to each itinerary location identified on the travel order, e.g., from the old duty station to home leave to consultation to the new duty station. However, UAB weight shipped directly from the old duty station to the new duty station is deducted from the overall weight allowance and cannot also be shipped to other itinerary locations on the travel order at government expense.

d. UAB is not authorized for TDY travel unless specifically authorized in the travel authorization or when such TDY travel is in conjunction with travel on direct transfer, home leave, or home leave and transfer, in which case UAB may be shipped between points specified in such authorization.

e. The UAB weight allowance is not applicable for a newborn child when an employee is granted a layette weight allowance in accordance with 14 FAM 613.4. In such cases, the normal increase in the unaccompanied baggage allowance will be effective when the next travel authorization is issued and authorizes travel of the family.

f. UAB is authorized for travel against the involuntary or voluntary separate maintenance allowance (SMA) travel authorization.

g. Tri-wall cartons containing airfreight shall not exceed 15 cubic feet (0.424 cubic meters), 200 pounds (90.90 kilograms) per carton, and dimensions of 37 inches by 23 inches by 30 inches (0.9398 meters by 0.5842 meters by 0.762 meters).

h. For shipment of UAB on a cost-constructive basis, see 14 FAM 612.3-2 and 14 FAM Exhibit 613.3.

i. For shipment/storage of UAB in conjunction with educational travel, see 4 FAM 467.1-2.

j. For excess luggage in lieu of UAB, see 14 FAM 568.1.

14 FAM 613.3-2 Recommended Unaccompanied Air Baggage (UAB)

(CT:LOG-418; 06-05-2025)

(State/USAGM/USAID/Commerce/Agriculture)

(Foreign Service)

a. For the UAB shipment, the employee should consider only those items that will be required immediately upon arrival, such as clothing, non-liquid toiletries, pots, pans, unbreakable dishes, sheets, blankets, and essential light housekeeping articles. UAB is not meant to include large household items such as furniture, room-sized rugs, TV sets, major appliances, or any item that exceeds the standard measurements and weights of 15 cubic feet (0.424 cubic meters), 200 pounds (90.90 kilograms), and dimensions of 37 inches by 23 inches by 30 inches (0.9398 meters by 0.5842 meters by 0.762 meters). Fragile items should not be sent by airfreight. Liquids, including alcoholic beverages, are prohibited in UAB shipments. Exceptions (e.g., baby cribs and baby chairs) that exceed these dimensions may be approved by the Director, Office of Transportation Management (A/GO/OPS/TM) when a layette allowance is not authorized.

b. UAB shipments are measured by gross weight. Gross weight is the net weight of the shipment plus any outside containers and bracing required by the packers or airlines. It is recommended that 5-10 pounds per box in the UAB be allowed for this purpose. If the weight limit is exceeded, the employee must resolve the overweight problem or pay for the excess before the shipment will be moved.

c. UAB is a separate allowance from HHE shipping and storage. Any unused airfreight weight cannot be added to the HHE shipment and storage allowance.

14 FAM 613.4 Shipment of a Layette

(CT:LOG-418; 06-05-2025)

a. A separate and distinct airfreight weight allowance for the shipment of a layette may be authorized in an amount not to exceed 113 kilograms or 250 pounds gross weight for a newborn infant or adopted child less than five years of age who is an eligible family member of an employee assigned to a post (and who has arrived at the post) where suitable layettes are unavailable locally and must be obtained in the United States or its territories (Puerto Rico, U.S. Virgin Islands, Guam, American Samoa, and The Commonwealth of the Northern Mariana Islands).

b. See definition of layette in 14 FAM 611.3 for allowable layette items.

c. An air shipment may commence 120 days before the expected birth and no later than 120 days after the birth of a child. For an adopted child, an air shipment should commence no later than 120 days after the adoption. The time limitations specified in 14 FAM 584.2 are not applicable to this allowance. On subsequent travel involving authorization for transportation of airfreight, the family and new child will receive weight allowances as set forth in 14 FAM 613.3.

d. Items shipped in the layette may not exceed the dimensions of a standard tri-wall carton of 37 inches by 23 inches by 30 inches (0.938 meters by 0.5842 meters by 0.762 meters). Exceptions (e.g., baby cribs and baby chairs) that exceed these dimensions may be approved by the director, Office of Transportation Management (A/GO/OPS/TM).

e. Travel authorizations for State Department personnel may be amended to include authorization for the layette shipment. The request for amendment must be cabled to the attention of GTM/EX/IDSD certifying that the post has determined suitable layettes are not available locally (see 14 FAM 523.2-1, subparagraph f(2)(e)).

f. Layette shipments for Commerce must be sent to USFCS/OIO/OFSHR.

g. Layette shipments for USAGM must be sent by the traveler to his or her Washington, DC headquarters office.

14 FAM 613.5 Alcoholic Beverages

(CT:LOG-257; 03-29-2019)

(State/USAGM/USAID/Commerce/Agriculture)

(Foreign Service)

Alcoholic beverages within the free entry import limitations prescribed by the Treasury Department must accompany the traveler and may not be shipped as unaccompanied baggage (see 14 FAM 618.3).

14 FAM 613.6 Shipping Consumables

(CT:LOG-363; 10-05-2022)

(State/USAGM/USAID/Commerce/Agriculture)

(Foreign Service)

a. When the Office of Allowances (A/OPR/ALS) designates a post as one at which conditions make it difficult to obtain locally the consumables required by employees and their eligible family members, an authorizing officer must authorize a separate weight allowance for the shipment of consumables, in addition to the HHE weight allowance. The A/OPR/ALS website, Office of Allowances, lists posts with consumables shipments authorized.

b. Consumables are limited to foodstuffs for human consumption (with the exception of pet food or cat litter) or items used for personal or household maintenance such as toiletries and nonhazardous cleaning supplies. Consumables shipments may not include HHE or items used for the care and maintenance of vehicles; however, HHE shipments may include consumable items. A summary of HHE items can be found in 14 FAM 611.5.

c. The weight allowance for shipment of consumables is established for a two-year tour and for a three-year tour for each employee, regardless of family status. Some posts with limited tour lengths have a lower weight allowance for shipment of consumables: See the periodic memorandum entitled "Posts with Special Shipment Allowances for Post Assignment Travel" maintained by the Department of State’s GTM Assignments Division.

d. The employee will have one of the following consumables weight allowances on the initial orders and time limitations:

(1) Weight allowance for a one-year tour is defined in "Posts with Special Shipment Allowances for Post Assignment Travel" referenced above. Up to two CNS shipments are permitted on a one-year tour, and both must be initiated and booked for shipment to post within six months from the date of arrival at post - unless otherwise defined on the TA;

(2) Weight allowance for a two-year tour is 1,134 kilograms or 2,500 net pounds unless otherwise defined on the TA and there will be a one-year time limitation from the date of arrival at post within which to request the first available pack date to ship against this weight allowance;

(3) Weight allowance for a three-year tour will be 1,701 kilograms or 3,750 net pounds unless otherwise defined on the TA with a two-year time limitation from the date of arrival at post within which to request the first available pack date to ship against this allowance; or

(4) The above six-month, one- and two-year time limitations may be extended with full justification. Request for extension and amendment to the assignment orders must be approved by the appropriate authorizing official in advance of any shipment; and

(5) An employee with a one-year tour is allowed two consumables shipments. An employee with a two-year tour is allowed up to three consumables shipments, i.e., an initial plus two supplemental shipments. An employee with a three-year tour is allowed up to four consumables shipments, i.e. an initial plus three supplemental shipments.

e. Perishable or frozen foods may not be included in a consumables shipment.

f. The minimum consumables shipment weight is 200 net pounds.

g. An additional weight allowance will be provided under the following conditions:

|

|

With each six-month extension |

With a one-year extension |

With a second two- or three-year tour at post |

|

An employee will be authorized: |

An additional shipment of 284 kilograms or 625 net pounds |

An additional 568 kilograms or 1,250 net pounds |

A full second consumables weight allowance |

|

Shipment is to be requested for the first available pack date: |

Within 30 days of the beginning of the extension (the request for an extension will also serve as the request that the original travel orders be amended to increase original weight allowance) |

Within 60 days of the beginning of the extension |

Within one or two years respectively, of the beginning of the new tour of duty |

|

NOTE: For additional consumables weight allowances at selected special shipment posts, see the periodic memorandum entitled "Posts with Special Shipment Allowances for Post Assignment Travel," maintained by the Department of State’s GTM Assignments Division. |

|||

14 FAM 613.6-1 Criteria for Consumables

(CT:LOG-363; 10-05-2022)

(State/USAGM/USAID/Commerce/Agriculture)

(Foreign Service)

a. The intent of the consumables weight allowance is to recognize the extreme conditions at specific posts and to provide employees with adequate consumables.

b. In order for a post to be designated as a “consumables post,” consumable items must be of limited availability and extremely difficult to obtain locally; unavailable from the closest source of supply such as a neighboring country; of substandard quality locally; severely restricted or prohibited in host-government importation policies; or unavailable because group orders cannot be established or the mission is too small to support a commissary or group order; e.g., goods cannot be shipped in sufficient quantity to meet minimum shipping requirements.

c. The Office of Allowances (A/OPR/ALS) review and decision will be based on the most recent Post Consumables Survey (Form DS-267-A) which posts submit to A/OPR/ALS. Surveys must be certified as accurate, complete, and current by the person primarily responsible for coordination and preparation of the report.

14 FAM 613.6-2 Justification

(CT:LOG-363; 10-05-2022)

(State/USAGM/USAID/Commerce/Agriculture)

(Foreign Service)

a. All consumables weight allowance posts are required to submit a new justification every two years. For justification renewals, Post Consumables Surveys (Form DS-267-A) are to be forwarded to the Office of Allowances, A/OPR/ALS, based on the Post Differential Questionnaire reporting schedule found in the Department of State Standardized Regulations (DSSR) Section 920. A/OPR/ALS will send a courtesy reminder to post.

b. A post may submit a new justification for review whenever conditions at the post change.

c. An employee assigned to a consumables post is not affected if the post is deleted from the list of designated posts (see A/OPR/ALS). When a post is added to that list, all employees with more than one year remaining in the tour of duty will qualify for a consumables weight allowance.

|

NOTE: An employee is considered assigned to a consumables post for purposes of 14 FAM 611.5 and 14 FAM 613.6 once that employee has been paneled and an official assignment has been made. |

14 FAM 613.7 Unaccompanied Air Baggage (UAB)/Household Effects (HHE) under a Separate Maintenance Allowance (SMA)

(CT:LOG-363; 10-05-2022)

(State/USAGM/USAID/Commerce/Agriculture)

(Foreign Service)

a. Transportation of HHE/UAB is authorized when family members are eligible to receive an SMA grant under the Standardized Regulations (SR), Section 260, subject to the rules below.

b. U.S. origin point HHE/UAB: Upon the approval of an employee's initial election of SMA when transferring from the United States to a foreign post of assignment, HHE/UAB may only be shipped if the authorized SMA location is different from the employee's point of origin. Shipping weight to the SMA point combined with the weight of the employee's shipment to a new assignment and the amount in storage may not exceed the combined, authorized shipping and storage allowance(s) permitted in the employee's travel authorization.

c. HHE/UAB transfers between foreign locations: Upon approval of the initial election of SMA when an employee is transferring between foreign posts, HHE/UAB may be shipped from the losing post to the authorized SMA location in the United States. If the initial election is for the family members to travel to the new post from an authorized SMA location, HHE/UAB may be shipped from the location in the United States to the gaining post. The total shipping weights must not exceed the employee's authorized HHE/UAB weight allowance. When an alternate SMA location is selected in a foreign location for family member(s) the employee is responsible for paying any excess transportation of HHE/UAB charges on a cost-constructive basis from the authorized SMA point. When the SMA grant of the family member(s) terminates in a foreign country due to an employee's subsequent foreign assignment, the employee will be responsible for paying any additional costs to the onward location.

d. HHE during tour of duty at post:

(1) When SMA is approved during a tour of duty at a foreign post, HHE may be shipped from post to the authorized SMA location. Weight of effects shipped to the SMA location and at the end of the tour may not exceed the employee's shipment allowance for that post of assignment; and

(2) When the SMA grant terminates during a tour of duty at a foreign post, HHE may be shipped from the authorized SMA location in the United States to post up to the employee's remaining shipment allowance.

e. If the employee elects SMA at the time of transfer to a limited shipment (furnished quarters) post from a full shipment (unfurnished quarters) post, shipment of HHE to the authorized SMA point is not restricted to the limited shipment allowance. All shipments combined, including any amounts in continuing storage, must not exceed the limits established in 14 FAM 613.1. Employees' liabilities are established in 14 FAM 612.3.

14 FAM 614 PROCESSING SHIPMENTS OF HOUSEHOLD AND PERSONAL EFFECTS

14 FAM 614.1 Through Shipments

(CT:LOG-257; 03-29-2019)

(State/USAGM/USAID/Commerce/Agriculture)

(Foreign Service)

Whenever money can be saved by doing so, ship effects on a through-bill of lading rather than to an intermediate point for transshipment.

14 FAM 614.2 Shipments of Effects from United States

14 FAM 614.2-1 Surface Shipments

(CT:LOG-363; 10-05-2022)

(State/USAGM/USAID/Commerce/Agriculture)

(Foreign Service)

a. Non-through-bill of lading HHE shipped by surface and originating from the United States is forwarded by U.S. despatch agencies to posts. Transportation offices of the State Department and USAID issue packer authorizations (PAs) to transportation service providers to perform packing services. These PAs allow service providers in the United States to pack and pick up HHE shipments from the employee's residence or vendors and load the HHE into wooden lift vans that meet Department specifications. These lift vans become the property of the U.S. Government. Transportation offices are responsible for ensuring that export HHE shipments are made available in a timely manner, and that the appropriate U.S. despatch agent is advised to move the shipment to post. The various agency transportation offices monitor and control the shipment until it is pulled by the appropriate despatch agency. The U.S. despatch agency receives and books the HHE shipment onto a vessel for forwarding to the post.

b. The mission or post can obtain shipment status by accessing the Transportation Lite (T-Lite) module in ILMS. Additional assistance is available from the responsible transportation office or servicing U.S. despatch agency.

c. When status is required for the shipment of a POV, posts and missions abroad should inquire directly of the U.S. despatch agency to which the employee submitted the automobile shipping form.

14 FAM 614.2-2 Outside Washington, DC Area

(CT:LOG-418; 06-05-2025)

(State/USAGM/USAID/Commerce/Agriculture)

(Foreign Service)

For employee shipments originating in localities more than 50 miles (straight-line distance) from the Washington Monument, the Department will select a firm to export-pack, store, and provide related services in the locality.

14 FAM 614.2-3 In Washington, DC Area

(CT:LOG-418; 06-05-2025)

(State/USAGM/USAID/Commerce/Agriculture)

(Foreign Service)

a. The employee must notify the Department or respective agency each time service is required in connection with the transportation or storage of personal or household effects located in the Washington, DC area. This includes effects or purchases made after the initial shipment (see 14 FAM 611.6 on supplemental shipments). Employees should not arrange with commercial firms for performance of services in connection with such effects until they have obtained instructions from their agency's transportation office:

(1) Departments of State and Commerce: Office of Transportation Management (A/GO/OPS/TM); and

(2) USAID: Travel and Transportation Management Division (M/MS/TTD).

b. When the Department has contracts or price arrangements with designated packers, forwarders, carriers, or other firms, payment for authorized services performed by those firms is an allowable expense. If other firms are used at the employee's request and pre-approved by the director, A/GO/OPS/TM, the employee is responsible for all excess costs involved and must make personal arrangements with the firm or firms selected (14 FAM 618.2). Allowable expenses are limited to actual expenses incurred, not exceeding the amount that the U.S. Government would have paid under its contract or other price arrangements. When two or more firms have been approved to perform a particular service, reimbursable expenses are limited to the average price of the approved firms.

14 FAM 614.2-4 Authorization to Pack and Ship

(CT:LOG-393; 03-26-2024)

(State/USAGM/USAID/Commerce/Agriculture)

(Foreign Service)

The Department or agency will issue the necessary documents to the firm or firms that will perform the required services under the Actual Expense Method (41 CFR 302-7).

14 FAM 614.2-5 Unaccompanied Air Baggage (UAB) Shipments

(CT:LOG-418; 06-05-2025)

(State/USAGM/USAID/Commerce/Agriculture)

(Foreign Service)

UAB shipments from the United States are controlled by the transportation office of the employee's agency or State (A/GO/OPS/TM). If State prepares the documentation for an employee of another agency, an en route notification is forwarded by State or the agency's transportation office, to the employee's post of assignment, citing the air waybill number, weight and cube, number of pieces, and UAB airline shipping date (based on information from the packer). If the UAB does not arrive within a normal time frame, the GSO at post can initiate tracer action. Requests for status or tracer action should be sent to the transportation office of the employee's agency and not the U.S. despatch agency.

14 FAM 614.3 Shipments to Post Handled by European Logistical Support Office (ELSO)

(CT:LOG-363; 10-05-2022)

(State/USAGM/USAID/Commerce/Agriculture)

(Foreign Service)

a. Shipments originating at one of the U.S. despatch agencies and bound for ELSO-serviced posts utilize U.S.-flag vessels that normally discharge at the Ports of Antwerp, Rotterdam, and Bremerhaven. The U.S.-flag vessel companies then deliver the cargo and containers by truck to their terminals located in Antwerp and Bremen at which point ELSO takes receipt of the shipments. The U.S. despatch agent provides ELSO and the destination post with advance shipping information in the form of the en route notification. Packing lists and other shipping documentation should be available in the ILMS record. The average transit time from the U.S. east coast to receipt of the shipment at ELSO's facilities ranges from 17 to 20 days.

b. Once a shipment is in its possession, ELSO arranges for the onward movement of the shipment to the consignee. ELSO inspects arriving shipments against the shipping documents to confirm arrival of the total number of pieces shipped. When necessary, ELSO repairs and/or repacks shipments. If applicable, claims are filed with the parties responsible for damages. As soon as shipments are booked, ELSO advises the destination post by an en route notification with shipping details. Posts should immediately notify ELSO of a shipment's arrival or nonarrival to allow ELSO to begin tracing action on missing shipments, make payment of shipping charges, and update and close ELSO shipping files.

c. Destination posts should take into consideration unavoidable delays, (i.e., delayed arrival of carrier, bad weather, inaccessible road transportation, customs problems, etc.), before requesting the status of household and personal effects shipments transiting ELSO. Posts should allow at least 20 days from the actual departure date of the shipment from the United States before asking ELSO about transshipment information.

|

NOTE: When requesting information for any shipment, posts should refer to either the U.S. despatch agent or ELSO shipment number, if known. |

14 FAM 614.4 Surface Shipments between Posts

14 FAM 614.4-1 Obtaining Information

(CT:LOG-295; 10-26-2020)

(State/USAGM/USAID/Commerce/Agriculture)

(Foreign Service)

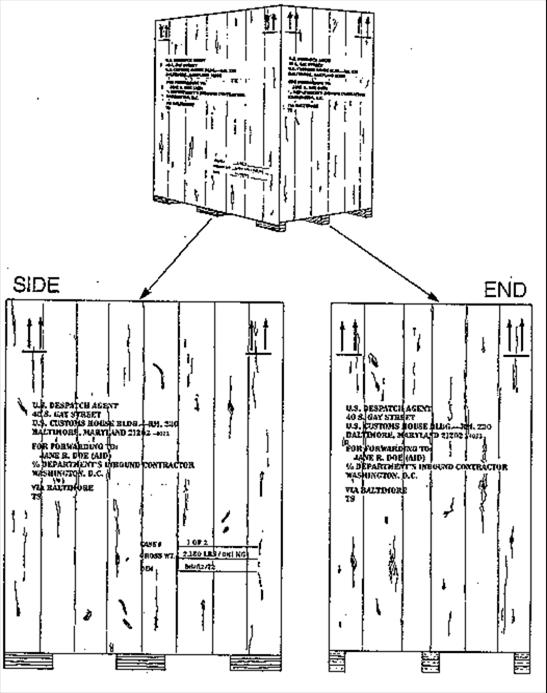

When preparing a surface shipment between posts, the losing post, before initiating shipment, must get specific instructions from the gaining post regarding the following factors:

(1) Limitations of size and weight of shipping containers;

(2) Port of discharge (if destination post is not a port of call);

(3) Marking instruction to be placed on containers;

(4) Suggested routing;

(5) Consignee to be designated on ocean bill of lading; and

(6) Import restrictions, if any, on certain commodities; e.g., alcoholic beverages, firearms, automobiles.

14 FAM 614.4-2 Arranging for Shipment

(CT:LOG-363; 10-05-2022)

(State/USAGM/USAID/Commerce/Agriculture)

(Foreign Service)

When arranging for packing effects, the post must make every effort to protect the employee and the U.S. Government from excess charges by taking the following actions:

(1) Obtain economical and efficient packing services;

(2) Assist employees in obtaining an accurate estimate of the net weight of their effects;

(3) Ascertain that the effects are properly packed in suitable containers of the minimum size, weight, and cubic measurements necessary to ensure their safe arrival at destination;

(4) Determine that the shipment is correctly marked, routed, and forwarded without delay; and

(5) Ensure that a complete and proper inventory is prepared that describes the shipped articles and their condition and does not include any articles described as “packed by owner (PBO)” or “contents unknown,” which will cause delays in customs clearance and may result in excess costs.

14 FAM 614.4-3 En Route Notification

(CT:LOG-295; 10-26-2020)

(State/USAGM/USAID/Commerce/Agriculture)

(Foreign Service)

a. When an employee's effects and/or POV are consigned to a U.S. despatch agent or to a post, the employee arranging the shipment must send an en route notification to the gaining post via ILMS with the following documents attached to the shipment record:

(1) The original bill of lading;

(2) Packing list; and

(3) Any other documents necessary for clearance and forwarding of the shipment.

b. When effects are consigned to a U.S. despatch agent for onward shipment to another post, an en route notification should be sent by the losing post to the gaining post with an information copy to the U.S. despatch agency and to the employee's agency transportation office.

14 FAM 614.5 Arranging for Export Packing and Transportation Services

14 FAM 614.5-1 Shipment Originating Abroad

(CT:LOG-363; 10-05-2022)

(State/USAGM/USAID/Commerce/Agriculture)

(Foreign Service)

a. The appropriate administrative personnel of each establishment are responsible for the packing, crating, and shipment of personal and household effects, and for their transportation to storage or to other destinations from posts abroad. When sufficient U.S. Government personnel are not available to perform these services, the services may be obtained by:

(1) The use of small purchase and other simplified purchase procedures under the authority of Federal Acquisition Regulation (FAR) 48 CFR Part 13, Simplified Acquisition Procedures;

(2) Sealed bidding under the authority of FAR 48 CFR Part 14; or

(3) By negotiation under the authority of FAR 48 CFR Part 15.

b. Use the ITGBL program as addressed in 14 FAM 614-5.5 or negotiate a rate tender under a federal transportation procurement statute, 49 U.S.C.10721 or 13712. Contact your supporting despatch agency for more information about procuring transportation using a tender of service.

c. Posts must establish reasonable service standards for the proper protection of effects to ensure high quality service. Post should contact the Office of the Procurement Executive (OPE) Evaluation and Assistance Division for contract templates.

14 FAM 614.5-2 Establishing Requirements

(CT:LOG-363; 10-05-2022)

(State/USAGM/USAID/Commerce/Agriculture)

(Foreign Service)

a. The arrangements made for packing and shipping HHE will be influenced by the size of the post, the type of quarters provided, and the presence of other foreign affairs agencies’ programs, which increase the number of persons the post assumes responsibility for servicing.

b. Posts should estimate their packing, crating, and shipping requirements based upon anticipated normal transfer of personnel that will occur during a 12-month period. If the estimated volume of services is expected to exceed $25,000 each year, consider establishing a contract in accordance with FAR 48 CFR 16.503 - Requirements contracts or 48 CFR 16.504 - Indefinite quantity contracts. If the estimated volume of services is expected to be $25,000 or less each year, it may be more appropriate to obtain the services on a case-by-case basis in accordance with one of the small purchase or other simplified purchase procedures set forth in FAR 48 CFR Part 13.

14 FAM 614.5-3 Competitive Solicitations for Packing, Crating, and Shipping Services

(CT:LOG-257; 03-29-2019)

(State/USAGM/USAID/Commerce/Agriculture)